Education Loan Finance (ELFI) offers competitive private student loans for undergraduates, graduate students, and parents, as well as a student loan refinancing product for borrowers seeking a better deal. The company aims to offer transparent payment options, competitive interest rates, and flexible terms along with an application process that is easy to understand.

Education Loan Finance Review: Private Loans and Refinancing

Education Loan Finance (also known as ELFI) is a division of Tennessee-based SouthEast Bank. Launched in 2015, this student loan company offers undergraduate student loans, graduate student loans, parent loans and student loan refinancing with no hidden fees.

Summarized Rating

This parameter considers loan term lengths, loan limits, and loan structure optionality (fixed and variable rate offerings). For each loan type offered, each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

ELFI gets a near average 4.0 for Loan Features, which is attributable to its average term lengths and best-in-class loan structure optionality (fixed vs. variable).

Education Loan Finance Pros

Education Loan Finance Cons

What Types of Student Loans Does Education Loan Finance (ELFI) Offer?

Education Loan Finance (ELFI) offers student loans for undergraduate students, graduate students, and parents, as well as student loan refinancing. The company is also incredibly transparent about their requirements for borrowers, and their student loans are offered with no application fees, no origination fees, and no prepayment fees.

The following sections in our Education Loan Finance review explain the fees, features, and eligibility requirements for each loan product Education Loan Finance offers:

- Undergraduate student loans

- Graduate student loans

- Parent student loans

- Student loan refinancing

ELFI Undergraduate Student Loans Review

Undergraduate Student Loan Features

Education Loan Finance offers undergraduate student loans that can be personalized to your needs and goals. For example, you can choose from repayment periods that last for 5 to 15 years, and you can decide to begin repaying your loans during school or after. Interest rates can also be fixed or variable.

Loan terms |

5 to 15 years |

Repayment period |

Begins during school or after |

Loan amount |

$1,000 up to the cost of tuition |

Loan Structure Flexibility |

Fixed or variable |

Undergraduate Student Loan Interest Rates and Fees

Undergraduate student loans from ELFI come with no origination fees, no prepayment fees, and no hidden fees. However, you may be assessed a late fee of 5% of the past due amount or $50 (whichever is less) if you pay your student loan bill beyond its due date. Interest rates are competitive and can be fixed or variable based on your preferences.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

5% of the past due amount or $50, whichever is less |

Maintenance Fees |

None |

Fixed Rates |

3.20% APR and up |

Variable Rates |

1.20% APR and up |

Undergraduate Student Loan Qualification Requirements

While ELFI does not disclose the maximum debt-to-income ratio for their student loans, the company is incredibly transparent about other eligibility requirements. For example, they list a minimum credit score of 680 and a minimum income requirement of $35,000. Also note that borrowers must have a minimum credit history of 36 months. Education Loan Finance allows cosigners for their undergraduate student loans.

Institution Type & Course Load Requirements |

Borrower must be enrolled in a program for a Bachelor’s, Master’s, or Doctoral Degree and attending at least half-time |

Minimum Credit Score |

680 |

Minimum Income |

$35,000 |

Maximum Debt-to-Income |

Not disclosed |

Co-signer/Joint Application Requirements |

Cosigners accepted |

ELFI Graduate Student Loans Review

Graduate Student Loan Features

Education Loan Finance offers graduate student loans that are geared to students pursuing an MBA, a law degree, or an advanced degree in healthcare. These loans come with a minimum amount of $1,000, and you can borrow up to the school-approved cost of attendance. Borrowers can also choose to begin repaying their student loans during school or after.

Loan terms |

5 to 15 years |

Repayment period |

Begins during school or after |

Loan amount |

$1,000 up to the cost of tuition |

Loan Structure Flexibility |

Fixed or variable |

Graduate Student Loan Interest Rates and Fees

Graduate students who turn to Education Loan Finance for student loan assistance will find loan options with no origination fees, no early payment fees, and no hidden fees. Interest rates are also competitive, and they can be fixed or variable.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

5% of the past due amount or $50, whichever is less |

Maintenance Fees |

None |

Fixed Rates |

3.20% APR and up |

Variable Rates |

1.20% APR and up |

Graduate Student Loan Qualification Requirements

Borrowers seeking a private graduate student loan will need to meet specific eligibility requirements regarding their degree program. A minimum credit score of 680 is required, as well as a minimum credit history length of 36 months. A minimum income of $35,000 is also a requirement, although cosigners are accepted.

Institution Type & Course Load Requirements |

Borrower must be enrolled in a program for a Bachelor’s, Master’s, or Doctoral Degree and attending at least half-time |

Minimum Credit Score |

680 |

Minimum Income |

$35,000 |

Maximum Debt-to-Income |

Not disclosed |

Co-signer/Joint Application Requirements |

Cosigners accepted |

ELFI Parent Student Loans Review

Parent Student Loan Features

Education Loan Finance also offers student loans for parents, which come with no prepayment penalties and payment plans that last from 5 to 10 years. Borrowers can secure fixed or variable interest rates, and loan amounts are offered from $1,000 up to the cost of attendance.

Loan terms |

5, 7, or 10 years |

Repayment period |

Begins during school or after |

Loan amount |

$1,000 up to the cost of tuition |

Loan Structure Flexibility |

Fixed or variable |

Parent Student Loan Interest Rates and Fees

Parent student loans from ELFI come with no origination fees, no prepayment penalties, and no hidden fees. Interest rates and terms can also be incredibly competitive when you compare to federal student loans for parents. By contrast, Parent PLUS loans charge an origination fee and come with a fixed interest rate of 6.28%.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

5% of the past due amount or $50, whichever is less |

Maintenance Fees |

None |

Fixed Rates |

3.20% APR and up |

Variable Rates |

1.20% APR and up |

Parent Student Loan Qualification Requirements

Parent student loans come with similar requirements as other student loans from Education Loan Finance. The same minimum credit score of 680 and minimum income of $35,000 applies, and students must be enrolled in a program for a Bachelor’s, Master’s, or Doctoral Degree and attending at least half-time.

Institution Type & Course Load Requirements |

Student must be enrolled in a program for a Bachelor’s, Master’s, or Doctoral Degree and attending at least half-time |

Minimum Credit Score |

680 |

Minimum Income |

$35,000 |

Maximum Debt-to-Income |

Not disclosed |

Co-signer/Joint Application Requirements |

Co-signer/Joint Application Requirements |

ELFI Student Loan Refinancing Review

Student Loan Refinancing Features

Education Loan Finance makes it possible to refinance federal student loans or private student loans into a new loan product. Traditional student loan refinancing comes with repayment plans that last for up to 20 years, and students who refinance parent student loans can repay for up to 10 years. A minimum loan amount of $15,000 is required for student loan refinancing. Note that, once your student loans are refinanced, MOHELA (Missouri Higher Education Loan Authority) or AES (American Education Services) will actually service your loans.

Loan terms |

5 to 20 years |

Repayment period |

Repayment begins right away |

Loan amount |

Minimum of $15,000 |

Loan Structure Flexibility |

Fixed or variable |

Student Loan Refinancing Interest Rates and Fees

Interest rates for student loan refinancing are incredibly competitive, and there are no origination fees, no application fees, and no hidden fees to avoid. ELFI interest rates can also be fixed or variable based on your needs. Interestingly, Education Loan Finance caps variable interest rates on their refinance loans at 9.95% APR.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

5% of the past due amount or $50, whichever is less |

Maintenance Fees |

None |

Fixed Rates |

2.43% APR and up |

Variable Rates |

1.86% APR and up |

Student Loan Refinancing Qualification Requirements

Borrowers who want to refinance will need to have earned a Bachelor's degree or a graduate degree. The same minimum credit score of 680 applies, as well as a minimum income requirement of $35,000. Refinance customers also need to have at least 36 months of credit history to be approved.

Institution Type & Course Load Requirements |

Borrowers must have earned a Bachelor’s degree or higher |

Minimum Credit Score |

680 |

Minimum Income |

$35,000 |

Maximum Debt-to-Income |

Not disclosed |

Co-signer/Joint Application Requirements |

Cosigners accepted |

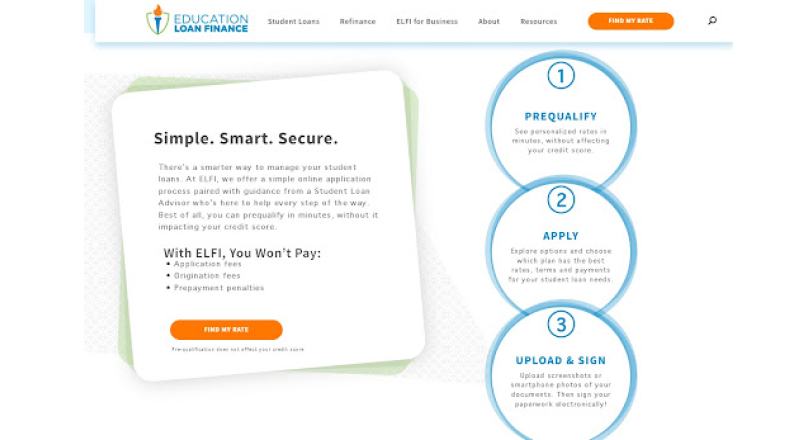

Education Loan Finance Student Loan Application Process

Education Loan Finance strives to make their online application process as seamless as possible. Borrowers can check their rate without any impact to their credit score, and they can choose from multiple repayment plans and loan options from the comfort of their home. Documents required for the loan process can also be uploaded directly from a home computer, so applicants will never need to visit a loan office in person.

To start the process, borrowers should head to the Education Loan Finance website and click the button that says "find my rate."

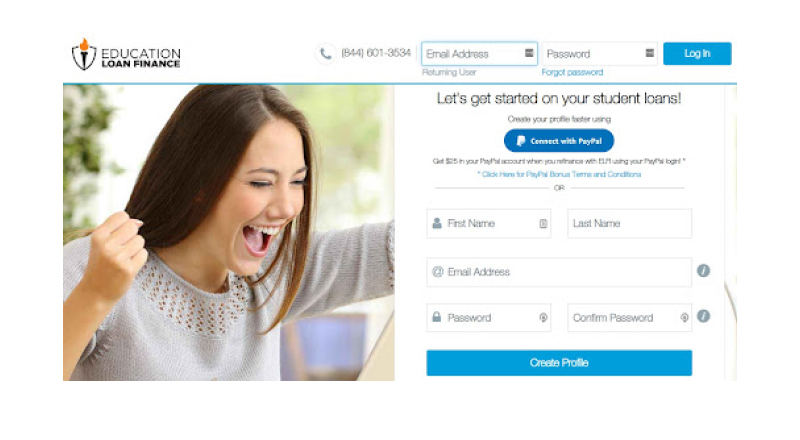

From there, Education Loan Finance asks borrowers to create a profile for their ELFI account. For the most part, this entails sharing a name and an email address and creating a password for the account.

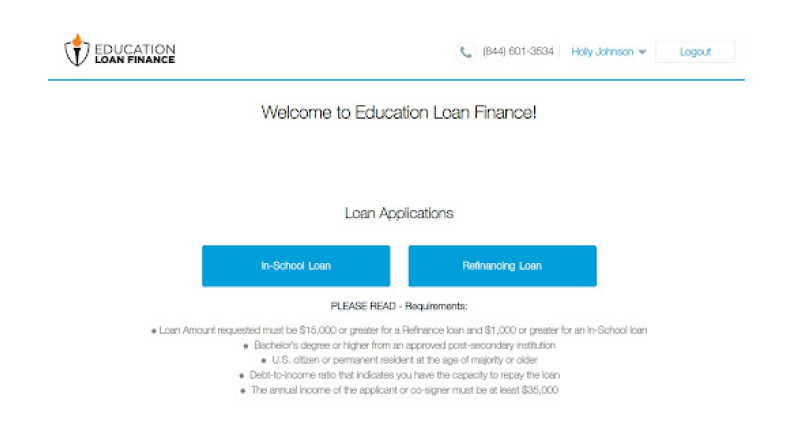

At this point in the process, you'll let Education Loan finance know whether you're seeking a student loan during college or aiming to refinance student loans you already have. You'll also be reminded of the general eligibility requirements for each type of student loan.

Once you let ELFI know which type of student loan you're after, you'll share more information with the goal of checking your rate. For example, you'll share information on the school you're attending, the type of degree you're pursuing, your expected graduation date, and your income. If you're applying with a cosigner, you'll share similar information for them.

Once you complete this part of the process, you'll be shown a selection of interest rates and payment plans you may be eligible for. If you like what you see and you decide to move forward with a full loan application, you can do so by providing the following:

- Proof of income

- Government-issued ID

- Social Security number

- School information

- Loan amount

- Financial aid you expect to receive

Once your loans are approved, it can take 4 to 6 weeks for the school to send verification for the loans and accept financing. Meanwhile, Education Loan Finance (ELFI) says that it can take 30 to 45 days for an old loan to be paid off during the refinance process.

Education Loan Finance Customer Support

While Education Loan Finance does not list specific business hours, they do offer a few different ways to contact them. For example, you can call ELFI at 1-844-601-ELFI, or you can email them at answers@elfi.com. You can also visit the Education Loan Finance website and participate in a chat session with a customer service representative.

Customer service reviews on platforms like Trustpilot are also incredibly favorable, and that's particularly true when it comes to their customer service and support.

As one customer put it, "My experience refinancing my old student loans was very good. Stan Mitchell kept me up to date on what was happening with my application. He was very clear in describing the documentation needed from me. I highly recommend the company and the rep who assisted me."

Another past user said the following, "Andrea was extremely helpful and assisted tremendously in the process! She was a huge help in walking me through each step and answering any questions that popped up. Thanks a ton Andrea!"

Education Loan Finance Online Reviews

Education Loan Finance boasts an average star rating of 4.9 stars out of 5 on Trustpilot. Meanwhile, 93% of their reviews on the platform were ranked as "excellent" and another 5% were marked as "great." Only a handful of online reviews for this company have anything negative to say.

Generally speaking, past customers seem to be incredibly happy with the interest rates and customer service they received. Many also state that the loan process was seamless and stress-free, and some call out specific customer service agents that helped them through the process.

One reviewer said the following, "This was the smoothest process for something that could be very stressful. I needed to call customer service in the beginning regarding the process and a gentleman named Dallas was so pleasant and patient with all my questions. Once I submitted the application Stan took over and again very responsive, was very clear what he needed and always checked back to see if I had any questions. Very professional operation."

Another had this to say, "Service went extremely well and ELFI was super helpful and accommodating. For years, I’ve been scared to refinance. And I am so glad that I did. Approved for an amazing rate and the process was easy."

The positive reviews are related to |

The negative reviews are related to |

Quick and easy loan approval process |

Slow loan disbursements |

Excellent customer service |

Higher rates than advertised |

Competitive rates |

No forbearance options if you lose your job |

Education Loan Finance Perks and Bonuses

Flexibility

Education Loan Finance offers very flexible repayment options for each type of student loan they offer. Most plans let you choose when to begin repaying your loans, whether you want to make immediate payments, make interest-only payments during school, make fixed payments on your loans , or defer payments until 30 to 60 days after your loan's grace period ends.

Note that Education Loan Finance does not offer any additional savings opportunities such as autopay discounts. Instead, they say all discounts are already factored into their low rates.

Finally, it's worth noting that this company has a referral program that lets customers earn money for referring their peers. Specifically, ELFI customers get their own personalized referral link, which they can use to refer friends for a $400 referral bonus. The referred friend also gets a $100 credit applied to the principal balance of the Education Loan Finance loan for participating in the program.

Mentorship

Education Loan Finance connects each borrower with a Student Loan Advisor who can provide professional advice and walk them through each step of the process. The company offers quite a few resources on their website, from an education blog to student loan calculators.

Technology

Education Loan Finance offers a helpful online platform where students can log in to see where their loan is in the process. The company also uses standard encryption technology to protect your data.

Education Loan Finance (ELFI) does not offer its own mobile app.

Final Thoughts

Education Loan Finance offers private student loans that could fit nearly any borrower's needs, and they let applicants apply with or without a cosigner. Their transparency makes it easy to know whether you're eligible for their loan products, and the company offers competitive interest rates and flexible loan terms.

The fact Education Loan Finance lets you check your rate without a hard inquiry is also a major plus. By checking your rate and comparing Education Loan Finance to a few other student loan companies, you can wind up with the best student loan for your needs and your budget.