Founded in 2014, College Ave Student Loans offers financial products that help students afford college while minimizing long-term costs. Not only do they offer undergraduate and graduate school loans, but they also grant specialized Career Loans at specific schools — all with no fees to apply. More importantly, College Ave student loans come with flexible repayment terms and competitive interest rates for creditworthy borrowers.

College Ave Student Loans Review: Student Loans and Refinancing

College Ave Student Loans is a private lender that offers student loans and refinancing products for college students. With competitive interest rates and flexible loan terms, they strive to help borrowers save money as they fund their college dreams.

Summarized Rating

This parameter considers loan term lengths, loan limits, and loan structure optionality (fixed and variable rate offerings). For each loan type offered, each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

College Ave scores an excellent 4.5 for Loan Features. This is attributable to its relatively flexible term lengths and best-in-class loan structure optionality (fixed vs. variable).

College Ave Pros

College Ave Cons

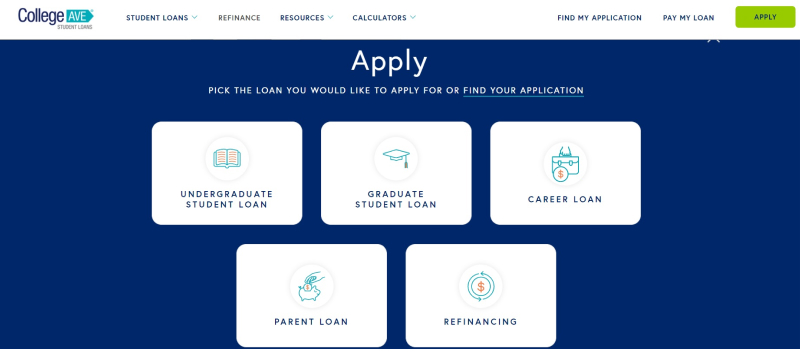

What Types of Student Loans Does College Ave Offer?

College Ave Student Loans offers a similar selection of private student loans as their competitors, which include undergraduate school loans, graduate school loans, student loans for parents and student loan refinancing. However, this lender also extends specialized Career Loans for students who attend select institutions or career training programs.

We’ll go over the fees, features, and eligibility requirements for each College Ave student loan product below so you can decide if this student loan company is a good fit.

Types of student loans offered through College Ave Student Loans:

- Undergraduate student loans

- Graduate student loans

- Career Loans

- Parent student loans

- Student loan refinancing

College Ave Undergraduate Student Loans Review

College Ave Undergraduate Student Loan Features

College Ave Student Loans offers flexible undergraduate school loans with multiple repayment terms to choose from and generous limits. Specifically, you can borrow up to the cost of tuition, plus books, housing, and other living expenses. Interest rates can be fixed or variable, and you can repay your loans on your own chosen timeline.

Loan terms |

5 to 15 years |

Repayment period |

Begins during school or after |

Loan amount |

Up to the cost of tuition plus living expenses ($1,000 minimum) |

Loan Structure Flexibility |

Fixed or variable |

College Ave Undergraduate Student Loan Interest Rates and Fees

College Ave Student Loans charges students zero in fees to apply, and there aren't any hidden fees, either. Interest rates on undergraduate school loans may also also lower than you can find with federal student loans, particularly for those with great credit. For example, Direct Subsidized Loans and Direct Unsubsidized Loans for undergraduate students currently charge a fixed APR of 3.73%.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

Varies based on loan amount |

Maintenance Fees |

None |

Fixed Rates |

2.99% - 12.99% APR |

Variable Rates |

0.94% - 11.98% APR |

College Ave Undergraduate Student Loan Qualification Requirements

College Ave does not list a minimum credit score requirement for approvals, nor do they set a specific minimum income or a maximum debt-to-income ratio. However, they do let applicants get prequalified online and without a hard inquiry on their credit reports, which helps borrowers gauge their ability to qualify before they fill out a full loan application.

Institution Type & Course Load Requirements |

Students must be attending an eligible degree-granting school, full-time, half-time or less than half-time and making satisfactory academic progress |

Minimum Credit Score |

Not specified |

Minimum Income |

Not specified |

Maximum Debt-to-Income |

Not specified |

Co-signer/Joint Application Requirements |

Co-signers accepted |

College Ave Graduate Student Loans Review

College Ave Graduate Student Loan Features

College Ave Student Loans also offers graduate school loans with similar features and terms, albeit with slightly higher interest rates than undergraduate loans. Borrowers can once again borrow up to the cost of tuition and fees with the addition of housing and living expenses if they need to. Interest rates can be fixed or variable, and borrowers can choose a repayment term that lasts for 5 to 15 years.

Loan terms |

5 to 15 years |

Repayment period |

Begins during school or after |

Loan amount |

Up to the cost of tuition plus living expenses ($1,000 minimum) |

Loan Structure Flexibility |

Fixed or variable |

College Ave Graduate Student Loan Interest Rates and Fees

College Ave Student Loans charges graduate school students $0 in fees to apply, and their graduate school loans are free of any hidden fees. Their interest rates are also incredibly competitive, particularly when you compare to federal student loans for graduate school students. By contrast, interest rates on Direct Unsubsidized Loans for graduate students are currently set at 5.28%, while Direct PLUS loans charge 6.28%.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

Varies based on loan amount |

Maintenance Fees |

None |

Fixed Rates |

4.49% - 11.98% APR |

Variable Rates |

1.99% - 10.97% APR |

College Ave Graduate Student Loan Qualification Requirements

College Ave is fairly vague when it comes to their approval requirements for graduate school loans. They do not disclose a minimum credit score requirement or any other criteria required for approval. They do, however, let users get prequalified online without a hard inquiry. Note that graduate school loans are for any graduate student, but that College Ave offers specific information on dental school loans, law school loans, medical school loans, MBA loans, and graduate school loans for specific health professions.

Institution Type & Course Load Requirements |

Students must be attending an eligible degree-granting school, full-time, half-time or less than half-time and making satisfactory academic progress |

Minimum Credit Score |

Not disclosed |

Minimum Income |

Not disclosed |

Maximum Debt-to-Income |

Not disclosed |

Co-signer/Joint Application Requirements |

Co-signers accepted |

College Ave Career Loans Review

College Ave Career Loan Features

College Ave Career Loans are a type of specialized student loan geared to borrowers pursuing an undergraduate or graduate degree from specific institutions. These loans are available for a variety of degree programs, including those at eligible community colleges. Repayment terms are flexible, and students can earn $150 in cash back once they complete their program of study.

Loan terms |

5 to 15 years |

Repayment period |

Begins during school or after |

Loan amount |

Up to the cost of attendance minus financial aid ($1,000 minimum) |

Loan Structure Flexibility |

Fixed or variable |

College Ave Career Loan Interest Rates and Fees

Like other student loans from College Ave, their Career Loans come with competitive interest rates and no hidden fees. Borrowers can also choose whether they want to lock in a fixed interest rate or go with a variable rate that can change over time.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

Varies based on loan amount |

Maintenance Fees |

None |

Fixed Rates |

2.99% - 13.95% APR |

Variable Rates |

0.94% - 12.99% APR |

College Ave Career Loan Qualification Requirements

College Ave Career Loans are for students pursuing higher education at select institutions, although the company does not publish a list of schools or programs that qualify. While traditional educational institutions can be eligible for these loans, some career training programs also qualify.

Institution Type & Course Load Requirements |

Students must be attending a select school or program, full-time, half-time or less than half-time and making satisfactory academic progress |

Minimum Credit Score |

Not disclosed |

Minimum Income |

Not disclosed |

Maximum Debt-to-Income |

Not disclosed |

Co-signer/Joint Application Requirements |

Co-signers accepted |

College Ave Parent Student Loans Review

College Ave Parent Student Loan Features

College Ave student loans for parents can come in different forms, including loans given directly to parents and loans for borrowers who have a parent co-signer. Student loans offered directly to parents through College Ave offer similar features as other loans offered by this lender, such as repayment terms of up to 15 years and fixed or variable interest rates. Parent loans also allow parents to receive up to $2,500 of the loan proceeds directly so they can use it for college-related expenses as they choose.

Loan terms |

5 to 15 years |

Repayment period |

Begins during school or after |

Loan amount |

Up to 100% of the school-certified cost of attendance |

Loan Structure Flexibility |

Fixed or variable |

College Ave Parent Student Loan Interest Rates and Fees

College Ave student loans for parents also come free of hidden fees, including no origination fees or prepayment fees. Borrowers can also choose between fixed interest rates or variable rates based on their needs.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

Varies based on loan amount |

Maintenance Fees |

None |

Fixed Rates |

3.34% - 12.99% APR |

Variable Rates |

1.04% - 11.98% APR |

College Ave Parent Student Loan Qualification Requirements

According to College Ave, parent student loans are available for parents, grandparents, and potentially even guardians who want to help cover the cost of higher education. While minimum credit score and income requirements aren't disclosed, applicants can see if they qualify and check their rates without an impact on their credit report.

nstitution Type & Course Load Requirements |

Students must be attending a select school or program, full-time, half-time or less than half-time and making satisfactory academic progress |

Minimum Credit Score |

Not disclosed |

Minimum Income |

Not disclosed |

Maximum Debt-to-Income |

Not disclosed |

Co-signer/Joint Application Requirements |

Not applicable |

College Ave Student Loan Refinancing Review

College Ave Student Loan Refinancing Features

College Ave Student Loans offers a refinancing option for borrowers who have federal student loans or private student loans. Repayment terms are offered for anywhere from 5 to 15 years, and limits tend to be high. In fact, borrowers with a traditional undergraduate or graduate school degree can refinance up to $150,000 in student loan debt.

Loan terms |

5 to 15 years |

Repayment period |

Begins one month after disbursement |

Loan amount |

$5,000 to $150,000 for undergraduate and graduate degrees; up to $300,000 for borrowers with medical, dental, pharmacy or veterinary doctorate degrees |

Loan Structure Flexibility |

Fixed or variable |

College Ave Student Loan Refinancing Interest Rates and Fees

College Ave refinance loans also come free of any origination fees, prepayment penalties or hidden fees. Interest rates are also competitive and may be significantly lower than borrowers are paying on federal student loans.

Borrowing/Origination Fees |

None |

|

Prepayment Fees |

None |

|

Late Payment Fees |

Varies based on loan amount |

|

Maintenance Fees |

None |

|

Fixed Rates |

2.99% - 5.09% APR |

|

Variable Rates |

2.94% - 4.99% APR |

College Ave Student Loan Refinancing Qualification Requirements

To qualify for student loan refinancing with College Ave Student Loans, borrowers must be at least 18 years old and a U.S. citizen or permanent resident. They also need to have graduated from a selection of Title IV eligible undergraduate or graduate programs and meet College Ave Refi’s underwriting requirements. While applicants can apply to refinance their loans on their own, co-signers are accepted on student loan refinancing products.

Institution Type & Course Load Requirements |

Borrowers must be a U.S. citizen or permanent resident who has graduated from an eligible Title IV undergraduate or graduate program |

Minimum Credit Score |

Not specified |

Minimum Income |

Not specified |

Maximum Debt-to-Income |

Not specified |

Co-signer/Joint Application Requirements |

Co-signers accepted |

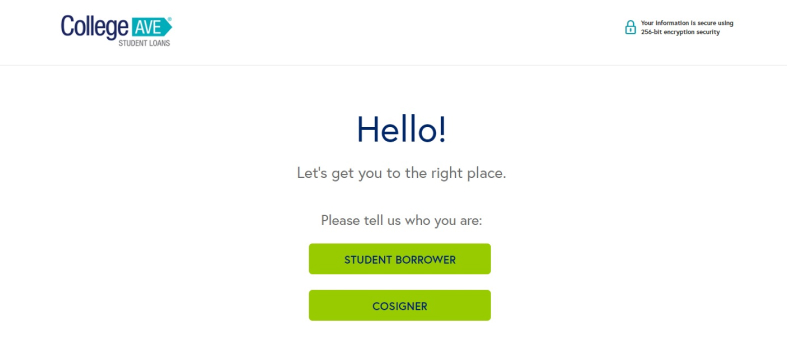

College Ave Application Process

College Ave only allows online applications for their student loans, and the process can look slightly different depending on the type of loan you're applying for.

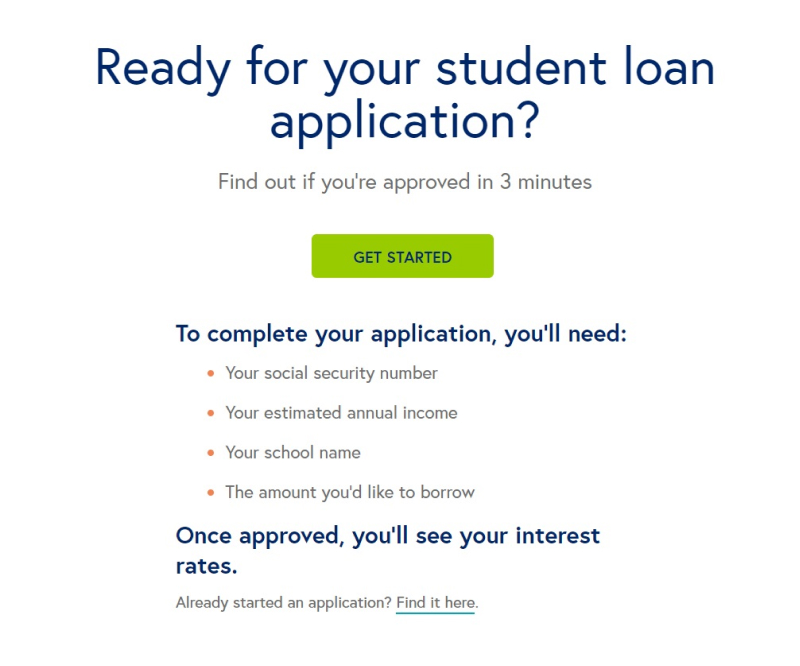

You'll start the process by selecting the type of loan you need, whether you plan to apply for an undergraduate or graduate student loan or you need to refinance loans you already have. From there, you'll let College Ave know if you're applying alone or with a co-signer.

The next step is starting your loan application, which can be completed in as little as three minutes. Information you'll need to get started includes your Social Security number, your estimated income for the year, your school name, and an estimate of how much you want to borrow.

If you're approved for a private student loan or student loan refinancing through College Ave, you'll be shown the interest rates you're eligible for. From there, you can decide to move forward and complete the loan application. However, you can also skip finalizing your application if the rates and terms you're offered aren't what you were looking for.

According to College Ave, acceptance of your new loan can be completed entirely online if that's your choice. To finish this step, you'll read over the loan agreement and e-sign your loan documents. At that point, College Ave Student Loans will send your loan details to your school for certification.

College Ave says this step of the process can take several days or weeks to complete, mostly because each individual school has their own processes and timelines. Either way, College Ave can send the funds to your institution once they receive an affirmative response. From start to finish, the entire loan process for private student loans usually takes at least 10 business days.

That said, the process will be different for student loan refinancing since you don't need verification from a school. If you're approved for student loan refinancing through College Ave, they use the funds from your new loan to pay off your old ones.

College Ave Customer Support

College Ave Student Loans offers a broad range of ways to contact them. You can send them an email, send a message to customer support through the College mobile app, or call them at 844-422-7502 on Monday through Friday from 9 a.m. to 8 p.m. EST.

The company also offers text message support, which you can connect with using the number 855-910-0510. You can also head to the company website or use the app to chat with a live representative during regular business hours.

Customer service reviews on platforms like Trustpilot are mostly favorable with many past clients speaking the praises of the company's customer service team.

As one customer put it, "Online process is extremely easy and customer service is readily available and amazing if needed."

Another said the following: "This was a super efficient way to get my loans! It was fast, efficient, easy to use, and was approved in 3 days. I was always informed on what was going on with my loan."

College Ave Online Reviews

College Ave has a current rating of 2.6 out of 5 stars on Trustpilot. While past user experiences are definitely mixed, 73% of customers said their experience with the company was "excellent," and another 15% noted their experience was "great."

Throughout the bulk of the reviews, commenters said they were satisfied with their experience and happy with the results. As one reviewer put it, "Their process is always very seamless and easy to contact them!"

Another had the following to say: "Easy to process. Borrowing is a difficult thing to do and they made it as painless as possible."

Some common themes were found among negative reviews for College Ave as well, which are outlined below.

The positive reviews are related to |

The negative reviews are related to |

Quick and easy loan approval process |

Higher rates than advertised |

Excellent customer service and support |

Delayed loan funds |

Strong financial products |

Customer service calls not being returned |

College Ave Perks and Bonuses

Flexibility

College Ave Student Loans offer flexible repayment terms that last for 5, 8, 10, or 15 years. Not only can borrowers select a payment plan that works with their needs and budget, but they can qualify for a .25% auto-pay discount when they set up their loans for auto-debited monthly payments.

Customers can also choose when they want to begin repaying their loans, whether they prefer to start making payments during school or after they graduate. Some of their loans even allow for flat payments or interest-only payments during school so borrowers can keep interest charges at bay as long as possible.

Finally, College Ave makes it possible to refinance federal student loans or private student loans with preferential terms. All of their loans extend their option to apply with a co-signer.

Mentorship

College Ave doesn't offer any direct mentorship opportunities, but they do make it possible to contact them for help and advice. You can reach out to the company by phone, email, text or the online chat function on their website.

Technology

This company has its own mobile app that lets you manage your student loans and monthly payments on the go. Users can also utilize the app to speak with a representative by email or online chat.

Also note that College Ave keeps your personal information safe with the help of 256-bit encryption security.

Final Thoughts

College Ave Student Loans is worth considering if you need private student loans with flexible repayment terms, and especially if you want to avoid hidden fees. You can even get prequalified online, and you can apply with a co-signer if you need to.

That said, you should still shop around and compare terms among multiple student lenders. College Ave offers competitive rates and terms, but you won't know if they're the best around unless you check.

Frequently Asked Questions (FAQs)

This app literally changed my like. It provides a great experience. I absolutely love it!