| All content presented here and elsewhere is solely intended for informational purposes only. The reader is required to seek professional counsel before beginning any legal or financial endeavor. |

A line of credit, in most cases, is cheaper in terms of the interest that you would need to pay than a credit card. While they are both in essence a loan, a line of credit is often extended to businesses that have a financial credit history and collateral that is used as a guarantee. This makes the risk for the lender of the borrower not repaying the loan lower and therefore incurs reduced interest rates.

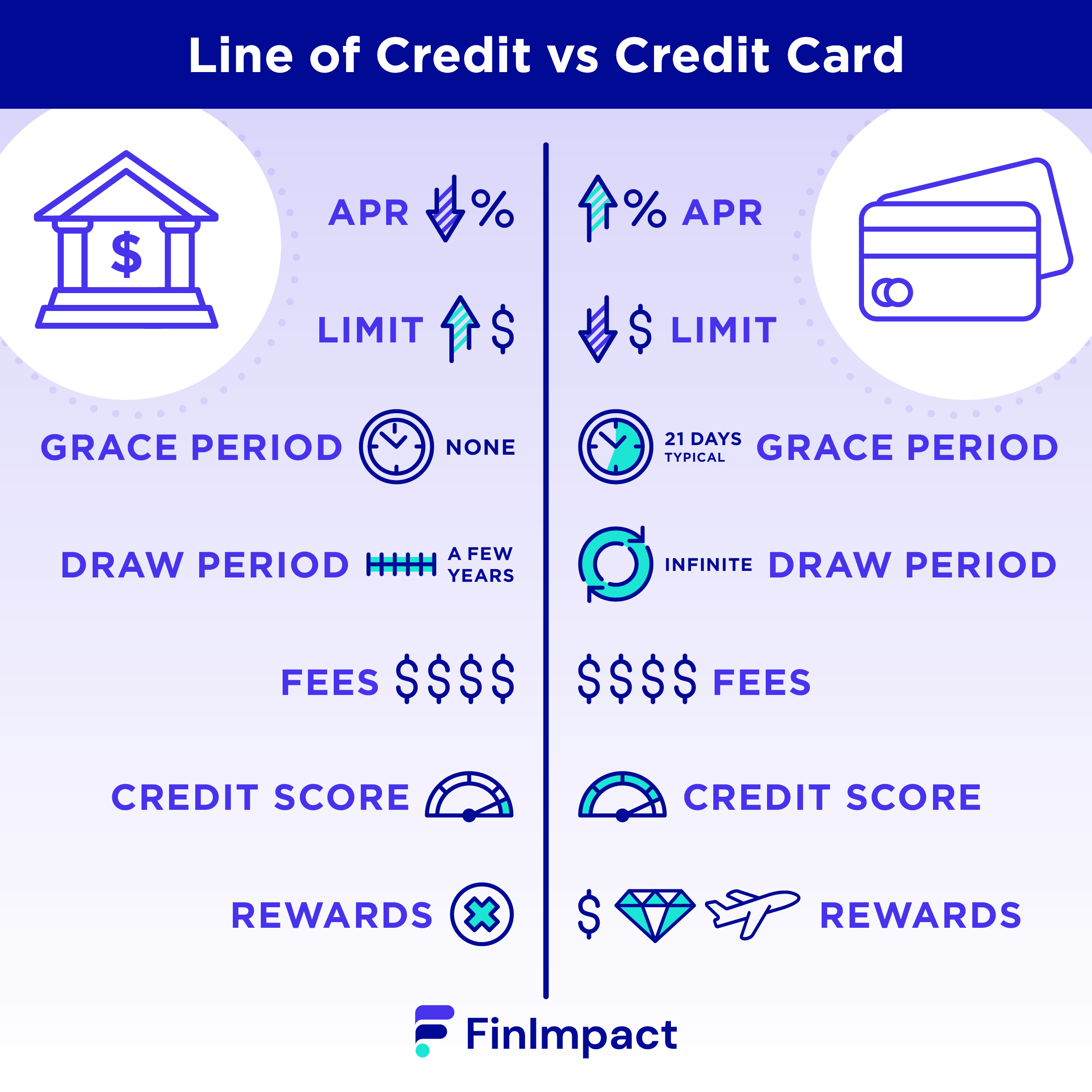

Key Differences: Line of Credit vs. Credit Card

A line of credit and a credit card are both forms of revolving credit that provide borrowers a convenient way to access or buy money. Understanding the difference between line of credit vs credit card can help you better navigate both topics. There are a number of notable differences between the two. The table below summarizes them.

| Key Features | Line of Credit | Credit Card |

| Average APR | Typically, lower than a credit card, especially when secured with collateral | Typically, higher than a line of credit |

| Credit Limit | Typically, much higher than a credit card, especially when secured with collateral | Typically, much lower than a line of credit |

| Grace Period | No grace period | Typically, 21 days |

| Draw Period | Typically, a few years; longer periods exist, with some rare arrangements offering an infinite draw | Infinite draw period, assuming you make the required minimum payments |

| Fees | Potentially, activation fees, annual maintenance fees, draw fees, late payment fees, and returned payment fees | Potentially, annual maintenance fees, balance transfer fees, cash advance fees, late payment, and returned fees |

| Credit Score Requirements | Typically calls for good to exceptional credit | Wide availability for high to low credit scores, with increasingly high APRs |

| Rewards/Perks | No rewards/perks | Diverse rewards, including cash back statement credits |

| Common Uses | Significant outlays, such as capital expenditures, operating expenses associated with seasonal cyclicality, and emergency repairs | Recurring expenses, such as inventory purchases, rent, utility bills, and travel expenses. |

A line of credit is an automatic recurring loan up to a specified limit which you will pay for at an agreed point in time in the future.

You only pay interest on the money you borrow. However you may be charged a fee each time you borrow from the business line of credit. The outstanding loan balance and interest simply revolve into the next billing period.

A line of credit provides you access to more cash, but the availability of the line is limited…

Different Types of Lines of Credit:

Secured:

A secured line of credit is when you pledge objects of value, such as business equipment or personal assets, like an automobile or home, to lower the risk for the institution lending you money. An equipment line of credit also allows you to pledge purchased machinery as a collateral.

Secured lines of credit loans are less risky for lenders.

They have better terms: lower interest rates, fixed-rate and variable-rate and longer terms of availability. Secured lines are much riskier for borrowers or buyers of money, because they put your assets at risk. Visit our other article to learn more about the best business line of credit rates available.

Unsecured:

An unsecured business line of credit does not require a security pledge. This means there is a higher risk for the lender. As a result, to mitigate their risk, the interest rates or the price of the money you buy is often higher.

In addition their policy requirements are often more complex. They may require a cosigner which puts whomever that is at risk if you default.

With a credit card, your access to funds is lower and costlier, but you have the ability to utilize the credit indefinitely...

Interest Rates With a Line Of Credit

1. Variable Rate

A variable rate is an interest rate that fluctuates over time. It fluctuates because it is based on the governmental understanding of what the interest rate should be which, in turn, is dependent on many economic market factors that change.

For example: let's say that you need $1,000 to start a business. Professional Banana Lenders offer you a price of variable interest rate at prime plus 5%. That means that the interest rate or the cost of the money you are buying equals whatever the prime rate is plus 5%. If the prime rate is 4%, then your interest costs will be 9% of the amount you borrowed.

2. Fixed Rate

With a fixed rate, the interest charged on the amount you borrowed will not fluctuate throughout the life of the loan. It remains the same regardless of what is happening in the financial market economy that would affect the cost of the money or interest rate in the variable interest rate structure.

A line of credit should be used sparingly, perhaps, for unexpected capital expenditures or operating expenses associated with seasonal changes...

What is a Credit Card?

A credit card is a type of line of credit or financial mechanism that lends you money very easily and instantaneously.

This type of lending happens in real time as you buy something in-person, over-the-phone or online. They are also a form of a personal line of credit.

- Most credit cards are unsecured and they carry high interest rates.

- Those with the lowest interest rates and most flexible payment terms are reserved for borrowers with the highest credit scores.

- You don't need an exceptional credit score to get a credit card.

How Does a Credit Card Work?

Making purchases with a credit card can be done by physically swiping or inserting the card in a terminal. You can also use it to purchase items by verbally communicating the card’s number, expiration date, and security code over the phone. Using a credit card can also be done by entering the card’s number, expiration date, and security code into an online payment form.

Once a transaction is processed the purchase amount is added to your account balance. This reduces your available credit and all purchases are tracked and reported to you, along with any accrued interest, via periodic billing statements.

Each billing period spans 30 days with payment due no less than 21 days following the issuance of the billing statement.

- Most credit cards offer a grace period on each bill. Essentially, this allows you to avoid any interest charges by paying the entire balance by the due date.

- If you pay less than the full balance, you lose the grace period privileges. This means you will be charged interest on the unpaid portion of the balance, and you will be charged interest right away on any new purchases.

- You must pay at least the stipulated minimum amount by the due date. Failure to do so is likely to result in late fees, a higher APR, and a delinquency notice on your credit report.

Alternatives to a Line of Credit

An even better idea than using these types of money purchasing systems is to provide the money yourself:

Focus on saving. Establish a rigorous, but realistic budgetary framework – with a focus on generating savings each month. Gradually build up a money reserve you can tap for unexpected operational needs and capital expenditures.

Establish more lenient payment plans. Work with your key vendors to extend your payment terms. This can improve your near-term cash flows and give your more day-to-day flexibility.

Sell unnecessary fixed assets. Oftentimes, businesses acquire assets that become obsolete over time. Assess your stock of fixed assets to determine if you are holding onto any unnecessary equipment, furniture, or automobiles. Selling these assets could be an easy way to raise cash.

Leverage local support. Explore your community to find business associations, mutual assistance groups, and stimulus-oriented non profit organizations that can provide free consulting services, monetary grants, and donations of real assets to facilitate your business endeavors.

When To Use a Line Of Credit or Credit Card

In light of their differences, there are certain situations when using a line of credit is optimal and other situations where credit card utilization is more sensible.

A Line of Credit is most useful when you have the potential for unexpected, large outlays. Especially if it is a revolving line of credit. It gives you the flexibility to address these issues without the need to precisely time and fund them via a cash reserve or a well-defined installment loan.

A Credit Card is most useful when your potential spend is low to moderate. It’s a highly convenient way to facilitate purchases without drawing down on your cash reserve.

You should only use a credit card for everyday spending if you intend to pay your bill off each month by the due date. Doing so you’ll avoid accumulating problematic debt, needing a debt consolidation loan and paying interest of 15-30 percent.

Ideally, a credit card should be used for high volume transactions with relatively moderate costs, such as service subscriptions, travel expenses, meals, and supplies…