No matter your situation, Credible is a good place to begin your search. This platform works best for borrowers who want to compare loans without having to fill out multiple loan applications. Read our Credible review to learn about the pros and cons of this company, how it works and how you can use it to apply for student loans.

Credible student loan review

When you need to borrow money to cover college tuition and fees, private student loans from Credible can help. This online lending marketplace lets you compare multiple student loan offers in one place.

Summarized Rating

This parameter considers loan term lengths, loan limits, and loan structure optionality (fixed and variable rate offerings). For each loan type offered, each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

Credible gets a stellar 4.7 for Loan Features, which is attributable to its highly flexible term lengths, loan amounts, and loan structure optionality (fixed vs. variable).

Credible Pros and Cons

Credible Pros

Credible Cons

What Types of Student Loans Does Credible Offer?

Credible student loans can suit the needs of any type of borrower, including students pursuing graduate level education. Loans offered through Credible include:

- Undergraduate student loans

- Graduate student loans

- MBA student loans

- Medical student loans

- Law school student loans

- Student loan refinancing

Undergraduate and graduate student loans review

Undergraduate and graduate student loan features

Credible student loans for undergraduate and graduate students are offered through many top lenders including College Ave, CommonBond, PenFed and more. You can choose a repayment period that suits your needs and your budget, and you may be eligible to borrow up to the cost of attendance at your chosen school.

Loan terms |

Fixed or variable APR |

Repayment period |

5 to 20 years |

Loan amount |

Up to the cost of attendance (minus financial aid received) |

Loan Structure Flexibility |

Choose your own repayment plan |

Undergraduate and graduate student loan interest rates and fees

Loans for undergraduate and grad students offered through Credible don't charge any origination fees, nor do they charge any prepayment penalties if you pay your loan off early. Other fees can vary based on the lender you borrow from.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

Varies by lender |

Maintenance Fees |

None |

Fixed Rates |

2.99-13.65% APR |

Variable Rates |

0.94-11.98% APR |

Undergraduate and graduate student loan qualification requirements

When it comes to undergraduate and graduate school loan requirements, these will vary widely depending on the student lender you choose. However, a credit score of 700 or higher will help your approval odds, and so will a debt-to-income ratio that's below 50%.

Institution Type & Course Load Requirements |

Varies by lender |

Minimum Credit Score |

Typically 700+ (varies by lender) |

Minimum Income |

Varies by lender |

Maximum Debt-to-Income |

50% maximum DTI ratio |

Co-signer/Joint Application Requirements |

Varies by lender |

MBA student loans review

MBA student loan features

Credible also offers student loans for borrowers seeking an MBA. These loans are very flexible in general, although some of the loan features vary by lender. Generally speaking, you can use MBA student loans from Credible to borrow with a fixed or variable APR. You may also be able to choose a repayment plan that lasts for up to 20 years.

Loan terms |

Fixed or variable APR |

Repayment period |

5 to 20 years |

Loan amount |

Up to the cost of attendance (minus financial aid) |

Loan Structure Flexibility |

Choose your own repayment plan |

MBA student loan interest rates and fees

MBA student loans from Credible come with no origination fees and no prepayment penalties. However, other fees like late fees can vary by lender. Rates are also competitive, especially when you compare them to interest rates on federal student loans for MBAs and other graduate degrees.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

Varies by lender |

Maintenance Fees |

Varies by lender |

Fixed Rates |

2.15% APR and up |

Variable Rates |

1.83% APR and up |

MBA student loan qualification requirements

MBA student loan requirements vary by lender, so you may not know which lenders will accept you until you start the process to get a free quote. Either way, you'll likely need a credit score of at least 700, and any debt-to-income ratio over 50% may prevent you from being approved.

Institution Type & Course Load Requirements |

Varies by lender |

Minimum Credit Score |

Typically 700+ (varies by lender) |

Minimum Income |

Varies by lender |

Maximum Debt-to-Income |

50% maximum DTI ratio |

Co-signer/Joint Application Requirements |

Varies by lender |

Medical student loans review

Medical student loan features

Medical student loans from Credible come with flexible repayment plans as well, with options to repay your loans over 5 to 20 years depending on the lender. You can also choose from competitive fixed or variable interest rates.

Loan terms |

Fixed or variable |

Repayment period |

5 to 20 years |

Loan amount |

Up to the cost of attendance (minus financial aid |

Loan Structure Flexibility |

Choose your own repayment plan |

Medical student loan interest rates and fees

Credible medical school loans come with some of the lowest potential interest rates out there, and you won't have to pay an origination fee or any prepayment fees. However, other fees charged by lenders, including late fees, can vary based on the lender you choose.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

Varies by lender |

Maintenance Fees |

Varies by lender |

Fixed Rates |

2.99-13.65% APR |

Variable Rates |

0.94-11.98% APR |

Medical student loan qualification requirements

As you decide how you want to borrow for medical school, keep in mind that course load requirements and minimum income requirements can vary by lender. However, you will typically need a credit score of 700 or higher to qualify, and you'll need a debt-to-income ratio of 50% or less.

Institution Type & Course Load Requirements |

Varies by lender |

Minimum Credit Score |

Typically 700+ (varies by lender) |

Minimum Income |

Varies by lender |

Maximum Debt-to-Income |

50% maximum DTI ratio |

Co-signer/Joint Application Requirements |

Varies by lender |

Law school student loans review

Law school loan features

According to Credible, average law school debt is currently at $134,600 nationwide. With that in mind, you should make sure you're borrowing the least amount you can, and with the best loan rates and terms. Fortunately, law school loans from Credible come with competitive fixed or variable interest rates. You can also choose your own repayment plan that lasts from 5 to 20 years depending on the lender.

Loan terms |

Fixed or variable |

Repayment period |

5 to 20 years |

Loan amount |

Up to the cost of attendance (minus financial aid) |

Loan Structure Flexibility |

Choose your own repayment plan |

Law school loan interest rates and fees

Credible law school loans don't charge any prepayment penalties or loan origination fees. Other fees can vary based on the lender you choose. In the meantime, the interest rates can be fixed or variable, and they tend to be extremely competitive either way.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

Varies by lender |

Maintenance Fees |

Varies by lender |

Fixed Rates |

2.99-13.65% APR |

Variable Rates |

0.94-11.98% APR |

Law school loan qualification requirements

Details like the type of institution you plan to attend, your course load and the minimum credit score you need will vary by lender. That said, you are more likely to be approved for the loan amount you want if you have a credit score of 700+ and your debt-to-income ratio is no more than 50%.

Institution Type & Course Load Requirements |

Varies by lender |

Minimum Credit Score |

Typically 700+ (varies by lender) |

Minimum Income |

Varies by lender |

Maximum Debt-to-Income |

50% maximum DTI ratio |

Co-signer/Joint Application Requirements |

Varies by lender |

Student loan refinancing review

Student loan refinancing features

While you can apply for student loans from Credible to fund your college education, you can also use this platform to refinance student loans you already have. Through the Credible interface, you can choose from fixed or variable student loans that last for anywhere from 5 to 20 years. How much you can borrow via a Credible student loan refinance varies by lender.

Loan terms |

Fixed or variable |

Repayment period |

5 to 20 years |

Loan amount |

Varies by lender |

Loan Structure Flexibility |

Choose your own repayment plan |

Student loan refinancing interest rates and fees

Throughout this Credible review, you have probably noticed that none of the loans through the platform charge origination fees or prepayment fees. Other fees can vary by lender. Meanwhile, the interest rates for a Credible student loan refinance are competitive, especially since you get the chance to compare multiple loan offers in one place.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

Varies by lender |

Maintenance Fees |

Varies by lender |

Fixed Rates |

2.15% APR and up |

Variable Rates |

1.83% APR and up |

Student loan refinancing qualification requirements

According to the company, most of the lenders who operate within their platform require a minimum credit score of 670 to 700 for a Credible student loan refinance. Other qualification requirements can vary based on the lender you select, including income requirements and co-signer requirements. If you're seeking a Credible loan consolidation, the qualification requirements are as follows.

Institution Type & Course Load Requirements |

N/A |

Minimum Credit Score |

670 to 700 |

Minimum Income |

Varies by lender |

Maximum Debt-to-Income |

50% maximum DTI ratio |

Co-signer/Joint Application Requirements |

Varies by lender |

Credible Application Process

The Credible loans process was set up to make applying for student loans a breeze. There are a few simple steps to get started, and you can complete all of them through the Credible website.

Step 1: Start by filling out a simple form with information Credible needs to approve your loan. If you plan to use a cosigner on your loan, you'll also enter their personal information during this part of the process.

Once you enter all the requested information Credible requires, such as your name, your address, your income, your school and how much you're hoping to borrow, Credible can let you know if you're prequalified for a loan. Just keep in mind that prequalification does not guarantee approval. It only helps you gauge your ability to qualify.

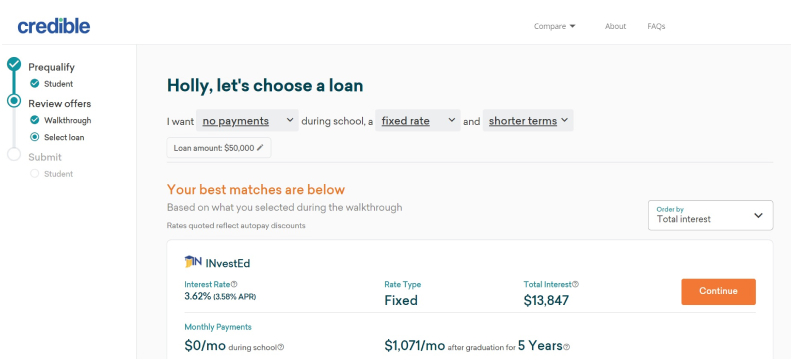

Step 2: Select the loan that works best for your needs. This part of the process lets you compare loan options from different lenders who are competing for your business. Not only will you want to compare loans based on their interest rates and fees, but you'll want to choose a loan with a repayment plan you can live with.

You can also see that, at the top of the page, you have the chance to tailor your offers to your needs. For example, you can decide when you want to begin making payments, whether you want a fixed rate or a variable rate and the type of repayment terms you're offered.

Step 3: Finalize your loan. This part of the process begins once you select the loan you want to move forward with.

Typically, you'll get started by providing supporting documentation for your loan approval and signing all the related documents. Once the loan is finalized, Credible will send the money to your school or your current lenders if you're refinancing.

| Will you need a cosigner? According to Credible, many borrowers with no credit history or minimal credit history will need a cosigner. They also add that students with a cosigner are 3x more likely to qualify for the Credible loans they need. |

Credible customer support

Credible doesn't list specific customer service hours, but they do offer multiple ways to contact them. For example, individuals can call Credible at 1-866-540-6005 or send them an email at support@credible.com. The Credible website also offers online chat support from their Client Success Team, although specific hours aren't listed for that option, either.

Fortunately, Credible tends to receive positive marks for their customer service from past users. For the purpose of this Credible review, we gathered a few customer service testimonials from the consumer review site Trustpilot:

"Great Service! They found me the best terms!" - Jaimi Washington on February 2, 2022

"Quick and streamlined process. Great service when we had to speak to a representative." - Kelly Wills on February 1, 2022

"Very easy, stress-free process with excellent communication!" - Adrienne Kraft on January 31, 2022

Credible review scores

Speaking of user reviews, Credible tends to score well among past users of the platform. On Trustpilot, for example, Credible boasts 4.7 out of 5 stars on average. On Consumer Affairs, the platform has an average star rating of 3.9 out of 5 stars.

That said, Credible reviews tend to be a mixed bag since not all of their customers were happy with the experience. The main positive and negative comments from reviews are listed below.

The positive reviews are related to |

The negative reviews are related to |

Easy loan comparisons |

Problems with fund transfers to schools |

Quick and seamless loan approval process |

Inaccurate interest rate quotes |

Great customer service |

Application delays |

Credible perks and bonuses

Since Credible is not a direct lender, most of the loan benefits and perks you'll receive won't come through them. That said, Credible does offer some benefits in terms of their flexibility, technology and security features.

Flexibility

Depending on the type of student loan you apply for and other details in your loan application, Credible loans may offer the chance for you to defer monthly payments until you graduate from school.

Credible also offers a Best Rate Guarantee. This guarantee states you'll receive a $200 gift card if you compare interest rates on Credible then find a lower rate elsewhere.

Technology

Credible uses up-to-date technology to match users to the best student loans for their needs. Applicants can complete the entire loan application online, and they can even upload required documentation through the platform.

Security

You can rest assured your information is safe with Credible. The company uses TLS security and 256-bit encryption to protect your personal and financial information.

Final thoughts

Since Credible is not a direct lender, you will still need to compare student loan companies to find the right fit. However, Credible makes it possible to compare several loan options along with their rates and terms in one place. This means you can use Credible to narrow down your loan options then do more research from there.

Considering Credible is entirely free to use, you have nothing to lose by using this platform to compare rates. This is especially true since Credible lets you get prequalified for a loan without a hard inquiry on your credit score.