Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

Fundera by NerdWallet Review: Expert Analysis & User Insights

Fundera is your one-stop shop for small business loans. Rather than applying directly to one lender, Fundera does the shopping for you and connects you to the best lender to meet your small business needs.

Expert Reviewer Verdict

Fundera's main strength is its connection to other lenders. Because of this, they can help those with low credit scores or minimal time in business to acquire a loan. Fundera’s comprehensive matching algorithm combined with high approval rates make this company a top choice for small business loans.

In this review, our team of expert reviewers has thoroughly analyzed and evaluated Fundera small business loans. We will share our findings and provide our expert recommendations on whether Fundera small business loans are worth considering.

Fundera by NerdWallet User Reviews

Fundera has a very impressive 4.7 stars out of 5 on TrustPilot and 5 out of 5 on Site Jabber. Customers are generally satisfied with the fast, efficient and friendly service offered by the platform. The company is praised for its clear communication and the personal service its agents give to help customers choose the right loan.

Where any criticism is raised, Fundera responds to this quickly and offers to assist in making things right. In some rare instances, customers have expressed dissatisfaction with loans; however, this doesn’t fall under the responsibility of Fundera as the platform doesn’t set rates and terms.

| Positive Fundera Reviews | Negative Fundera Reviews |

| Great customer Support Team | Some issues when responding to emails |

| Fast application process and approvals | Covid relief loans can be difficult to arrange |

| Highly personalized service | Terms changed by the lender after application |

| Efficient application process | Some lenders have high fees |

Summarized Ratings

Fundera has a peer leading User Reviews rating of 4.9. It reflects the average rating from 2 independent user review sites, including a Trustpilot score of 4.7.

Fundera by NerdWallet Review Video

Our expert, Gordon Scot reviews and describes Fundera business loans in detail.

What is Fundera?

Fundera by NerdWallet is an alternative lender operating both as a direct lender and a loan marketplace. This means that Fundera may choose to fund the entire loan themselves, or they may match you to one of the lenders in their network. This gives you speed and flexibility you may not find elsewhere.

Fundera Pros and Cons

Pros

Cons

Fundera by NerdWallet Loan Features

Fundera offers 8 loan options:

- Small Business Administration (SBA) loans

- Short-term business loans

- Business line of credit

- Equipment financing

- Invoice financing

- Startup business loans

- Merchant cash advances

- Term Loans

Fundera SBA Loans

SBA loans are business loans that have been guaranteed by the federal government and are intended to promote economic development. Fundera acts as an approved provider and can be a good option for those that have been rejected by the banks:

| Term length | Up to 30 years |

| Repayment period | Monthly |

| APR range | Starting at 2.75% |

| Min - Max amount | Up to $2M |

Fundera Term Loans

Term loans are what most people think of when it comes to small business loans. They provide fixed interest rates and monthly repayment periods, and funding is typically quick. Fundera will connect you to dozens of lenders that can provide this type of loan.

| Term length | 1 - 5 years |

| Repayment period | Monthly |

| APR range | 7% - 30% |

| Min - Max amount | Up to $600K |

Fundera Business Line of Credit

A business line of credit works like a credit card, but typically with lower interest rates and higher loan limits. You draw only on the money you need, and pay interest only on the funds you use.

| Term length | 3 month - 18 months |

| Repayment period | Flexible |

| APR range | 7% - 25% |

| Min - Max amount | $10,000 - over $1 million |

Fundera Equipment Financing

Equipment financing offers quick funding for new or used equipment purchases, which then serve as collateral for your loan.

| Term length | 5 - 6 years |

| Repayment period | Monthly |

| APR range | 4% - 40% |

| Min - Max amount | Up to 100% of the equipment cost |

Fundera Invoice Financing

Invoice financing enables you to borrow funds against the value of your unpaid invoices. Typically, you can borrow up to 85% of your invoice’s value, and you’ll receive the remaining 15% once your invoices are paid.

| Term length | Until your customers pay their invoices |

| Repayment period | Usually weekly or daily |

| APR range | 3% processing fee, ~1% each week until invoice is paid |

| Min - Max amount | Up to 85% of the value of your invoices |

Fundera Startup Business Loans

Designed to assist new businesses, startup loans can be paid in a lump sum and used for a variety of purposes. We recommend SBA microloans, in particular, because they are backed by the Small Business Administration and usually have less stringent requirements for qualifying.

| Term length | Up to 6 years |

| Repayment period | Monthly |

| APR range | 8% - 13% |

| Min - Max amount | Up to $50,000 |

Fundera Short-term Business Loans

Short-term business loans give businesses fast access to cash to cover short-term financing needs, such as managing cash flow or dealing with an emergency. Terms are shorter than with business term loans, and repayments are typically made daily or weekly.

| Term length | 3 - 18 months |

| Repayment period | Daily or weekly |

| APR range | Starting at ~10% |

| Min - Max amount | Up to $250,000 |

Fundera Merchant Cash Advances

Merchant cash advances are for business owners who aren’t able to qualify for other types of business loans. Here, you’ll be paying your loan back on a daily or weekly basis directly from your credit card sales, and you can expect rates to be high.

| Term length | 3 - 6 months |

| Repayment period | Daily or weekly - Typically around 15% of sales |

| APR range | Factor rates between 1.15 and 1.5 |

| Min - Max amount | Up to $500,000 |

Fundera by NerdWallet Interest Rates and Fees

Because Fundera connects you to other lenders, it can be difficult to get specific information on rates and fees before signing up. We recommend you pay particularly close attention to the following fees:

- Origination fees - Typically anywhere between 1% - 5% on average, we wouldn’t recommend any higher than this

- Prepayment fees - Most lenders won’t charge you for repaying early, so if these fees are particularly high it could be a red flag

- Late payment fees - These will be a percentage of that month’s missed payment, usually around 5% - 10%

- Maintenance fees - Usually found on a line of credit and will be around $50 per month

For interest rates, Fundera offers the following indicative rates for each loan type:

- SBA - From 2.75%

- Term Loans - Between 7%-30%

- Business line of credit - Between 7%-25%

- Equipment financing - 4% - 40%

- Invoice financing - A 3% flat charge on the total amount, plus ~1% per week on any outstanding balance

- Startup loans - 8% - 13%

- Short-term loans - From 10%

- Merchant cash advance - Factor rates between 1.15 - 1.5

If you have specific questions regarding rates and fees, a Fundera representative is there to help.

If you were to carry a term loan for five years at 30% interest, you might end up paying double the original amount of the loan. That doesn't make business sense to most small business owners.

These kinds of loans need to be the kind of thing that you can pay back rather quickly.

How to Qualify for a Fundera by NerdWallet Loan

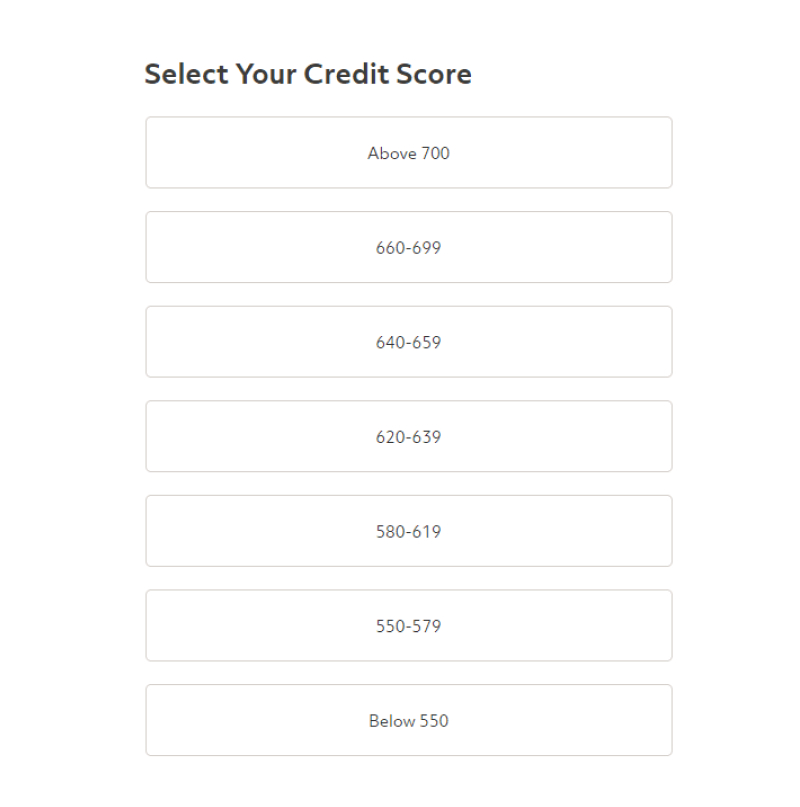

To qualify for a Fundera small business loan, you should have a credit score of at least 550. However, you may still be accepted based on other aspects of your business.

Fundera will also look at your annual business revenue and your length in business, but there are no minimum requirements for these two criteria. The lenders you’re connected to will use a whole range of different assessment methods to determine your eligibility, so even those new to borrowing may qualify.

A summary of all loan types is below:

| Minimum Credit Score | 550+ |

| Minimum Annual Revenue | No minimum requirement |

| Minimum Time in Business | No minimum requirement |

Fundera by NerdWallet Loan Application Process

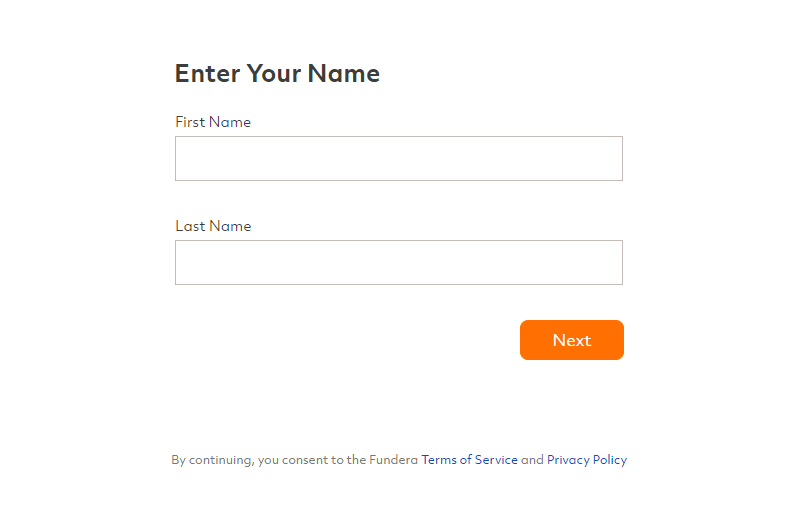

Fundera makes applying for a loan easy. With just one application, you can apply for multiple loans from multiple lenders.

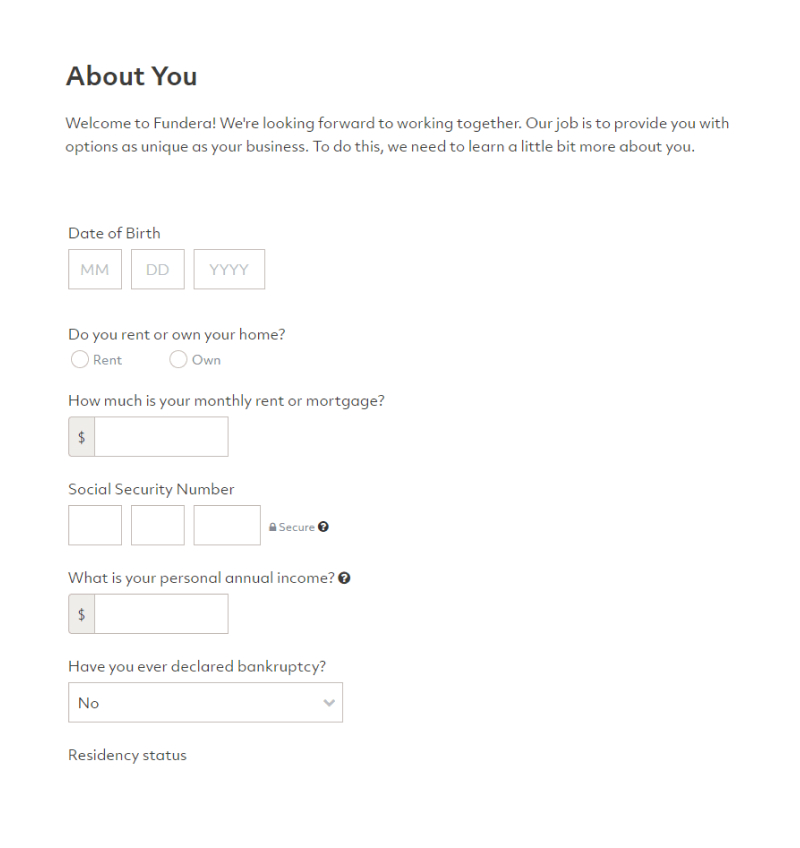

Fundera will first have you fill out some personal information, including your date of birth, personal annual income, and whether you own or rent your home.

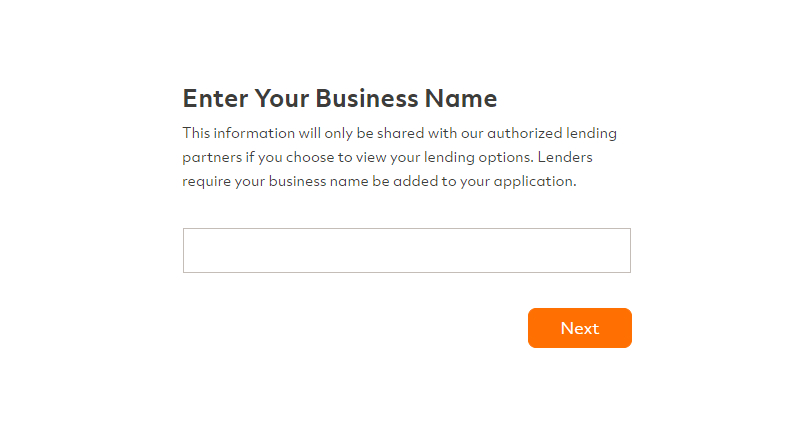

Next, Fundera will ask you your business name and credit score.

In fact, there are 22 different screens that ask for your personal information.

Most of the screens that you'll see are just single question answers that you can quickly provide.

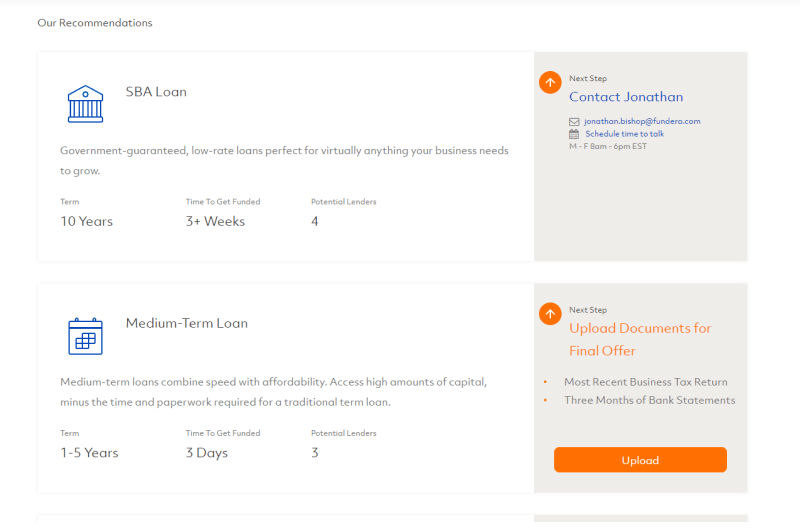

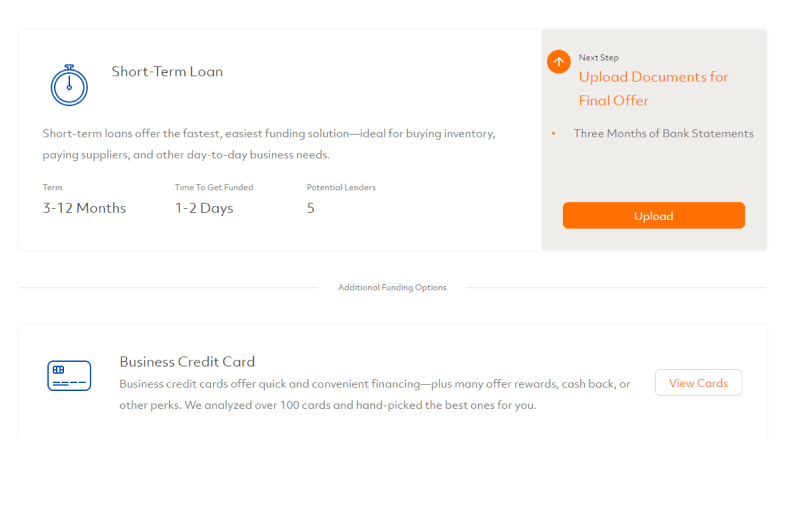

And finally, Fundera will give you your loan options, including loan terms and how long it takes to get funded.

Note: When applying, Fundera does a soft credit pull, meaning your credit score will not be affected. If you decide to move forward with a loan, the lender will perform a hard inquiry on your credit.

Fundera by NerdWallet Customer Support

Fundera offers several customer support options by phone, email, or live chat. The email adress is support@fundera.com

The website features a robust FAQ page which explains how Fundera works and what you can expect if you use them.

Once you decide to move forward with Fundera, you’ll be paired with a knowledgeable Funding Advisor. They’ll connect with you to learn more about your business and recommend the ideal product for your unique needs.

Most of Fundera’s reviews regarding customer service are positive. Customers are pleased with its fast, efficient service and appreciate its transparent communication. Here’s what two of them had to say:

“Fantastic customer service - guided us every step of the way!”

“Simply the best customer service and communication!”

Fundera by NerdWallet Perks and Bonuses

Flexibility

Since Fundera is an online loan marketplace, flexibility varies from lender to lender. Some lenders are more flexible than others. Therefore, if you’d like to lock in special rewards or discounts or defer your payments in the event of hardship, let your Funding Advisor know. They can try to match you to a lender that offers the flexibility you’re looking for.

Transparency

Fundera’s website features no shortage of information on how it works, the specific lenders it partners with, and the various loans available. There’s also plenty of useful resources you can take advantage of, including detailed guides and lists of the best business credit cards, best payroll companies, and more.

There is no history of complaints from customers regarding poor sales practices. In fact, most customers praise Fundera for its exceptional transparency.

Technology:

Technology offerings will depend on the specific lender you choose for your loan. Fortunately, many of the lenders Fundera works with offer mobile functionality and the ability to pay online.

Conclusion

Fundera offers an impressive range of loan types with efficient and friendly customer service. It welcomes applications from long-standing businesses, new startups, and those with bad credit, so there’s an excellent chance you’ll find what you’re looking for here.

Frequently Asked Questions(FAQ)

This app literally changed my like. It provides a great experience. I absolutely love it!