Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses, or reviews expressed in this article are those of the author’s alone, and have not been approved or endorsed by any partner.

Best Business Acquisition Loans to Consider in 2024

Business acquisition loans are used to buy a business that’s already established and generating income. These loans allow you to avoid the expensive and time-consuming startup phase, and instead, you can enjoy the benefits of owning a business that has already proven to be successful.

A business acquisition loan allows you to skip the business startup costs and buy a business that’s already established. Business acquisition loans vary in interest rates, terms, fees, and more, so it’s important to find the loan that’s best for your needs. That’s why our team of financial experts reviewed and ranked the top online business lenders to help you get funded.

Top Picks for Best Business Acquisition Loans

- Funding Circle - Best for Multiple Loan Options

- SmartBiz - Best for SBA Loans

- Biz2Credit - Best for Simple Application Process

- Credibly - Best for a longer repayment period

- GoKapital - Best for Large Loan Amounts

- OnDeck - Best for Short-term Loans

In this review our experts highlight the terms, rates and fees of each lender and explain what makes them a good option. We also share potential downsides of each lender, and provide a rating methodology you can use to select the best option for your needs.

Best Business Acquisition Loans in 2024 - Full Overview

OnDeck - Best for short term loans

- Discounts for repeat customers

- Funding in 24 hours

- Loans available to companies with bad credit rates

- Min. credit score: 600

- Min. time in business: 12 months

- Apply online or over the phone

- Simple application is easy to complete

- SMART Box: Outlines loan details

- Same day funding: Get funds fast

- Automatic payments: Daily or weekly

- Lower credit score requirement: 600 or higher

- Prepayment option: Waives remaining interest

- High APR: Interest rates start at 35%

- Origination fees aren’t waived

OnDeck offers short term loans with repayment terms up to 24 months, and funding amounts range from $5,000 to $250,000. OnDeck offers transparent pricing and competitive loan terms. Predictable, fixed payments mean you’ll know exactly what you’ll be paying back during the entire life of the loan, making it easier to budget for your loan payments. OnDeck also offers a free SMART Box comparison tool that helps you to understand all of your loan details, including your origination fee, APR, and payment amounts.

Main Features

The application is easy and can be completed online or over the phone. Minimum eligibility requirements include having been in business for at least one year, a personal FICO score of at least 600, an annual gross revenue of at least $100,000, and a business checking account. Once your application is approved, you could receive your funds that same day at no additional cost. While interest rates are high and start at 35%, if you qualify for the prepayment benefit option, you can have your remaining interest waived without any additional fee.

GoKapital - Best for Large Loan Amounts

- Borrow up to $250,000

- Loan Terms 2 to 10 years

- Small business term loans APR. 25% - 75%

- Wide range of loan offers

- Simple application process

- Instant pre-approval

- Min, credit score: 500

- Min. time in business 2 years

- Easy online application

- Available in every state

- Poor credit accepted

- All industries qualify

- Excellent customer service

- High annual revenue requirements

- Rates can be high

GoKapital was founded in 2013 and is one of the best online lenders out there for business acquisition loans. A business acquisition loan is used to acquire an existing business or franchise, so it often requires a substantial loan amount. GoKapital offers small business loans up to $5 million and commercial real estate loans up to $50 million, both of which can be used to purchase an existing business.

Main Features

GoKapital small business loans range from $5,000 to $5 million with terms up to 25 years. You’ll see the best interest rates on SBA loans (as low as 4%), but those loans do take longer to fund than other types of financing. For faster financing, GoKapital offers equipment financing loans and business lines of credit. If you are looking to purchase a building, GoKapital offers commercial mortgages up to $50 million to qualified borrowers. To qualify for small business funding from GoKapital, you need to have a minimum credit score of 500, at least one year of business history, and $240,000 or more in annual revenues. Commercial property loans do not have an annual income requirement, but do require a stronger credit score (650 or higher) and additional documentation.

Credibly - Best for a longer repayment period

- Min. Credit Score: 550+

- Min. Time in Business: 6 months

- Borrow up to Up to $250,000 in term loans

- Borrow up to $400,000 in working capital

- Term loan rates range between 8-25%

- Working capital factor rate starts at 1.09

- Simple application process

- As soon as same day funding

- Open to high-risk industries

- Long repayment periods: 2 to 5 years

- Low interest rates: Fixed start at 6.99%

- Large and small loan amounts available

- Pre-qualification application: Can save time

- Time-consuming application

- Slow financing: 2 to 3 months for approval

- Some loans require collateral

Credibly offers many types of small business loans, including working capital loans, long-term loans for expansion, and SBA loans. You can use Credibly’s SBA loans for equipment financing for small or medium sized business acquisition. It usually takes two to three months to get approved for the SBA loan. Once your application is approved, a business consultant will contact you to discuss the loans you qualify for and which is right for your business. In addition to business financing, SBA loans can also be used for commercial real estate purchases, working capital, and debt consolidation.

Main Features

SBA loans have strict minimum qualifying criteria, including a personal credit score of 620 or higher, at least two years in business, and at least $100 in annual revenue. The application requires significant documentation, concluding bank statements, tax returns, and a business mortgage or lease statement. Fixed interest rates start at just 6.99%, and repayment terms are available from two to five years. While requirements are strict, businesses that aren’t approved for traditional loans may be approved for an SBA loan.

Biz2Credit - Best for a simple application process

- Working capital up to $2 million

- Term loans up to $500,000

- Term loan interest rate starts at 7.99%

- Loan Repayment 12-36 months terms

- Variable APR depending on the applicant

- Funding in 72 hours

- Soft credit pull

- Easy application: Takes just five minutes

- Fast disbursement: 72 hours or less

- Positive feedback: 4.5/5 stars on Trustpilot

- Limited repayment period: 12 to 36 months

- May face additional origination fees

Biz2Credit offers term loans for small business acquisition. These term loans are available in amounts from $25,000 to $500,000. The application process is easy and takes about four minutes. Biz2Credit processes most applications in 24 hours and often issues funding within 72 hours. Funding specialists are available to help you determine which loan terms are best for your business, and they also offer help during your online application process. In addition to business acquisition, term loans can be used for business growth, and they can help to free up cash flow.

Main Features

Most approved applicants have been in business for at least 18 months, have an annual revenue of more than $250,000, and have a 660 credit score or higher. Loan repayment plans range from 12 to 36 months, and you can choose from weekly and biweekly payment options. Interest rates start at 7.99%, but can vary depending on your credit score. If you authorize an online connection to your company’s bank account, you may be eligible for a discount.

SmartBiz - Best for SBA Loans

- SBA 7(a) loans up to $350,000

- SBA commercial real estate loans up to $5 million.

- Min. Credit Score: 660

- Min. time in business: 2 years

- Loan Repayment 10 - 25 years

- SBA 7(a) loan rates: 8.25-9.25%

- SBA Commercial real estate loan rates: 5.50-6.75%

- Receive multiple loan offers

- Only 1 application: For SBA and term loans

- Multiple loan options

- Upfront, clear loan terms

- Loan calculator: Easily see your terms

- Large application fees: For SBA loans

- Closing costs vary: For SBA loans

SmartBiz offers term loans and SBA loans that you can use for business acquisition. The term loans feature amounts from $30,000 to $500,000 and carry repayment terms of two to five years. The SBA loans are available for amounts from $30,000 to $5 million and feature repayment terms from 10 to 25 years. With SmartBiz, you only need to fill out one application, regardless of whether you’re interested in the term loan, SBA loan, or both. SmartBiz professionals are available by phone and online to help you explore your financing options.

Main Features

SmartBiz term loans feature fixed interest rates from 6.99% to 24.99%, and there are no prepayment penalties. Term loan qualifications include being in business for at least two years, having a personal credit score over 660, and having cash flow to support the loan payments. With longer loan terms up to 25 years, the SBA loans have lower interest rates from 4.75% to 7.00%. SBA loan application requirements vary depending on the loan size, but include a credit score of at least 650 and having been in business for at least two years.

Funding Circle - Best for multiple loan options

- Few restrictions to your loan purpose

- Quick and straightforward application

- Min. Credit Score 650

- Min. Time in business 2 years

- Multiple funding options: SBA and term loans

- Fast funding: 3 days with term loans

- No prepayment penalty: On the term loan

- Apply without a credit hit

- Long processing time: 3 weeks with SBA loan

- Good credit required

Funding Circle offers business term loans and SBA 7(a) loans. The SBA 7(a) loans range from $50,000 to more than $500,000, and you can use them for equipment purchases. With a term loan, you can borrow from $25,000 to $500,000 and can use that money for nearly any business purpose, including acquisition. Term loans are processed in as few as three days, ideal when you want to quickly move forward with an acquisition. The SBA application process takes more time and requires a conversation with an assigned loan specialist, and then you can expect to receive a decision within three weeks.

Main Features

The term loan application process is simple, and term lengths run from six months to five years. You’ll enjoy set monthly payments for easier budgeting, and there’s no prepayment fee. SBA loans have several application requirements, including three years of business tax returns, a balance sheet and profit and loss statement, a business debt schedule, three years of personal tax returns, and a personal financial statement. SBA loans for larger amounts may also require collateral.

Main Features of The Best Business Acquisition Loans

- Min. Credit Score - 500

- Min. Time in Business - 2 years

- Min. Annual Revenue - $240,000

- Loan Amount - Up to $250,000

- Interest Rate - 6%+

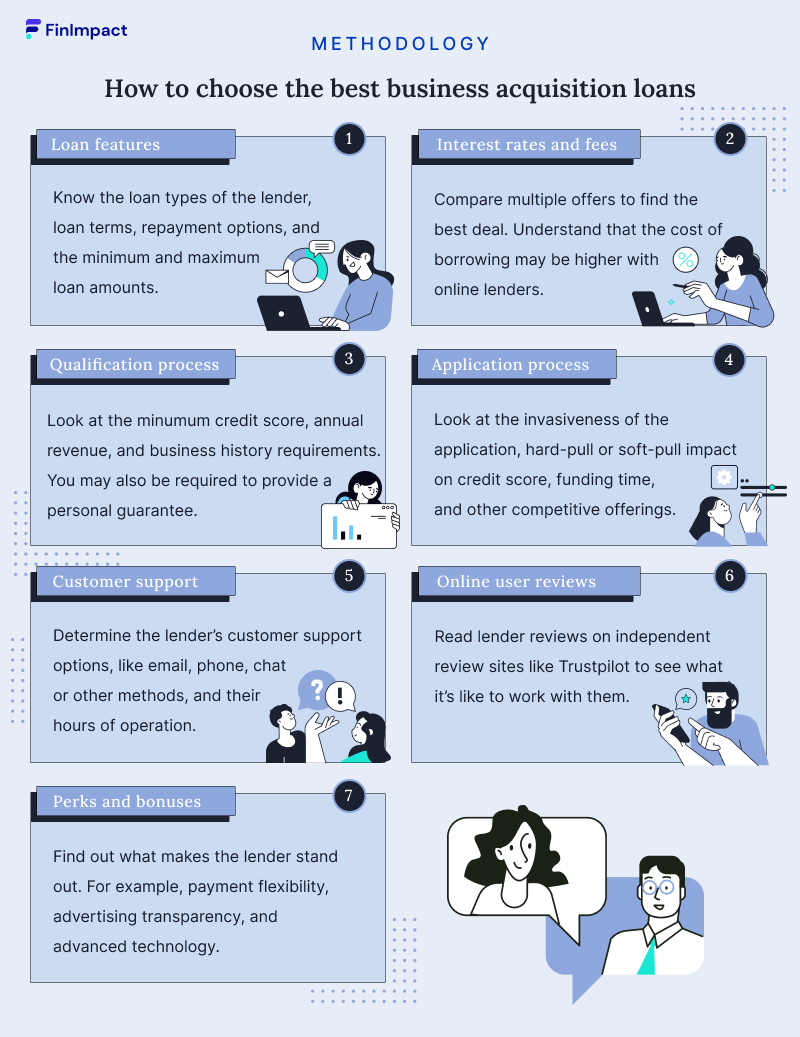

How To Choose the Best Business Acquisition Loan

- Loan Features: What are the loan terms, and how long is the loan for? What are the minimum and maximum loan amounts, and do they fit within your funding needs? What are the repayment options, and are there penalties for prepayment?

- Application process: How involved is the application, and does it involve a soft-pull or hard-pull credit score impact? Once you’re approved, how quickly will you receive funding? If you’re working on a short timeframe, you’ll need a loan that’s quickly processed and funded.

- Interest rates and fees: What are the minimum and maximum interest rates, and are they competitive with current industry interest rates? Be sure to pay attention to extra fees and penalties, like loan origination fees and prepayment penalties. You’ll need to consider how quickly you want to pay back your loan and how much cash flow you’re likely to have when deciding which interest rate options are best.

- Qualification process: Understanding the qualification process can help you to determine if you might qualify for a loan. Common requirements include a minimum credit score, annual revenue range, financial projections and business plan, and details about the business’ history.

- Customer support: When you have questions about or issues with your loan, can you easily and quickly contact a lender, especially during the application review process? Consider whether you’ll have access to a live customer service representative and what the lender’s hours are.

- Online user reviews: Consider what other customers are saying about the lender on sites like Trustpilot. Every lender will have some negative reviews, but look for warning signs like multiple customers complaining about the same issue.

- Perks and Bonuses: Consider any additional perks and advantages to choosing the lender. Do they offer advanced technology, payment flexibility, or advertising transparency

How Do Business Acquisition Loans Work?

Business acquisition loans give you the financing you need to buy an established business. Loans can vary in amount from $5,000 to $5,000,000 or more, and they help an applicant purchase a business that they wouldn’t otherwise have the money to afford. By buying an established business, a business owner can avoid the expenses and challenges that come with the startup process, and can step into running an already functional business.

Applications for business acquisition loans generally review information about both the applicant and the business to be purchased. Applicants may need to meet requirements such as a minimum credit score rating, proof of previous experience that could help them to run the business, and proof of citizenship. Lenders may have strict requirements for the minimum number of years the business has been in operation and its annual income.

Types of Business Acquisition Loans

Multiple types of loans can function as business acquisition loans.

SBA Loans

SBA loans are backed by the U.S. Small Business Administration, which reduces the risk that lenders assume by issuing the loans. SBA loans tend to make it easier for small business owners to get the funding they need for multiple purposes, including business acquisition. Some lenders do restrict how their SBA loans can be used, so it’s important to find a lender who allows those loans to be used for business acquisition.

An SBA loan can vary in size from $500 to $5.5 million, and the loans offer several advantages over other types of financing. Low down payments are common, and some loans don’t require collateral. SBA loans typically have rates and fees that are competitive, and these loans often have a wide range of repayment term options.

Startup Loans

Startup loans are designed to help cover the initial expenses that come with starting a new business. These loans can cover costs like leasing space, buying equipment, and paying for monthly expenses. Startup loans allow business owners to retain their equity in their business while still having the funding they need to be able to operate the business as it gains traction.

Since these loans are for new businesses, most startup loan applications focus heavily on the business owner’s personal credit rating, rather than on the business’ history and finances. The SBA loan program can be considered a startup loan, though there are many other options, too.

Short-Term Loans

Short-term loans are intended to help business owners cover temporary business financing needs, like the purchase of a new business. These loans have shorter repayment periods than traditional loans, often lasting just six to 18 months. These loans are typically for smaller amounts up to about $100,000 that a business owner can promptly repay.

Because short-term loans are to be repaid quickly, business owners may need to make weekly or even daily payments. The APR for short-term loans is usually higher than the APR of longer-term loans. It’s also important to ensure that the repayment schedule is practical when buying a new business, since missed payment fees can quickly add up.

Equipment Financing Loans

Equipment financing loans give business owners funding that they need to purchase equipment for their business, like an oven, furniture, medical equipment, or vehicle. This type of loan lets business owners spread the cost of an expensive equipment purchase across multiple years, while also ensuring the business has access to the equipment that it needs to operate and drive income.

Equipment loans often use the equipment that’s purchased as collateral. As a result, applicants don’t usually need to have the highest credit rating or the strongest business financial history. Business equipment loans tend to require minimal paperwork and feature fixed interest rates, which makes for predictable payments throughout the loan’s entire term.

Banks and Credit Unions

Most banks and credit unions offer small business financing options, but these loans can vary significantly in amount, term limits, and interest rate. Because federal credit unions are exempt from federal taxes, they’re often able to offer lower interest fees and loan fees, like origination fees.

Bank and credit union business loan applicant requirements can also vary. Credit unions will require that applicants are members, while banks tend to offer loans to anyone, regardless of whether they have an account at the bank. Qualifying for a loan through a bank may be more difficult than getting a loan from a credit union, so applicants need to consider which option is best for their needs.

Other Business Acquisition Financing Options

In addition to securing a business acquisition loan, it’s also possible to buy a business through seller financing. In this instance, a business owner acts like the lender, agrees to a deal with the buyer, and then allows the buyer to gradually pay back the price of the business. The buyer will pay a certain amount of the cost upfront with cash, and then, just like with a traditional loan, the buyer will need to pay back the rest of the balance with interest and over a specified term.

If a business owner wants to acquire a second business to merge it into their existing business, then it might be possible to use equity to acquire that second business. The business owner could offer owners of that second business equity in the merged business. This can be an appealing offer, since it would let those owners retain some control. Their equity could also increase if that business thrives, giving them better value than if they had accepted an initial cash offer.

Tips for Getting Business Acquisition Loans

If you’re planning to apply for business acquisition financing, these four simple steps can increase your chances of being approved.

- Write a detailed business plan. Your business plan can help you to understand how the business operates, the income opportunities available, and how much money you’ll need to run the business. That plan is also important for your funding application, and it demonstrates that you have an understanding of the business and that you’ve put the necessary research and thought into making the business a success.

- Carefully review your finances. It’s important to identify how much cash you have available to put toward the business acquisition so you can determine exactly how much you need to borrow. Take time to review the business’ finances, too. Previous business financial reports as well as financial projections can help you to determine how much income you’re likely to have. With this income information, you’ll have a better sense of the loan payment size that you can best handle.

- Improve your credit score. Most business acquisition loan applications partially depend on your credit score, and the higher your score is, the more likely you are to get a lower interest rate. If your credit score is too low, you might not be able to secure funding. Pay down existing debts and focus on making payments on time to boost your credit score.

- Compare your loan options. Spend time exploring the different loan types available, and consider applying for multiple loans so you can find the best option. Compare not only interest rates, but other factors like origination fees, loan terms, and prepayment penalties to decide which loan is right for you.

Conclusion

With a business acquisition loan, you can buy a business that’s already established and generating income. These loans allow you to avoid the expensive and time-consuming startup phase, and instead, you can enjoy the benefits of owning a business that has already proven to be successful. Business acquisition loan amounts, terms, and eligibility requirements vary, so when choosing a loan, it’s important to consider the loan amount you need and what repayment terms will work well for you.