An equipment line of credit is a loan that allows businesses to borrow money to purchase critical equipment. The credit line becomes reusable as the sum is repaid. Often, the loan is secured by existing or financed equipment that serves as collateral. If payments are not made, the equipment may be taken to satisfy the debt.

Key Points:

- Equipment line of credit offer relatively quick and easy financing for businesses looking for equipment financing options.

- Many ELOCs require collateral unless you have a robust credit history.

- ELOCs can be found through online lenders who offer faster funding and less strict credit requirements.

Understanding Equipment Line of Credit (ELOC)

Why Do Businesses Take Out an Equipment Line of Credit?

The main reason companies take out an ELOC is the time frame for getting financing. When you go with traditional financing to purchase business equipment, you could be waiting weeks to actually get the money. ELOCs often provide business equipment financing a lot quicker, sometimes even the next day.

Additionally, ELOCs give you access to a revolving line of credit that you can draw on more than once. Equipment loans, on the other hand, provide a one-time business equipment financing option.

Who Can Take Out an Equipment Line of Credit?

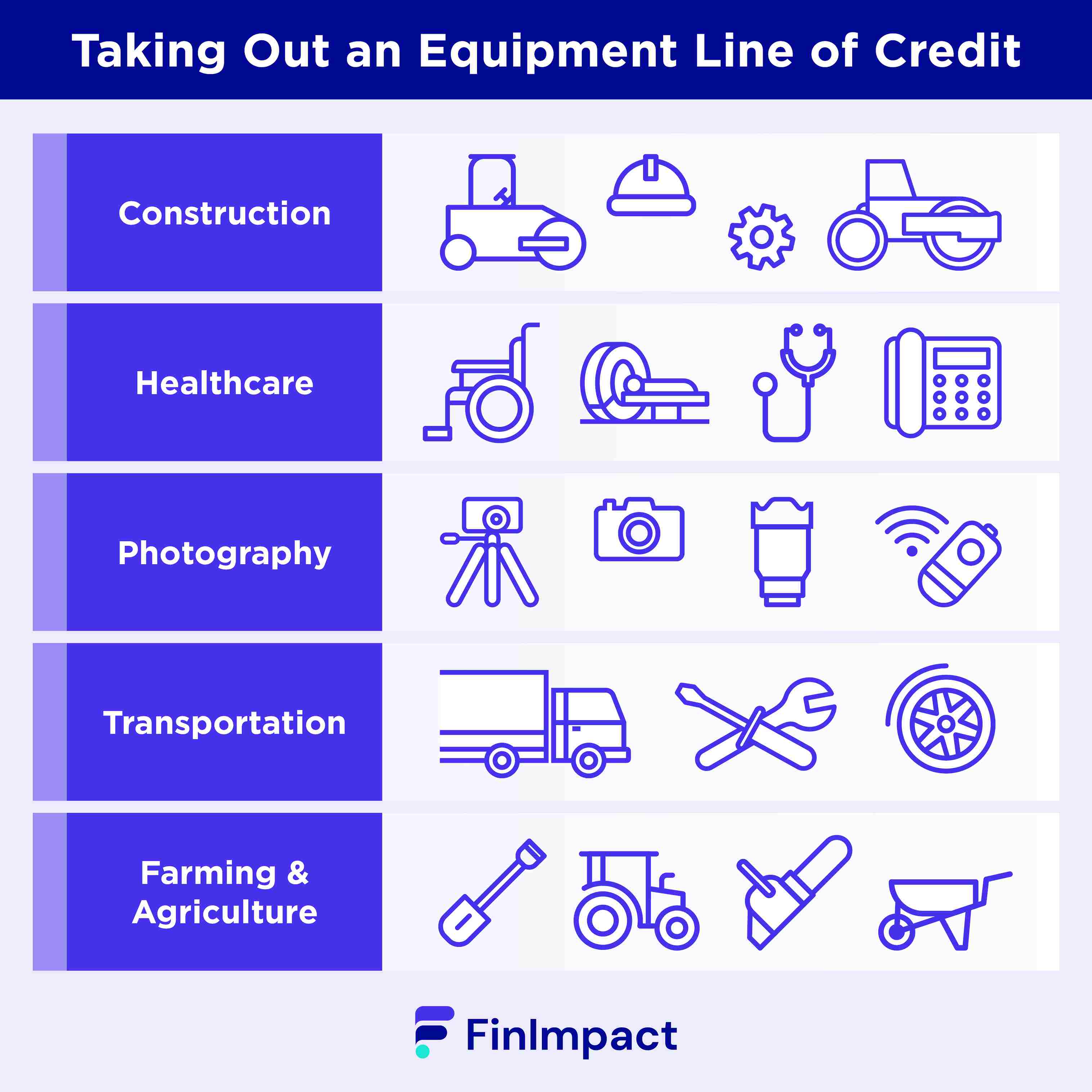

Many industries use equipment lines of credit, but those who frequently have to replace equipment are the ones who benefit most. These industries include:

- Construction: Heavy equipment, which is often expensive, is a necessity in the construction industry, so a line of credit can help replace this equipment in an emergency.

- Healthcare: The healthcare industry changes quickly, meaning new equipment comes along each year. Hospitals and private practices can take advantage of an medical equipment line of credit to ensure they have the most up-to-date equipment.

- Photography: It can be challenging for professional photographers to finance camera equipment through traditional banks. Since they have a relatively small income but need to purchase or replay equipment regularly, a business line of credit is a great option. A business line of credit also allows photographers to cover unexpected expenses.

- Transportation: Truck drivers must spend a lot of money to keep their trucks running, and those who own whole fleets of trucks need cash available quickly when something needs to be replaced. Equipment line of credit can help with this.

- Farming and agriculture: Farmers use their equipment to make their living and feed their local communities. When tractors and other farming equipment need replacing, it’s something that has to happen quickly. Having access to revolving credit can ensure farmers can keep their farms up and running.

What Equipment Can Be Purchased through an Equipment Line of Credit?

Equipment line of credit provides almost open-ended funding for equipment needs. While you’ll likely be asked what you plan to use the ELOC for during the application process, it doesn’t matter much if you’re using the business line of credit to purchase heavy equipment, kitchen equipment, office equipment, etc.

Is Collateral Required for an Equipment Line of Credit?

Yes and no. Many lenders won’t require any collateral, but for these options, you’ll likely need better credit. Some other lenders will require the equipment you purchase to act as collateral. If you make payments on time each month, this shouldn’t pose a problem since you’re not at risk of having your equipment seized.

Where Can You Get an Equipment Line of Credit?

Typically, you’ll find three options that allow you to take out an equipment line of credit:

- Traditional banks: Big name banks like Chase, for example, offer equipment line of credit up to $500,000. Working with a trusted name may be more comfortable for some business owners, but be prepared to wait a little longer for financing.

- Credit unions: Local credit unions can often offer better terms on an equipment line of credit. Not every credit union will offer this financing option, but those that do provide a more hands-on experience and may work better for those with a more sorted financial past.

- Online lenders: The lenders often offer next-day financing and require little background information to secure a business line of credit. This will likely be the option with the highest interest rate and, though, so make sure you’re comfortable taking that one. You can check out the latest offers of recommended equipment financing companies in our article.

What Interest Rates and Terms Are Available on ELOCs

This will ultimately depend on the lender you choose and your financial health as a business. Generally, online lenders will have repayment terms of up to a year or a couple of years. Just like a credit card, you’ll start making monthly payments once you draw on the line of credit.

An interest rate average doesn’t really exist, since it’s so heavily dependent on your financial profile. As always, those with better credit scores will likely qualify for much better interest rates. Still, be prepared to pay in the double digits no matter your score.

How Do You Qualify for an Equipment Line of Credit?

In order to qualify for an equipment line of credit, you’ll need to have quite a bit in order so you can ensure you get approved quickly. Generally, you’ll need the following:

- A good credit score: While ELOCs tend to have more lenient credit requirements, if you have a bad credit score, you’ll pay higher interest rates and likely have less satisfying terms.

- A history of being in business: Most lenders will require at least three months in business. They require this to ensure that you’re making money so you can, in fact, pay back your line of credit.

- Documentation of your annual revenue: Again, this documentation is to help the lender understand how much you can realistically play each month.

Unsecured vs. Secured Equipment Line of Credit

This is where collateral makes a difference. A secured ELOC is going to require collateral - likely equipment you already own or that you plan to finance. This financing option usually comes with less strict requirements since the collateral acts as a safety net for the lender.

Unsecured ELOCs, on the other hand, don’t require any collateral. To qualify, though, you’ll need to be able to meet stricter financial requirements. Often, you’ll need to have been in business longer, make a certain amount annually, and have a good personal and/or business credit score.

Neither option is truly better than the other, it just depends on what you’re looking for from an equipment loan and the type of financial profile you have.

Pros and Cons of Financing Equipment through an Line of Credit

While ELOCs provide plenty of benefits to business owners, there are some downsides you shouldn’t ignore. Let’s take a look at the pros and cons of taking out a business line of credit.

| Feature | Pros of Financing Equipment through a Line of Credit | Cons of Financing Equipment through a Line of Credit |

| Flexibility | Can purchase various equipment as needed. | May lead to overspending if not managed properly. |

| Ownership | Business owns the equipment once purchased. | The responsibility of maintenance and repairs. |

| Collateral | Can use existing or newly purchased equipment. | Equipment can be seized if payments are not made. |

| Interest Rates | Can benefit from low rates if well-managed. | Variable rates can increase the cost over time. |

| Repayment & Replenishment | As balance is paid, the credit line becomes available again. | May encourage over-borrowing, leading to debt. |

| Cash Flow Management | Only pay interest on the amount used. | Variable payments can make cash flow management difficult. |

| Credit Utilization Impact | Can improve credit score with good repayment history. | High credit utilization can negatively impact credit score. |

| Tax Benefits | Possible depreciation and interest expense deductions. | Tax benefits depend on the specific situation and regulations. |

| Loan Amount | Based on credit line limit, not tied to specific equipment. | Limited by the credit line limit. |

| Upfront Costs | May have lower upfront costs than other financing options. | Some lenders may require down payment or fees. |

| Ease of Access | Can be easier to obtain than traditional loans. | Requires good credit history and collateral. |

| Equipment Age | Can be used for new or used equipment. | Some lenders may have restrictions on equipment age. |

Pros of Financing Equipment through an ELOC

- Less strict requirements: ELOCs don’t always have the same requirements that loans do. Equipment loans often require a down payment, an excellent credit score, collateral, and a strict repayment schedule. Equipment lines of credit, on the other hand, are more lenient with credit and collateral requirements.

- Revolving credit: When you pay down the loan from the business line of credit, that line becomes open again and you can reuse it.

- Potentially faster financing: ELOCs can offer fairly quick financing because it comes with less strict requirements. Conventional loans, on the other hand, can take weeks.

- Frees up your business’s cash flow: When you don’t have to put a giant chunk of cash upfront to cover new equipment, your business has access to that cash to do other things the business may need.

Cons of Financing Equipment through an ELOC

- Collateral may be required: Some lenders will require you to put up equipment as collateral. So be 100% sure you can make payments on any money you borrow from your line of credit.

- You’ll need to have a history of being in business: ELOCs aren’t a way to get a business up and running. For most lenders, you’ll need to have been in business for at least a short amount of time.

- Potentially high interest rates: Like other loan options, you’ll be paying a substantial amount to have access to a business line of credit. Financing upfront is always your best option if you don’t want to pay interest.

How Does an Equipment Line of Credit Compare to Other Types of Financing?

A business equipment line of credit is far from your only financing option. Generally, you’ll find two other equipment purchasing options: leasing and loans.

Equipment Line of Credit vs. Equipment Leasing

A line of credit and a lease offer entirely different financing methods. The goal with the business line of credit is to someday own the equipment you’ve purchased on that credit equipment line. Leasing equipment, on the other hand, is a temporary ownership. For fast-evolving industries like the healthcare industry or the construction industry, leasing equipment may be a better option since you’ll need new, up-to-date equipment so frequently.

| Feature | Equipment Line of Credit | Equipment Leasing |

| Definition | A loan providing access to funds for purchasing business equipment. | A contract allowing temporary use of equipment for a fee. |

| Ownership | The business owns the equipment once purchased. | The leasing company owns the equipment; the business only uses it. |

| Collateral | Usually, existing or purchased equipment serves as collateral. | Generally, no collateral is required. |

| Repayment & Replenishment | As the balance is paid down, the credit line becomes available again. | Regular lease payments; no replenishment. |

| Tax Benefits | Possible depreciation and interest expense deductions. | Lease payments may be tax-deductible as operating expenses. |

| Flexibility | Allows purchasing various equipment as needed. | Limited to leased equipment; options depend on the leasing company. |

| Upfront Costs | May require down payment or fees. | May require security deposit or initial fees. |

| Impact on Credit | Business bears the risk of equipment obsolescence. | Leasing allows for easier upgrades to newer equipment. |

| End of Term Options | Business keeps equipment; no further obligations. | May have options to buy, return, or renew the lease. |

Equipment Line of Credit vs. Equipment Loan

Lines of credit and loans offer two different ways to reach the same end goal: equipment ownership. Equipment lines of credit offer a revolving line of credit as long as you pay down your purchases frequently. Loans, on the other hand, provide one-time financing, often for more expensive equipment.

| Feature | Equipment Line of Credit | Equipment Loan |

| Definition | A loan providing access to funds for purchasing business equipment. | A loan specifically for buying business equipment. |

| Ownership | The business owns the equipment once purchased. | The business owns the equipment after fully repaying the loan. |

| Collateral | Usually, existing or purchased equipment serves as collateral. | Purchased equipment often serves as collateral. |

| Repayment & Replenishment | As the balance is paid down, the credit line becomes available again. | Fixed repayment schedule; no replenishment. |

| Flexibility | Allows purchasing various equipment as needed. | Typically used for a single equipment purchase. |

| Interest Rates | Variable rates, often based on the prime rate. | Fixed or variable rates, depending on the loan terms. |

| Loan Amount | Based on the credit line limit. | Based on the cost of the specific equipment. |

| Upfront Costs | May require down payment or fees. | May require down payment or origination fees. |

| Impact on Credit | Can affect credit score depending on utilization and repayment. | Can affect credit score depending on repayment history. |

| Tax Benefits | Possible depreciation and interest expense deductions. | Possible depreciation and interest expense deductions. |

| Loan Duration | Often revolving, with no fixed end date. | Usually fixed term, based on loan terms and equipment life. |

| Equipment Age | Can be used for new or used equipment, depending on the lender's terms. | Can be used for new or used equipment, depending on the lender's terms. |

ELOC (Equipment Line of Credit), Lease, or Loan: Which Is Right for You?

With so many financing options, how do you decide which is right for your business? Well, let’s take a look at a few scenarios that each option is right for.

| Step | Decision Process | Equipment Line of Credit | Equipment Loan | Equipment Lease |

| 1 | Determine Needs & Objectives | |||

| - Equipment Ownership | Yes | Yes | No | |

| - Tax Benefits | Yes | Yes | Yes | |

| - Flexibility in Equipment Acquisition | Yes | No | No | |

| - Cash Flow Considerations | Variable | Fixed | Fixed | |

| 2 | Assess Financial Situation | |||

| - Credit Score | Consider | Consider | Lesser Impact | |

| - Available Collateral | Required | Required | Not Required | |

| - Credit Score | Consider | Consider | Consider | |

| - Available Collateral | Required | Required | Not Required | |

| - Cash Flow for Down Payment/Security Deposit | Consider | Consider | Consider | |

| 3 | Evaluate Options | |||

| - Flexibility, Collateral, Variable Interest Rate | ELOC | |||

| - Ownership, Fixed Repayments, Credit Score | Equipment Loan | |||

| - Avoid Obsolescence, No Ownership, Lease Payments | Equipment Lease | |||

| 4 | Compare Lenders & Terms | |||

| - Research Reputable Lenders | Do | Do | Do | |

| - Compare Interest Rates, Fees, Terms | Do | Do | Do | |

| - Seek Professional Advice if Needed | Do | Do | Do | |

| 5 | Choose the Best Option for Your Business | |||

| - Align with Business Needs & Financial Situation | Choose if Appropriate | Choose if Appropriate | Choose if Appropriate |

Choose an ELOC if…

- You want continued access to a line of credit that doesn’t involve pulling your credit each time.

- You know your business will have to purchase multiple pieces of equipment in a small amount of time.

- You want a fast funding process.

Choose an equipment lease if…

- The equipment you need changes frequently or becomes outdated quickly.

- You want smaller monthly payments.

Choose a loan if…

- You need the highest amount of financing, as equipment loans can offer millions in financing.

- You want the longest repayment time.

- You’re only planning to buy one piece of equipment in the near future.

How to Obtain an Equipment Line of Credit

Getting an ELOC is a relatively easy process, especially if you have a good credit score and you take the time to shop around. Here’s the general process for getting an equipment line of credit:

- Gather your financial information: Most lenders will ask for your business’s basic financial information. This can include tax statements and profit and loss statements.

- Pick the type of lender you want to work with: If you want a faster, less invasive process, an online lender may work best. For those who prefer the old-school touch or who have a more complicated financial situation, an in-person credit union or bank will be your better option.

- Apply online or in person: Now it’s time to apply! This part is usually fairly easy, with an application taking just a few minutes as long as you already have all of your paperwork in order.

- Understand the terms you’re offered: If you’re offered a business line of credit, make sure you read through everything in the fine print. Understand what your interest rate will be, any late payment fees, and how big of a line of credit you have. Don’t be afraid to talk with customer support at the lender of your choice if you have any questions.

- Receive financing: How quickly you’ll receive financing will depend entirely on the line of credit lender you choose. Lenders like Fundbox and Ondeck can provide funding in as little as a day, while credit unions may take a few days.

Tax Consideration of Equipment Line of Credit Financing

When financing equipment acquisitions, a business can benefit from an equipment line of credit (ELOC). Interest and depreciation on acquired equipment may be tax deductible, thus lowering your taxable income. Yet, in order to realize these benefits and maintain compliance with tax regulations, it is critical to understand the precise tax issues and implications related with ELOC financing.

When you finance equipment, whether through loans or lines of credit, you have the potential to qualify for a major tax break. Section 179 states that when you finance equipment and place it in use, you’ll get an immediate tax deduction. As of 2022, you can deduct up to $1,080,000.

To give you a real-world example, let’s say a farmer buys a new tractor for $175,000. Using a Section 179 calculator and assuming the farmer has a tax rate of 12.5%, the deduction can save the business over $21,000. This is cash that can be used to grow other parts of his business.

Section 179 Deduction: Companies can deduct the entire cost of eligible equipment in the year it is acquired. This deduction has the potential to drastically lower taxable income.

Bonus Depreciation: In certain situations, firms can claim additional depreciation on eligible equipment, lowering taxable revenue even further.

Interest Cost Deduction: In most cases, interest paid on an ELOC can be deducted as a business expense, lowering your tax obligation.

Alternative Minimum Tax (AMT): Section 179 and Bonus Depreciation deductions may reduce your exposure to the AMT, potentially lowering your overall tax burden.

Documentation: Accurate documentation of equipment purchases and ELOC transactions is critical for obtaining tax deductions and ensuring compliance.

Tax Filing Deadlines: Be aware of the deadlines for filing tax returns and claiming deductions, as failure to do so can result in missed tax benefits or fines.

Contact a Tax Professional: Because tax regulations are complicated and constantly changing, it is best to consult a tax professional to ensure you maximize ELOC-related tax benefits while remaining compliant.

Final Word

An equipment line of credit can provide a flexible way to finance business equipment. Since you can draw on it as needed, you only have to spend what you truly need. With online options and traditional brick-and-mortar options, equipment lines of credit can be fairly flexible.