Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

Lendio Reviews: Professional Analysis & User Insights for 2024

Lendio is an online marketplace for a variety of small business loans. Customers shop and compare offers across a range of loan products from various lenders. In addition to loans, Lendio offers free tools to send invoices and track expenses.

Lendio is an easy-to-use online lender. It takes just 15 minutes to fill out their application and get connected to trustworthy small business lenders. Lendio’s small business loans are offered by more than 74 lending partners and there are more than 10 types of funding options available. With high loan amounts and low minimum credit score requirements, Lendio is a great choice for businesses of all types.

Summarized Ratings

Lendio gets a 3.7 for Loan Features. This above average score reflects a very broad offering of loan terms, fairly flexible loan limits, and accommodative repayment options.

Lendio Reviews - What People Are Saying

Lendio has 4.8 out of 5 stars on Trustpilot and more than 19,000 reviews (89% of which are “excellent”). The majority of positive reviews highlight the professional customer service and holistic experience provided by Lendio. Several highlight the help provided by the funding manager in guiding them through the process.

Of the reviews listed on Trustpilot, the majority of complaints centered around PPP applications. As of May 2021, these were no longer available.

ConsumerAffairs gives Lendio 4 out of 5 stars, with nearly 500 reviews. Five-star reviews rave about the quick funding times and excellent customer service, specifically via the chat feature. Borrowers also rave about the variety of loan options offered by Lendio.

Like Trustpilot, negative reviews seem to be focused on PPP loans, which are no longer being offered.

On the Better Business Bureau (BBB) website, Lendio receives 2.72 out of 5 stars across 122 reviews and an A+ rating. Notably, Lendio closed 186 complaints in the last 3 years and 10 in the last 12 months.

| Positive Reviews | Negative Reviews |

| Customer support and service | Expensive rates |

| User-friendly website | Difficulties with PPP loans (no longer offered) |

| Various types Of funding |

Pros

Cons

What Is Lendio?

Lendio is a business financing platform that acts as a one-stop shop for financing. Unlike other online lending companies, Lendio acts as a broker, connecting applicants with various lenders and products. Its network includes big names such as Bluevine, OnDeck, American Express Business Line of Credit, and Amex, to name a few.

Since its inception, Lendio boasts over 300,000 small business loans and $12+ billion funded. The company’s network includes 74+ lenders, with partners including PayPal, Bank of America, American Express Business Line of Credit, and LendingClub, to name a few.

Lendio Loan Features

As a marketplace that connects applications with loan providers, Lendio financial products include each of the following:

Business Line of Credit

Lines of credit act like credit cards, providing customers with a preset borrowing limit that can be used at any time. Borrowers can take out as little or as much as they need up to the credit limit. You are charged interest on the outstanding balance. As you repay the loan, the amount of available credit for you to borrow against increases.

| Term Length | 1-2 years |

| Repayment Period | Weekly or monthly |

| Apr Range | 8.00%-24.00% |

| Min-max Amount | $100,000 - $500,000 |

Short Term Loan

Short term loans are lump sum loans with short repayment periods, typically 3-10 years. Customers borrow a set amount, paying interest on the initial loan’s size even as you pay down the balance. Short term loans can be used for any business expense, including inventory, payroll, marketing, or even a new business opportunity.

| Term Length | 3-10 Years |

| Repayment Period | Monthly |

| Apr Range | 8.00% - 36.00% |

| Min-max Amount | $2,500-$500,000 |

Merchant Cash Advance

Merchant cash advances allow small businesses to borrow against future earnings. Collateral is not typically required, and funds can be made available in as little as 24 hours.

| Term Length | Up to 2 years |

| Repayment Period | Daily percentage of credit card sales or percentage of total daily business sales |

| Apr Range | As low as 18% |

| Min-max Amount | $5,000-$200,000 |

SBA Loans

SBA loans are government backed loans and one of the more popular options for small businesses. These loans include Paycheck Protection Program (PPP) loans and SBA 7(a), 504, and SBA Express loans.

SBA loans are term loans that extend over longer periods. Borrowers receive one lump sum, paying back the loan over 10+ years.

| Term Length | 10-30 Years |

| Repayment Period | Monthly |

| Apr Range | Prime+ |

| Min-max Amount | Up to $5,000,000 |

Equipment Financing Loan

Equipment financing loans are term loans used to purchase capital goods and equipment. These loans extend up to five years in duration, and the purchased equipment is used as collateral.

| Term Length | 1-5 Years |

| Repayment Period | Monthly |

| Apr Range | As low as 7.5% |

| Min-max Amount | $5,000-$5,000,000 |

Business Acquisition Loan

When you want to acquire another company, business acquisition loans can help. These loans let you purchase an existing company rather than starting one from the ground up. Business acquisition loans are designed to be paid back over multiple years, similar to a mortgage, and require borrowers to pay a 10-15% down payment.

| Term Length | 10-25 years |

| Repayment Period | Monthly |

| Apr Range | As low as 5.5% |

| Min-max Amount | $5,000-$5,000,000 |

Accounts Receivable Financing

When you need funds quicker than customers pay, accounts receivable financing can help. Accounts receivable financing (also known as factoring) pays you a portion of a customer’s outstanding invoice immediately. Once the customer pays, you receive the rest of the money less any fees.

| Term Length | Up to 1 Year |

| Repayment Period | Weekly |

| Apr Range | As low as 3% |

| Min-max Amount | Up to 90% of receivables |

Business Credit Card

One of the more well-known products, business credit cards act as a line of credit that you can draw on for business purchases. Business credit cards not only give you instant access to working capital, they also help build your business credit and track your expenses. While some cards do allow for cash advances, those typically come with a higher rate.

| Term Length | Revolving

|

| Repayment Period | Monthly |

| Apr Range | 8%-24% |

| Min-max Amount | Varies by Lender |

Commercial Mortgage

When you need to buy real estate for your business or upgrade your current property, commercial mortgages provide you with one-time funding for the purchase.

| Term Length | 20-25 years |

| Repayment Period | Monthly |

| Apr Range | 4.25%-6.00% |

| Min-max Amount | $250,000-$5,000,000 |

Startup Loan

Startup loans help small businesses get off the ground without giving away equity to investors or borrowing from family or friends. To qualify for this loan, you’ll want to make sure your credit score is up to par, as this is what lenders will mostly look at.

| Term Length | Up to 25 years |

| Repayment Period | Monthly |

| Apr Range | As little as 0%-17.00% |

| Min-max Amount | $500-$750,000 |

Business Term Loan

Business term loans are one of the most common small business loans. These loans provide one lump sum up front that is paid back over a set number of years.

| Term Length | 1-5 Years |

| Repayment Period | Monthly |

| Apr Range | As low as 6.00% |

| Min-max Amount | $5,000-$2,000,000 |

Lendio Interest Rates And Fees

Lendio is a marketplace for loans and not a direct lender. Because of this, fees, qualifications, and requirements may vary by lender.

| Loan Type | Interest Rates |

| Invoice Factoring | 8-24% |

| Term Loans | 8-13% |

| Merchant Cash Advance | Starts at 18% |

| SBA Loans | 5.50-8% |

| Equipment Financing | Starts at 7.5% |

| Business Acquisition | Starts at 5.5% |

| Accounts Receivable | Starts at 3% |

| Line of Credit | 8-24% |

| Commercial Mortgage | 4.25-6% |

| Startup Loan | Up to 17% |

| Business Term Loan | Starting from 6% |

How To Qualify For A Lendio Loan

Since Lendio acts as a lender marketplace, the qualifications vary between products and lenders.

However, there are some general guidelines to work with:

- The business should be operational for at least six months.

- You should have a personal credit score of 550 at least.

- Your business should generate at least $10,000 in monthly revenue.

| Business Line of Credit | Equipment Financing | Business Credit Card | Business Startup Loan | |

| Minimum Credit Score | 560 | 650 | 680 | 680 |

| Minimum Annual Revenue | $50,000 | $50,000 | Varies by Lender | Varies by Lender |

| Minimum Time In Business | 6 months | 12 months | Long Enough to Establish Credit History | 6 months |

Lendio Application Process

Lendio’s selling point is its streamlined application process. By filling out a single, 15-minute application, you can get matched with more than 74 lenders who will submit competing loan offers. This makes it much easier for you to find the right loan for your small business needs.

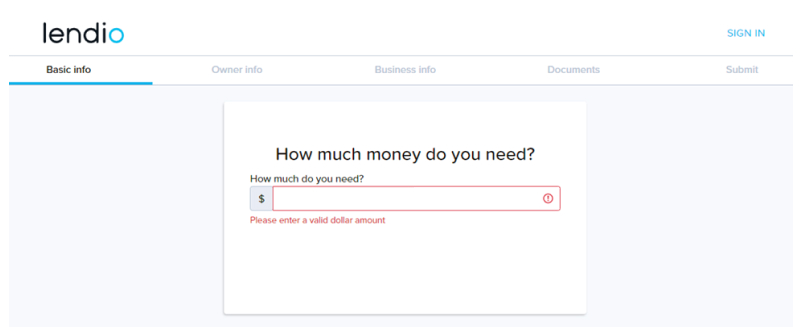

You’ll have to provide some basic information about your business, starting with how much you need to borrow.

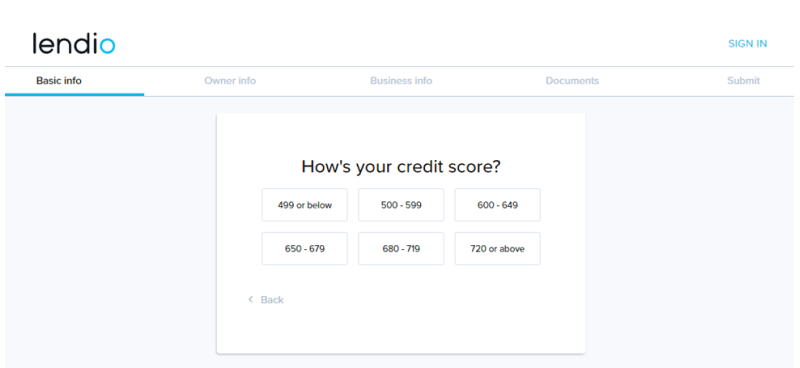

Then, you’ll have to estimate your credit score. Lendio allows customers to check their eligibility without it impacting their credit.

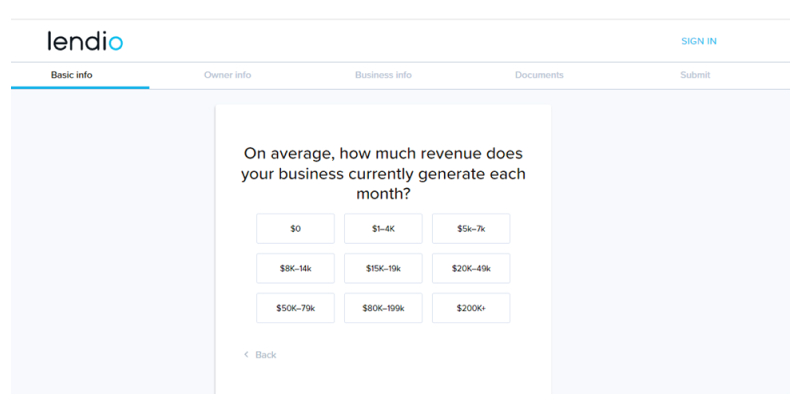

You’ll also have to talk a bit about your business.

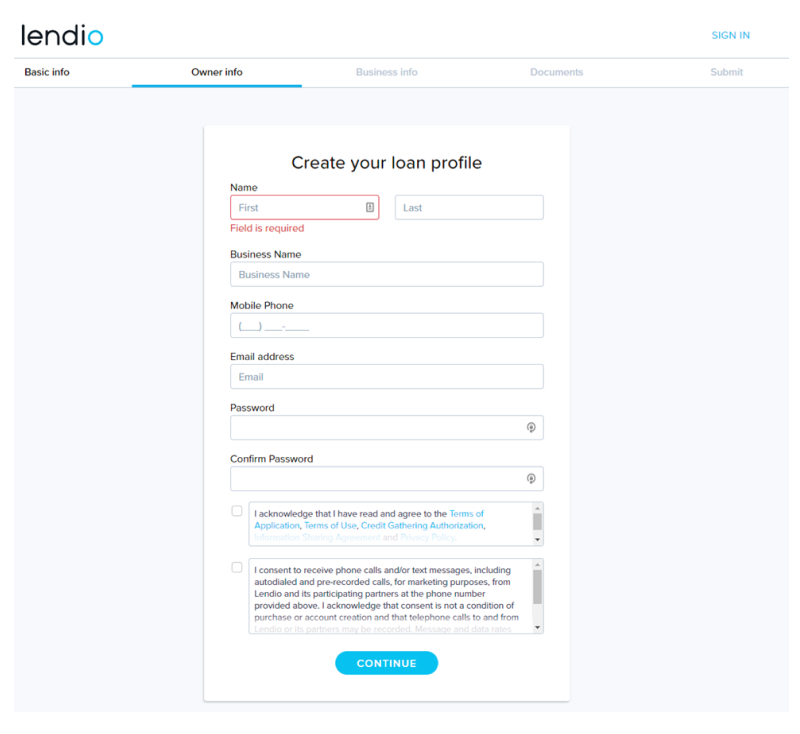

Once you answer all of the questions and create a profile, you’ll be asked to upload business documents, such as business bank statements. This makes the underwriting process seamless because lenders will already have all of the information that they need to give you a loan offer.

Once you submit the application, Lendio will send it to its lending partners and you’ll start getting competing offers from companies that want to lend to you.

Lendio Customer Support

Lendio offers multi-channel support, including phone, email, and social media on Facebook, Twitter, Instagram, and LinkedIn.

To help you through the loan process, Lendio assigns a personal funding manager to you when you apply. They’ll walk you through the various loan options and help you choose the one that’s right for you.

You can browse their resources and blog on their website, which includes articles that cover various small business topics of interest. Their FAQ page covers three main categories: types of loans, qualifying and applying, and small business basics.

Lendio Perks and Bonuses

Lendio is a great lender to work with because of its ability to match you with multiple lenders who want to compete with your business.

Flexibility

Lendio is a highly flexible lender, offering more than 10 types of loans to small business borrowers. Whether you have poor credit, are a startup company, have low annual revenues, or are in need of a larger loan amount, Lendio can provide you with the flexibility and specifications you need.

Transparency

Lendio is quite transparent when it comes to the types and terms of the loans you can get. However, they are not super specific when it comes to rates and fees, as those will vary by lender.

Technology

Lendio is a technology company at heart, making it easy for you to apply for a loan and get matched to lenders. Once you get a loan, however, it’s up to the lender whether you’ll have access to features like an online account portal or automatic payments, so keep that in mind when you choose a loan offer.

Lendio also offers small businesses bookkeeping solutions, such as tools to send invoices, track expenses, and manage your business finances. You can sign up for this service for free without having to apply for a loan.

Final Thoughts

Lendio fills a unique niche in the financial lending space. With the number of lenders available online, going through individual applications can be a time-consuming ordeal. With one simple application, Lendio provides access to multiple lenders and products, allowing customers to select the solution best-suited for their situation.

Frequently Asked Questions(FAQ)

This app literally changed my like. It provides a great experience. I absolutely love it!