Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses, or reviews expressed in this article are those of the author’s alone, and have not been approved or endorsed by any partner.

Best Unsecured Business Loans to Get In 2024

A small business may need an unsecured business loan to pay for operating expenses, open a second location, or pay for marketing costs. If you’re in need of extra capital, take a look at these best unsecured business loans to get started today.

Unsecured business loans are small business loans that do not require any collateral. Instead, they are issued based on creditworthiness, length in business, and monthly revenue. A business may choose to get an unsecured business loan if they don’t qualify for a bank loan or need access to funds quickly.

Unsecured business loans can be used to quickly expand, make repairs, or renovate their place of business. They are also used to meet payroll expenses, pay for marketing costs, and to cover emergency expenses that they can’t otherwise afford. Online lenders typically offer the best unsecured business loans, and our team of financial experts reviewed and ranked the best small business loans to help you get funded.

Top Picks for Best Unsecured Business Loans

- Lendzi - Best for Businesses With High Revenue

- Backd - Best for Cheapest Interest Rates

- National Funding - Best for Customized Loans

- Bluevine - Best for Unsecured Line of Credit

- Credibly - Best Unsecured Business Loan for Low Credit

- Biz2Credit - Best for Multiple Lending Products

- SMB Compass - Best for Fast Funding Times

With so many unsecured business loans available, choosing the best one for your business can be tricky and time-consuming. Luckily, we did the hard work for you. In this review, we highlight the terms, rates and fees of each lender and explain what makes them a good option. We also share potential downsides of each lender, and provide a rating methodology you can use to select the best option for your needs.

Best Unsecured Business Loans for 2024 - Full Overview

SMB Compass - Best for Fast Funding Times

- Loans up to $10 million

- Min. credit score: can go as low as 550 for certain loans

- Min. time in business: 1+ years in business, no startups

- Funding times: 5 to 7 days for term loans and 24 - 48 hours for line of credit

- Flexible terms: 2 – 10 years for term loans

- Interest Rates: starting at 8.99% for term loans

- Applying does not impact credit score

- Nine loan products to choose from

- Low, competitive rates

- Large loan amounts

- Loan terms up to 25 years

- Excellent customer service

- Poor credit not accepted

- Not available in all states

- Must be in business at least one year

- High revenue requirements

An unsecured business loan is one that is not backed by collateral. SMB Compass offers many different types of unsecured business loans, including business lines of credit, SBA loans, short-term loans, and bridge loans. Qualifications are a bit stricter with SMB Compass, but this allows them to offer better rates, more flexible terms, and faster funding times than you may see elsewhere. To qualify, the lender prefers a minimum credit score of 650, one year of business history, and $20,000 per month in revenue.

Main Features

SMB Compass offers nine different types of small business loans to borrowers, including unsecured business loans. Their mission is to make loans more accessible to small business borrowers by providing cost-effective and flexible lending solutions. SMB Compass business loans range from $10,000 to $10 million with terms up to 25 years. Rates start at 7.99% for qualified borrowers. The lender has currently provided more than 1,200 U.S. businesses with more than $250 million in financing. To apply, simply fill out their easy online application. It takes just a few minutes and will not impact your credit score. If approved, funding can be dispersed within 24 hours.

Biz2Credit - Best for Multiple Lending Products

- Working capital up to $2 million

- Term loans up to $500,000

- Term loan interest rate starts at 7.99%

- Loan Repayment 12-36 months terms

- Variable APR depending on the applicant

- Funding in 72 hours

- Soft credit pull

- Fast funding

- Higher loan limits

- Multiple loan types available

- Excellent customer service

- Additional fees may apply

- Not available in every state

- High annual revenue requirements

Biz2Credit offers term loans up to $500,000, in addition to a multitude of other lending products. The company is set up as a lending platform, so you’ll fill out an application and then be matched to the best lender for your specific small business. Different lenders and loan types have different borrower requirements and qualifications.

Main Features

Biz2Credit offers term loans up to $500,000, working capital loans up to $2 million or more, and commercial real estate loans up to $6 million. Interest rates start at 7.99% and there are interest-only options available for 36 months for qualified buyers.

To qualify for an unsecured term loan from Biz2Credit, you’ll need to be in business for at least 18 months, have a minimum annual revenue of $250,000, and have a credit score of 660 or higher.

Credibly - Best Unsecured Business Loan for Low Credit

- Min. Credit Score: 550+

- Min. Time in Business: 6 months

- Borrow up to Up to $250,000 in term loans

- Borrow up to $400,000 in working capital

- Term loan rates range between 8-25%

- Working capital factor rate starts at 1.09

- Simple application process

- As soon as same day funding

- Open to high-risk industries

- Low credit score requirement

- Discount if you pay loan off early

- Streamlined application process

- Not for startups

- Short repayment terms

- High interest rates

Credibly is both a direct lender and a loan marketplace, giving you a one-stop shopping experience to compare and contrast unsecured business loans. It offers a plethora of loan products, including SBA loans, term loans, and unsecured lines of credit. The company works with borrowers with a range of credit scores, and focuses more on the borrower’s overall credit profile and what they need the loan for rather than just their credit score.

Main Features

Credibly offers working capital loans up to $400,000 with terms up to 18 months. Repayments are made daily or weekly, and factor rates start at 1.09. Credibly’s unsecured lines of credit are up to $250,000 with rates as low as 4.8%. The company also offers SBA loans, which are backed by the Small Business Administration. These loans typically come with better rates, but they do require additional paperwork and have a longer funding time. Credibly doesn’t have any strict credit score requirements, but generally accepts borrowers with a minimum credit score of 500. Additional lending requirements include being in business for six months and having annual revenue of $180,000 or more. The company also offers discounts for paying your loan off early.

Bluevine - Best for Unsecured Line of Credit

- Funding up to $250,000

- Min. credit score: 625

- Min. time in business: 6 months

- Interest rates starting at 6.2%

- Loan Repayment 6-12 months terms

- Quick and simple application

- Low fees

- Easy application

- Excellent customer support

- Only one loan type

- Short repayment terms

- Not available in every state

Bluevine offers one type of unsecured business loan: a line of credit up to $250,000. You can apply online and get an approval decision in as fast as five minutes. Instead of getting a lump sum, you get a revolving line of credit that acts similar to a credit card. Use what you need, pay interest only on what you use, and then use it again.

Main Features

Bluevine offers unsecured lines of credit up to $250,000 with rates starting at just 4.8%. Payments are made weekly or monthly over six or 12 months with each draw. Once you pay back the line of credit, you can use it again, making it ideal for businesses who need continuous access to capital.

To qualify for a line of credit from Bluevine, you need a minimum credit score of 625, at least six months in business, and at least $10,000 in monthly revenue. There are no prepayment fees, origination fees, or maintenance fees associated with the loan.

National Funding - Best for Customized Loans

- Min. Time in Business: 6 months

- Min. Credit Score 600

- Borrow up to $500,000 in working capital

- Equipment financing up to $150,000

- Factor rate From 1.10

- Fast funding

- Early payment discounts

- Equipment financing repayment 2-5 years

- Working capital repayment 4 months - 2 years

- Funding in as little as 24 hours

- Early repayment discounts

- Customized loan options

- Daily or weekly repayments

- Personal guarantee required

National Funding takes a more custom approach to lending. It tailors its unsecured business loans to the individual business’ needs rather than offering general loans. It looks at more than just credit score and even has specific loans for certain industries. National Funding offers automatic payments and you work with a loan specialist to help with your application and any questions that may arise.

Main Features

National Funding offers unsecured business loans from $5,000 to $500,000. Terms range from four months to two years and payments are made daily or weekly. Once approved, funding takes place in just 24 hours.

To qualify for a small business loan from National Funding, you will need a credit score of 600 or higher and be in business for at least six months. Minimum revenue requirements are $250,000 per year or more.

Backd - Best for Cheapest Interest Rates

- Borrow up to $2 million

- Min. Credit Score: 640

- Min. Time in Business: 2 years

- Industry best factor rate for MCA - as low as 1.10

- APR for the Line of credit product starts at 35%

- Flexible repayment terms up to 16 months

- Get funding in as little as 24 hours

- Check your rate with a soft credit pull

- Fast decision and funding times

- Large loan amounts

- Easy online application

- Flexible payment options

- Must be in business for at least one year

- Loan rates not disclosed

- Not available to all industries

Backd offers large loan amounts and flexible repayment terms to borrowers, making them our top pick for best unsecured business loans. Backd is on a mission to provide funding to businesses who may not qualify elsewhere. To date, they’ve funded more than $1 billion to 10,000+ small businesses. If you’re in need of funding and don’t want to put up collateral to secure it, Backd could be the right choice.

Main Features

Backd offers two lending products - a working capital loan and a business line of credit. Neither option requires collateral, and both offer flexible payment terms. Working capital loans range from $10,000 to $2 million and have terms up to 16 months. Payments are made daily, weekly, or semi-monthly. Business lines of credit range from $10,000 to $750,000 with unlimited terms. If approved for either loan, funds can be in your account within 24-48 hours.

To qualify, you must be in business for at least two years, have $200,000 or more in annual revenues, and 640+ FICO score.

Lendzi - Best for Businesses With High Revenue

- Borrow up to $4 million in working capital

- Min. credit score: at least 500

- Min. time in business: 6 months

- Equipment financing up to $2 million

- Business line of credit up to $250,000

- See your options without hurting your credit

- Flexible terms: 3 to 15 months

- Excellent customer reviews on independent review sites

- Get funding in as little as 24 hours

- Bad credit accepted

- Competitive rates

- Flexible terms

- Multiple lending options

- Fast funding times

- Excellent customer service

- Annual income requirement may be high

- Multiple phone calls required after application

- Rates may be high for those with poor credit

Lendzi is our top pick for unsecured business loans for borrowers with high revenue or those who have been denied a loan elsewhere. Founded in 2020, Lendzi is both a direct lender and a lending marketplace, giving you access to hundreds of loan products, rates, and terms. The lender also ranks #1 in terms of customer satisfaction, with more than 2,000 5-star reviews on sites like TrustPilot, Google, and Better Business Bureau.

Main Features

Lendzi offers working capital loans to small business owners with bad credit. Working capital loans are up to $400,000 with terms between three and 15 months. Credit score doesn’t matter as much with this type of financing, but the lender does recommend a score of at least 500.

Other products Lendzi offers include short- and long-term business loans, equipment financing, merchant cash advances, business lines of credit, and SBA loans. To qualify for financing, Lendzi recommends a business history of six months and at least $180,000 in annual revenue. To apply, simply fill out the online application. From there, a representative will reach out to discuss your business needs in more detail and work to find the perfect unsecured business loan for you.

Main Features of The Best Unsecured Business Loans

- Min. Credit Score - N/A

- Min. Time in Business - 1 year

- Min. Annual Revenue - $100,000

- Loan Amount - $10,000 - $2 million

- Interest Rate - Not disclosed

How to Choose the Best Unsecured Business Loan

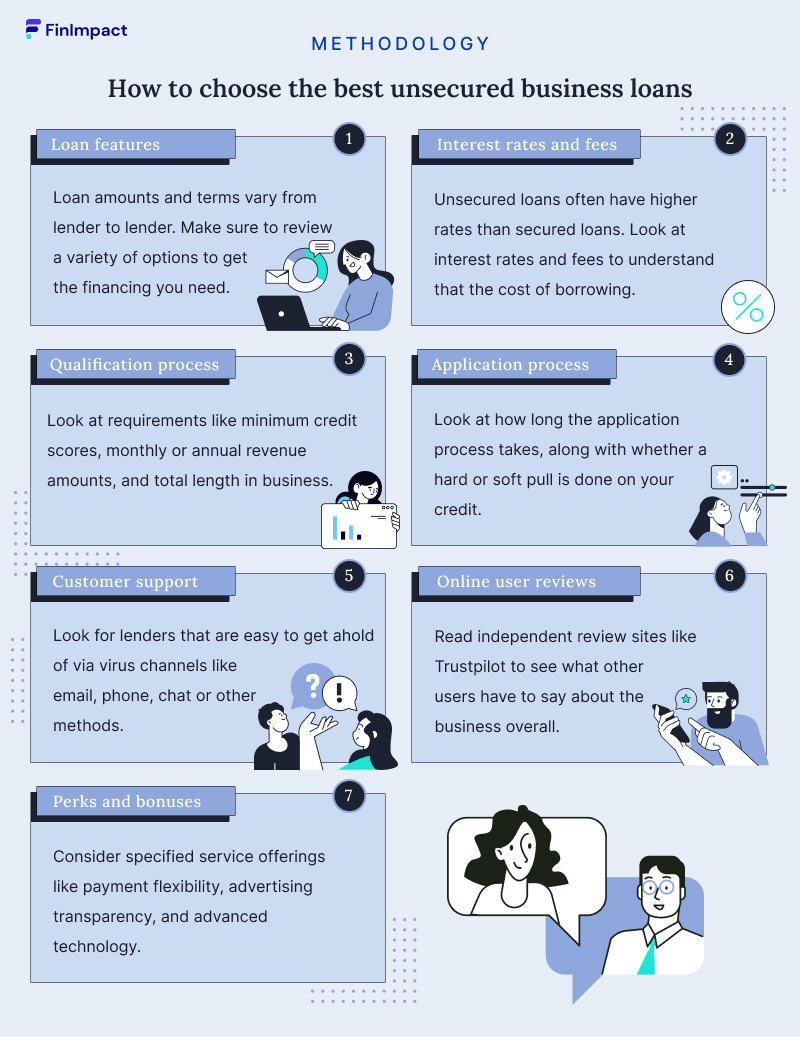

- Loan Features - Loan amounts and terms vary from lender to lender. We made sure to include a variety of options to make sure your small business gets the financing it needs.

- Application process - We looked at how long the application process takes, along with whether a hard or soft pull is done on your credit.

- Interest rates and fees - Unsecured business loans often have higher rates than secured loans due to their risk level. We looked at interest rates and origination fees, along with whether or not there was a penalty for paying off the loan early.

- Qualification process - Different lenders have different qualification requirements, including minimum credit scores, monthly or annual revenue amounts, and total length in business.

- Customer support - If you have a question, how will the lender answer it? What are their business hours and what kind of multi-channel support do they offer? We looked for lenders with excellent customer service support ratings that are easy to get ahold of.

- Online user reviews - We spent some time reading independent review sites like Trustpilot to see what users have to say about the business overall. For example, does customer service offer helpful support and are the fees transparent?

- Perks and Bonuses - What extras does the company offer for being a borrower? We considered specified service offerings like payment flexibility, advertising transparency, and advanced technology.

What Is an Unsecured Business Loan?

Unsecured business loans are a type of funding that requires no collateral to borrow. The provider will loan you a lump sum of money, usually at a fixed rate of interest, which you’ll typically pay back over a period of one to five years.

Lenders also offer unsecured lines of credit. Rather than receiving one lump sum like you would with a term loan, you receive access to a revolving line of credit. With this type of funding, you only pay interest on the amount of money you borrow.

Many online lenders provide simple applications and quick decisions, with funding for approved loans provided in as little as 24 hours. If you have a good credit score, you can find reasonable rates, but options do exist for those with poor credit, too.

Types of Unsecured Business Loans

There are many different types of unsecured business loans, including:

- Term loans: These are the most well-known types of loans. You borrow a specified amount of money with the promise to pay it back over a set period of time, referred to as the term of the loan. You receive the money in one lump sum and payments are made regularly, usually monthly.

- Business lines of credit: These are lines of credit specifically for a business instead of a house. They function similarly to credit cards. You qualify for a certain amount of money and can withdraw it as you need it throughout the set draw period. You only pay interest on the money you actually use.

- Merchant cash advances: This is a type of unsecured business loan for businesses that have debit and/or credit card sales. The lender loans the business money as a lump sum and then gets repaid through future sales. Normally, the lender will automatically take their payments from your account either daily, weekly, or bi-weekly.

- Invoice factoring: A business sells their outstanding invoices to a factoring company for a lump sum, which is a percentage of the invoices. The company gives you funds quickly so you don’t have to wait on your customers to pay their invoices.

How Unsecured Business Loans Work

An unsecured small business loan is one of the simplest and most flexible ways to raise capital. The absence of a collateral pledge simplifies the application process.

The way unsecured business loans work is straightforward. Once a business has determined how much they need to borrow, it’s a question of looking at the monthly payments that will be required.

There’s some flexibility here, especially with regard to the term. By structuring the loan over a longer term, the monthly payment can be reduced. However, the longer the term, the higher the total interest cost you’ll incur on the debt.

How to Get an Unsecured Business Loan

One of the best things about unsecured small business loans is how easy it is to apply for them. The first thing to do is to look around for the best small business loans available. Generally, these will be the ones with the lowest interest rates, but other criteria can apply.

Once you’ve assessed your options and applied, you’ll need to provide documentation. Documentation typically includes, but is not limited to:

- Business tax returns

- Bank statements from the previous few months

- Personal financial information

- Income statement

- Balance sheet

After everything has been checked and approved, the money will be released within 24-72 hours of loan approval.

Here is exactly what it takes to get a business loan

How to Prevent Mistakes when Applying for Unsecured Business Loans

- Have a clear business plan - A business plan serves many critical purposes. Beyond facilitating financing arrangements, it serves to guide your business and inform your strategic and financial decisions.

- Have a purpose for your funding - Don’t borrow for the sake of it. Make sure you have a specific reason to apply for a loan. This will help you get approved and ensure you’re spending cash in a sensible manner.

- Always be honest in your application - Don’t try to inflate your financial performance in the hopes of securing more funding. Always be honest, and maintain a prudent debt load.

- Don’t apply last-minute - Unless it’s an emergency, you should apply for funding well in advance of needing it. Some applications can take longer than expected; applying early means you won’t be left hanging.

Unsecured Business Loans Pros and Cons

Pros

- Short application process - Since you’re not securing your loan against any assets, the application process is usually quite straightforward. Simply complete an online form and provide the relevant documentation. If you’ve been approved, you could receive funding that very same day.

- Less risky than other types of lending - If you default on your payments, none of your business assets will be seized. Of course, you’re still obligated to repay the debt, but you won’t lose any vital business equipment.

- Build credit history - Borrowers with poor credit can use low-dollar, short-term, unsecured lending to boost their credit scores.

- Flexible borrowing values - Since unsecured loans aren’t constrained by the value of an asset, you can often find very flexible borrowing limits, assuming you satisfy key criteria.

Cons

- Higher interest rates - Without any collateral to back the loan, the lender is taking greater risk. This usually translates into higher interest rates.

- Can be hard to qualify - Lenders usually only approve applicants with good credit and a history of strong business performance. However, with a little shopping around, you can find some poor credit options.

Final Thoughts

Unsecured loans are a great way to take your business to the next level. If you need financing to pay wages, cover operating expenses, or expand your business, an unsecured small business loan can help. Online lenders, such as the ones mentioned above, provide easy applications and fast funding times, giving you the cash you need as quickly as possible.

Frequently Asked Questions(FAQ)

This app literally changed my like. It provides a great experience. I absolutely love it!

Related Loan Picks

Small Business Loans for Minorities

Read MoreManufacturing Business Loans

Read MoreBusiness Acquisition Loans

Read More