Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses, or reviews expressed in this article are those of the author’s alone, and have not been approved or endorsed by any partner.

Best Short-Term Business Loans to Consider in 2024

Short-term business loans are there if you need capital quickly. Typically funded within 24 hours of loan approval, short-term loans can bridge any gaps you have in revenue or cover emergency expenses.

Short-term business loans are typically given in one lump-sum, with fixed monthly payments and short repayment periods (average of one year). Getting a loan for short-term expenses can help cover payroll expenses, purchase equipment, invest in marketing, or cover any other business expenses you might have right now.

Alternative small business lenders offer short-term loans with quick applications and fast funding times. Our team of financial experts reviewed and ranked the best short-term business loans to help you get funded.

Top Picks for Best Short-Term Business Loans

- Lendzi - Best for Businesses With High Revenue

- SMB Compass - Best for Longer Loan Terms

- Backd - Best for Cheapest Interest Rates

- Bluevine - Best for Line of Credit

- National Funding - Best For Working Capital Loans

- Credibly - Best for Great Customer Service

- Fora Financial - Best for High Value Loans

When it comes to choosing the best short-term loan for your business, you’ll want to ask yourself how much you need to borrow, look to see what you qualify for, and see what the lenders' various rates and fees are.

You’ll find many short-term business loan options out there. In this review, we’ve done the homework for you using our rating methodology. This methodology is designed to help you select the best option for your needs.

Best Short-term Business Loans for 2024 - Full Overview

Credibly

- Borrow up to Up to $250,000 in term loans

- Borrow up to $400,000 in working capital

- Term loan rates range between 8-25%

- Working capital factor rate starts at 1.09

- Simple application process

- As soon as same day funding

- Open to high-risk industries

- Bad credit not an issue

- Fast funding

- Excellent customer service

- Fees on top of the factor rate charged

- Blanket lien required

Though there are many options for short-term business loans, not all of them offer stellar customer service. Credibly, though, is known for its attention to customers and fast application processing. Credibly offers a wide range of financial products, including: short-term loans, long-term loans, lines of credit, equipment loans, SBA loans, merchant cash advances, invoice factoring

Main Features

Credibly offers short-term loans up to $400,000 with daily, weekly, or monthly repayment plans. And if your credit isn’t great, no need to worry. Credibly looks at other factors besides your credit scores to determine eligibility.

Fora Financial - Best for High Value Loans

- Min. time in business: 6 months

- Min. credit score: 550+

- Borrow up to $1.4 million

- Factor rate from 1.15 to 1.40

- Ideal for plenty of industries

- Approval not solely credit based

- Early payoff discounts

- No restrictions on loan use

- High value loans

- Early payoff discounts

- High interest rates

- Origination fee charged

Short-term loans aren’t known for having high limits, but that’s not the case with Fora Financial. Fora Financial allows borrowers to get up to $750,000 in as little as 72 hours after being approved. Fora offers both term loans and merchant cash advances, and approval isn’t solely based on your credit profile. There are no restrictions on loan use, and businesses in many industries can qualify, including businesses in construction, retail, restaurant, medical, services, manufacturing, transportation, and more.

Main Features

You can borrow anywhere from $5,000 to $750,000 with Fora Financial, with terms up to 15 months. If you pay off your loan early, you may receive a discount. To qualify for a short-term loan from Fora Financial, you’ll need to have: 6+ months in business, $12,000+ in gross monthly sales, no bankruptcies on your credit report.

Bluevine - Best for Line of Credit

- Funding up to $250,000

- Min. credit score: 625

- Min. time in business: 6 months

- Interest rates as low as 4.8%

- Loan Repayment 6-12 months terms

- Quick and simple application

- Fast funding

- Borrow what you need, then pay back

- Reasonable interest rates

- Not available in all states

- May need a personal guarantee

If you’d prefer to have access to a line of credit rather than getting all your money at once, like with a loan, Bluevine can help. Bluevine offers a short-term line of credit for businesses up to $250,000. Borrow what you need and pay for what you use, and your credit line will replenish with your payments. Once you request funds, they’ll be in your account within hours, ready for you to use. Bluevine also offers business checking with 1.5% interest. There are no fees or monthly minimum balances required.

Main Features

Bluevine’s line of credit can get you as much as $250,000 that you can borrow from and repay again and again. Simple interest rates start at just 4.8%. To qualify for a business line of credit with Bluevine, you need: credit score of 625+, $10,000 or more in monthly revenue, 6+ months in business.

National Funding - Best For Working Capital Loans

- Min. Time in Business: 6 months

- Min. Credit Score 600

- Short-term business loans up to $500,000

- Equipment financing up to $150,000

- Factor rate From 1.10

- Fast funding

- Early payment discounts

- Equipment financing repayment 2-5 years

- Working capital repayment 4 months - 2 years

- Fair credit accepted

- Early repayment discount

- Great reputation

- No special interest loans

- High annual revenue requirements

- No mobile app

National Funding’s short-term business loans come with repayment terms ranging from four months to two years. Depending on your finances and unique situation, you can get approved for up to $500,000 to cover the costs of payroll, rent, utilities, or other everyday expenses.

Main Features

National Funding offers a quick, easy application process where you can get a decision and funding in as little as 24 hours of applying. You’ll also receive access to a Funding Specialist who can help answer any questions you may have about the loan. The factor rate starts at 1.10. To take out a working capital loan, you’ll need a minimum credit score of 600, a business track record of at least six months, and $250,000 or more in annual revenue.

Backd - Best for Cheapest Interest Rates

- Borrow up to $2 million

- Min. Credit Score: 640

- Min. Time in Business: 2 years

- Industry best factor rate for MCA - as low as 1.10

- APR for the Line of credit product starts at 35%

- Flexible repayment terms up to 16 months

- Get funding in as little as 24 hours

- Check your rate with a soft credit pull

- Loan amounts up to $2 million

- Fast funding times

- Flexible payment terms

- Startups will not qualify

- Interest rates not disclosed

- Not all industries will qualify

With Backd, you’re the boss and funding is tailored to fit your unique business needs. Loan amounts are high and terms are flexible. Backd was founded in 2018 and has since funded more than $1 billion to over 10,000 small businesses. If you’ve struggled to qualify with other lenders, Backd may be the solution you need.

Main Features

Backd offers two loan products - working capital loans and business lines of credit. Working capital loans range from $10,000 to $2 million with terms up to 16 months. Payments are made daily, weekly, or semi-monthly. With a business line of credit, there are no terms and loan amounts range from $10,000 to $750,000. To qualify for either option, you need to be in business for at least two years, have annual revenues of $200,000 or more, and 640+ FICO score. You must also be based in the U.S. and have a business bank account.

SMB Compass - Best for Longer Loan Terms

- Loans up to $10 million

- Min. credit score: can go as low as 550 for certain loans

- Min. time in business: 1+ years in business, no startups

- Funding times: 5 to 7 days for term loans and 24 - 48 hours for line of credit

- Flexible terms: 2 – 10 years for term loans

- Interest Rates: starting at 8.99% for term loans

- Applying does not impact credit score

- Nine loan products to choose from

- Low, competitive rates

- Large loan amounts

- Loan terms up to 10 years

- Excellent customer service

- Poor credit not accepted

- Not available in all states

- Must be in business at least one year

- High revenue requirements

Perhaps you need a business loan to cover gaps in revenue, purchase new equipment, or refinance some existing debt. While most short-term business loans are due within one year, SMB Compass offers business term loans up to 10 years. If you need a larger loan amount (up to $5 million) and more than a year to pay it back, SMB Compass could be the solution you’re looking for. To qualify for a short-term business loan, you need to be in business at least one year and have a credit score of 680 or higher. If you don’t meet these requirements, SMB Compass has eight other business lending products that you may qualify for. Customer service is excellent; so don’t hesitate to call and have someone guide you through the process.

Main Features

SMB Compass offers nine different types of small business loans to borrowers, including short-term loans. Their mission is to make loans more accessible to small business borrowers by providing cost-effective and flexible lending solutions. SMB Compass business loans range from $10,000 to $5 million with terms up to 10 years. Rates start at 8.99% for qualified borrowers. The lender has currently provided more than 1,200 U.S. businesses with more than $250 million in financing. To apply, simply fill out their easy online application. It takes just a few minutes and will not impact your credit score. If approved, funding can be dispersed within 5-7 days.

Lendzi - Best for Businesses With High Revenue

- Short-term business loans up to $250,000

- Min. credit score: at least 500

- Min. time in business: 6 months

- Equipment financing up to $2 million

- Business line of credit up to $250,000

- See your options without hurting your credit

- Flexible terms: 3 to 15 months

- Excellent customer reviews on independent review sites

- Get funding in as little as 24 hours

- Excellent customer service

- Multiple loan and lender options

- Poor credit is accepted

- Flexible terms

- Rates higher on this type of funding

- High annual income requirements

Lendzi is a direct lender and a lending marketplace partnered with more than 75 lenders. This gives you options when it comes to short-term business financing and allows you to compare loan amounts, interest rates, and loan terms quickly and efficiently. Founded in 2020, Lendzi is known for working with businesses that have been denied a loan elsewhere or may be struggling with their credit. In addition, they have more than 2,000 5-star reviews on trusted review sites, making them one of the best lenders out there according to customers like you.

Main Features

Lendzi short-term business loans range from $5,000 to $250,000 with terms up to 24 months. When you apply, only a soft pull will be done on your credit. After you submit your initial application, a representative will give you a call to discuss your business and your financial needs in more detail. Having someone walk you through the process will allow you to make the best lending decision when choosing a loan. Once approved, funds can be in your account in as little as 24 hours. To qualify for a short-term business loan from Lendzi, you’ll need: credit score of 625+, 6+ months in business, $180,000 in annual revenue.

Main Features of The Best Short-Term Business Loans

- Min. Credit Score - 625

- Min. Time in Business - 6 months

- Min. Revenue - $180,000

- Loan Amount - $5,000 to $250,000

- Interest Rate - Starting at 29.9%

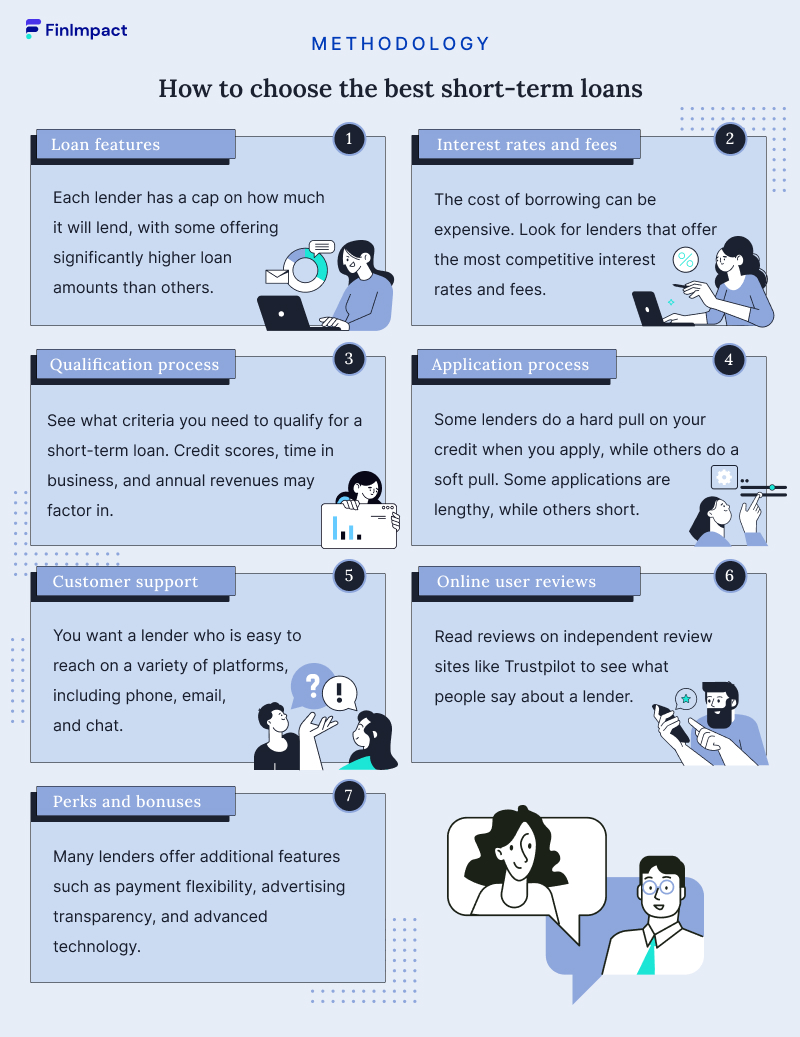

How We Choose the Best Short-Term Business Loan

- Loan features: Each lender has a cap on how much it will lend, with some offering significantly higher loan amounts than others.

- Application process: Some lenders do a hard pull on your credit when you apply, while others do a soft pull. Some applications are lengthy, while others short.

- Interest rates and fees: Every lender has different formulas for determining your interest rate, and many charge additional fees. The cost of borrowing can be expensive, so we took the time to look for lenders with the best rates.

- Qualification process: Before applying, see what criteria you need to qualify for a short-term loan. Credit scores, time in business, and annual revenues may factor in.

- Customer support: You want a lender who is easy to reach on a variety of platforms, including phone, email, and chat.

- Online user reviews: It’s smart to read reviews on independent review sites like Trustpilot to see what people say about a lender.

- Perks and bonuses: Lenders should work to get your business. Many offer additional features such as payment flexibility, advertising transparency, and advanced technology.

What Is a Short-term Business Loan?

A short-term business loan offers borrowers a lump sum of cash that’s paid off in monthly installments, usually at a fixed rate of interest. Repayment terms can be anywhere from a few months all the way up to five years.

Short-term loans can be secured or unsecured, with secured loans requiring collateral. The main pro in backing your loan with collateral is you’ll typically receive a much lower interest rate.There are many different types of collateral, including cash, property, vehicles, inventory, stocks, bonds, and more.

Generally, these loans are used to pay for one-off investments or expenses, but can also be handy in emergency situations when you need funding quickly. Given their versatility, short-term loans are one of the most common types of lending you’ll find.

How Do Short-term Business Loans Work?

In general, short-term loans have similar characteristics to long-term ones. You borrow a set amount of money from a lender and have to repay it over an agreed period.

However, one of the main differences between the two is that payments usually have to be made on a more frequent basis. In most scenarios, lenders will ask for weekly payments. Moreover, this means the interest rate is usually based on a “factor” rather than an APR.

For example, some short-term business loans may use business days in a year to determine the repayment plan. So, for a 12-month loan, you’d have to make repayments based on 264 business days. Understanding these subtle differences is crucial when you’re searching for short-term loans online.

When to Consider Short-Term Business Loans

There are a few situations in which a short term business loan may be ideal:

- You need access to capital quickly. Many short-term loan lenders give same-day decisions on applications and can fund your loan within 24 hours. This may be a great way to get access to cash fast

- You don’t qualify for other types of financing. Short-term loans often have less strict requirements to qualify. As a result, you may be able to get financing with poor credit or minimal time in business.

- You can pay back the loan quickly. Given the short nature of the repayment period, you’ll be limited in how much you pay in interest. Just be sure to calculate your monthly loan payment before signing the loan agreement to ensure you can afford it.

When to Avoid Short-Term Business Loans

Although short term loans can fill a need or two, there are certain situations when you might want to look for an alternative.

- You can’t afford to pay a large amount over a short period. It may be tempting to take out as large a loan as possible. But with a short term loan, this means you'll have a hefty loan bill due each month. If you can’t afford to pay it with what you’re bringing in now, a short-term loan may not be ideal

- The money won’t help you make more. Taking out a business loan can help you move your business forward. You can hire more staff members to increase productivity and serve more customers. If the short-term loan won’t do that, consider other types of financing.

- The interest rate is astronomical. Interest rates on short-term loans can get crazy, especially if you have bad credit. Calculate the total you’ll pay in interest, including origination fees, and decide whether the cost of financing is worth it.

Business Short-term Business Loan Rates

There are a number of factors that will determine the rates you’ll get on a business term loan. While rates will vary by lender and by your specific qualifications, you can expect a range from 4.00% - 30.00%, on average. Determining factors are outlined below.

- Credit score - The higher your credit score, the lower your rates tend to be. This won’t always be the case, but it’s the factor that is most commonly used by both traditional and alternative lenders.

- Length of time in business - The longer you’ve been operating, the lower your rates will be.

- Financial performance - From a lender’s perspective, the more money you’re earning, the lower the credit risk you present. If you can demonstrate a consistent level of profitability, then there’s an excellent chance you’ll be offered competitive rates.

Average small business loan interest rates for 2023 >>

How to Qualify for a Short-term Business Loan

Specific qualification criteria, such as monthly income and credit score, will vary between each lender. It’s worth checking your credit score and getting your documents together well in advance of any application.

Lenders will commonly ask for:

- Valid ID, such as a passport or driver’s license

- Two years personal and business tax returns

- Three months of business bank statements

- Proof of ownership of your company

- Evidence of asset ownership if you’re opting for a secured loan

- Business lease, if applicable

How to Apply for a Short-term Business Loan

The process will depend on each lender, but you can follow these general business loan application guidelines below to get an idea of what to expect

- Shop around – These days, most lenders will let you submit an application without facing a hard pull to your credit rating. We recommend submitting applications to a few different platforms. Assess each of them carefully before you accept a final offer.

- Prepare your documentation - You should have all of your financial records ready before you officially submit your application. This will speed up the process and make things much easier for you.

- Wait for approval - Most lenders will be able to either instantly reject your application or pre-approve you for a number of different offers. If you accept an offer at this stage, you’ll receive a hard pull against your credit rating. Full approval can happen in just a few hours, with funding taking place as soon as 24 hours from approval.

Final Thoughts

If you’re short on cash or want to take advantage of an opportunity and can’t wait for a bank loan application to process and fund, a short-term loan can provide the capital you need, fast.

Additionally, if you don’t have the credit scores required to qualify for traditional loans, short-term loans may open the door to the financing you seek.

Just keep in mind that with this convenience comes expense. Short-term loans often come with higher interest rates, so factor that cost into your decision to take on financing.

*The required FICO score may be higher based on your relationship with American Express, credit history, and other factors.