Ascent offers private student loans to borrowers of all backgrounds, including those who do not have a cosigner to help. They also offer career loans for students participating in specific career development programs, plus consumer bootcamp loans. Ascent gives borrowers the chance to repay their loan on their own terms, qualify for affordable rates, and earn discounts and cash back when they graduate.

Ascent Student Loans Review: Private Loans for All Borrowers

Ascent is an award-winning student loan company that offers private student loans for borrowers with or without a cosigner. Flexible repayment plans are available, and loans are available to undergraduate students, graduate students, DACA students, and even international students.

Ascent Pros

Ascent Cons

What Types of Student Loans Does Ascent Offer?

Ascent offers a dizzying number of student loan options that can seem complicated at first. However, their loans are targeted to specific types of borrowers, so it's not too difficult to figure out the type of funding you need to apply for. For example, Ascent offers credit-based loans that rely on your creditworthiness (with or without a cosigner), but they also offer outcome-based loans that rely on your future income to qualify.

Generally speaking, Ascent offers undergraduate and graduate school loans, student loans for international students and DACA students, bootcamp loans, and career loans. You'll need to take a close look at the details, however, since unique repayment options apply to each.

It's important to note that Ascent does not service their loans on their own. When it comes to their college loans, they do so with the help of a company called Launch Servicing.

Below, we'll explain how each type of loan works in terms of their features, fees, and eligibility requirements:

- Undergraduate student loans

- Graduate student loans

- Bootcamp loans

- Career loans

Ascent Undergraduate Student Loan Review

Undergraduate Student Loan Features

Ascent offers private student loans for undergraduate students with or without a cosigner, and these loans are even available for international students and DACA students who can meet eligibility requirements. Loans can be credit-based or outcomes-based, and repayment terms depend on the exact type of loan chosen.

Loan terms |

5, 7, 10, 12, or 15 years for credit-based loans 10 or 15 years for outcome-based loans |

Repayment period |

Begins during school or up to nine months after graduation |

Loan amount |

$2,001 to $200,000 aggregate maximum |

Loan Structure Flexibility |

Fixed or variable |

Undergraduate Student Loan Interest Rates and Fees

Undergraduate student loans from Ascent do not require any origination fees, prepayment fees, or maintenance fees. Interest rates can be fixed or variable, although they can depend on the type of loan you apply for.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

5% of the past due amount or $25 (whichever is less) |

Maintenance Fees |

None |

Fixed Rates |

3.97% - 11.89% APR for cosigned credit-based loan 6.60% - 13.65% APR for non-cosigned credit based loan 11.13% - 12.46% APR for outcome-based loan |

Variable Rates |

1.47% - 9.05% APR for cosigned credit-based loan 4.05% - 10.80% APR for non-cosigned credit based loan 8.90% - 11.31% APR for outcome-based loan |

Undergraduate Student Loan Qualification Requirements

Credit-based cosigned undergraduate student loans are available for U.S. citizens, DACA & international students, while non-cosigned loans are only available for U.S. citizens and DACA students. In the meantime, outcome-based student loans are only available for juniors & seniors with a 2.9+ GPA & no credit score. Students must be enrolled at least half-time in an eligible degree program to qualify.

Institution Type & Course Load Requirements |

Enrolled at least half-time in an eligible degree program |

Minimum Credit Score |

680 without a cosigner No minimum requirement for outcome-based loans |

Minimum Income |

$24,000 for the co-signed and non-co-signed credit-based option No income requirement for outcome-based loans |

Maximum Debt-to-Income |

Not specified |

Co-signer/Joint Application Requirements |

Co-signers accepted |

Ascent Graduate Student Loan Review

Graduate Student Loan Features

Ascent offers graduate student loans in a similar format to their undergraduate student loans. Borrowers can be U.S. citizens, international students, or DACA students, and they can apply with or without a cosigner. That said, exact repayment options depend on the type of graduate degree being pursued.

Loan terms |

7, 10, 12, 15, or 20 years |

Repayment period |

Begins during school or up to 9 months after graduation |

Loan amount |

Up to 100% of your tuition and eligible living expenses |

Loan Structure Flexibility |

Fixed or variable |

Graduate Student Loan Interest Rates and Fees

Ascent graduate student loans come with fixed or variable interest rates that vary based on the type of degree being pursued. Fortunately, these loans are also free of major loans fees like origination fees and prepayment penalties.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

5% of the past due amount or $25 (whichever is less) |

Maintenance Fees |

None |

Fixed Rates |

4.06% – 13.65% APR for MBA student loans 3.87% – 13.65% APR for medical school loans 3.99% – 13.65% APR for dental school loans 4.06% – 13.65% APR for law school loans 4.06% – 13.65% APR for other graduate programs |

Variable Rates |

1.48% – 10.81% for MBA student loans 1.46% – 10.80% APR for medical school loans 1.47% – 10.80% APR for dental school loans 1.48% – 10.81% APR for law school loans 1.48% – 10.81% APR for other graduate programs |

Graduate Student Loan Qualification Requirements

Ascent graduate student loans are available for students pursuing business (MBA), dental (DMD, DDS), law (JD, LLM), medical (MD, DO, DVM, VMD, DPM) or graduate degrees (MA, MS, PhD). U.S. citizens can apply, yet these loans are also available to international students and DACA students who meet requirements.

Institution Type & Course Load Requirements |

Must be enrolled at least half-time in a degree program at an eligible institution |

Minimum Credit Score |

680 without a cosigner |

Minimum Income |

Not specified |

Maximum Debt-to-Income |

Not specified |

Co-signer/Joint Application Requirements |

Cosigners accepted |

Ascent Bootcamp Loan Review

Bootcamp Loan Features

Ascent bootcamp loans are consumer loans that can be used to help pay for tuition or living expenses to attend a career preparation program at an eligible school. These loans can be credit-based, although applicants can apply with or without a cosigner. Outcome-based loans are also available, and you don't have to make payments until you receive a qualifying job offer. While Ascent says their bootcamp loans come with flexible repayment plans, they do not offer many details.

Loan terms |

Not specified |

Repayment period |

Begins during school or up to three months after graduation |

Loan amount |

Not specified |

Loan Structure Flexibility |

Not specified |

Bootcamp Loan Interest Rates and Fees

Ascent doesn't offer many details on their bootcamp loans other than the fact they're available. For example, they don't share information on fixed or variable interest rates. These loans are also offered through a partnership with Ascent and Richland State Bank (RSB).

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

None |

Maintenance Fees |

None |

Fixed Rates |

Not specified |

Variable Rates |

Not specified |

Bootcamp Loan Qualification Requirements

Ascent bootcamp loans are for students who are attending specific types of career preparation programs, such as coding bootcamps. However, they do not specify any credit score, income, or debt-to-income ratio details. You can apply for this type of student loan with or without a cosigner.

Institution Type & Course Load Requirements |

Must be attending a career preparation program at an eligible school |

Minimum Credit Score |

Not specified |

Minimum Income |

Not specified |

Maximum Debt-to-Income |

Not specified |

Co-signer/Joint Application Requirements |

Cosigners accepted |

Ascent Career Loan Review

Career Loan Features

Career loans from Ascent are available for U.S. citizens, DACA students, and U.S. temporary residents. These loans are consumer loans for students attending eligible professional training and certification programs at select schools, and they can be repaid for up to ten years after graduation. Rates can be fixed or variable, and payments can be deferred for up to three months after you graduate.

Loan terms |

5, 7 or 10 years |

Repayment period |

Begins during school or up to three months after graduation |

Loan amount |

$2,000 up to the total cost of tuition |

Loan Structure Flexibility |

Fixed or variable |

Career Loan Interest Rates and Fees

Career loans through Ascent are offered through a partnership with Richland State Bank (RSB). As a result, they do not offer as many details on the range of interest rates offered. That said, the sample repayment plans shown on the Ascent website show interest rates from 8.25% to 14%.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

Not specified |

Maintenance Fees |

None |

Fixed Rates |

Not specified |

Variable Rates |

Not specified |

Career Loan Qualification Requirements

Career loans from Ascent are offered to students who are attending eligible professional training and certification programs at select schools. Borrowers can also be U.S. citizens, DACA students, or U.S. temporary residents.

Institution Type & Course Load Requirements |

Must be attending eligible professional training and certification programs at select schools |

Minimum Credit Score |

Not specified |

Minimum Income |

Not specified |

Maximum Debt-to-Income |

Not specified |

Co-signer/Joint Application Requirements |

Cosigners accepted |

Ascent Student Loan Application Process

Like many other private student loan companies, Ascent makes it possible to check your rate without a hard inquiry on your credit report. You can start the process by heading to the Ascent website and clicking on "Apply Now." From there, you'll let them know whether you want to apply for a college loan or a career preparation or bootcamp loan.

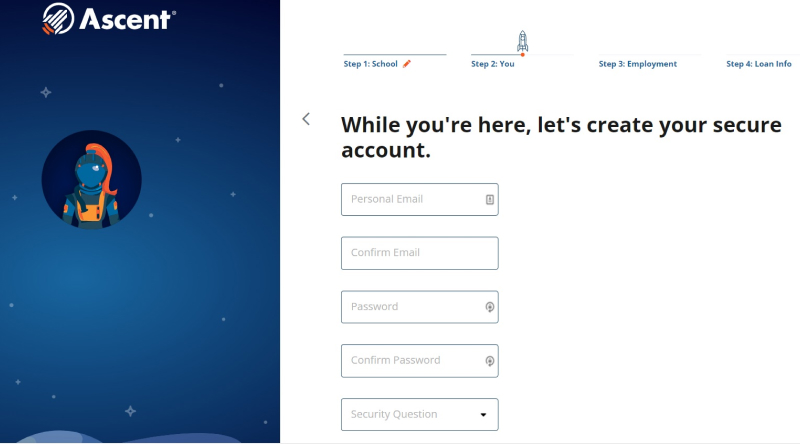

After choosing the type of loan you want to apply for, you'll also let Ascent know whether you're applying with or without a cosigner. From there, you'll enter information such as:

- Full name

- Phone number

- Citizenship status

- Social Security number

- Your school name and location

- How long you have been in college (if you're already attending)

- Your current GPA

- College major

- Enrollment status (full-time or half-time)

- Expected graduation date

During the process, Ascent will also prompt you to create an account for your loan application. You'll do this by choosing a password and setting up a security question and answer.

From there, Ascent will let you know if you're pre-qualified for funding for your degree program or career preparation program of choice. If you like your results, you can move forward with a full loan application to apply.

Ascent Customer Support

Ascent promises 100% U.S.-based customer service and support, and they make it possible to contact them in several ways. They also post specific business hours for customer service, which are from 7 a.m. to 5 p.m. PST from Monday through Thursday and 7 a.m. to 4 p.m. PST on Fridays.

Reach Ascent by calling them at 877-216-0876, or email them at help@ascentfunding.com or bootcamphelp@ascentfunding.com of you have a bootcamp loan inquiry. You can also leave Ascent a message on their contact page.

While Ascent does not have any reviews on Trustpilot or Consumer Affairs, they do post customer reviews on their own website. Most of them bode well for the company's customer service offerings, too.

As one customer put it, "It was the only decent loan provider that would accept a non-cosigned loan. My loan manager helped a lot."

Ascent Online Reviews

Finding online reviews for Ascent is very difficult right now since they do not have any user reviews on Trustpilot or Consumer Affairs. However, Ascent only has one closed complaint with the Better Business Bureau (BBB) over the last 12 months. The company also has an "A" rating on the platform.

Ascent does post some reviews on their own website, which are incredibly limited in scope and chosen by the lender.

One notable reviewer says the following, "The best thing about Ascent is the fact that they make the process easy. I was able to do everything online and the money was sent directly to my school."

Another reviewer had this to say, "Being young, I don't have a strong credit history. Ascent made it possible for me to have my own loan without the help of others. I'm thankful I found them."

Ascent Student Loans Perks and Bonuses

Flexibility

While Ascent student loans may seem complicated, they do come with myriad flexible repayment options and generous borrowing limits. Ascent customers can also benefit from a .25% autopay discount for credit-based loans and a 1.0% autopay discount for outcome-based undergraduate student loans with no cosigner.

Ascent customers may also be eligible to earn a 1% cash back reward when they graduate, although terms and conditions apply. They can also use a program called Ascent Rewards to earn cash back when they make purchases at more than 60,000 online retailers.

Finally, Ascent has a refer-a-friend program that lets borrowers earn up to $525 for each friend they refer to the lender. With this promotion, Ascent customers earn $25 when a college friend is approved for an Ascent loan, and they get another $500 when their friend's loan is funded and disbursed. Separately, the friend also earns $100 when their loan is funded and disbursed.

Mentorship

Ascent offers scholarships for their college loan and bootcamp loan customers. The company also offers an array of resources to students on their website, from a college checklist to budgeting tips and career advice.

Technology

Ascent does not have a mobile app. However, they do let students create an online account where they can monitor their loan application, make payments, and more. Ascent secures your information using 256-bit encryption security.

Final Thoughts

Ascent offers a range of private student loans for borrowers that may struggle to find funding elsewhere, including DACA students and international students. Loans may be acquired with or without a cosigner, although interest rates can be higher than average in some cases.

Fortunately, Ascent lets borrowers get pre-approved online without an impact to their credit. This means you can see your estimated interest rate and gauge your ability to qualify before you move forward.

Frequently Asked Questions

This app literally changed my like. It provides a great experience. I absolutely love it!