Founded in 2011, SoFi offers financial products that help people reach financial independence. This includes their popular private student loans and refinance products, which help borrowers secure competitive rates and terms with no hidden fees. In addition to student loan refinancing, SoFi offers undergraduate and graduate loans, law school & MBA loans, and parent student loans.

SoFi Student Loans Review: Private Student Loans and Refinancing

SoFi is a popular fintech company that offers private student loans and refinancing options in addition to other financial products. With competitive interest rates and no hidden fees, the company aims to help borrowers save money as they pay down student debt.

Summarized Rating

This parameter considers loan term lengths, loan limits, and loan structure optionality (fixed and variable rate offerings). For each loan type offered, each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

SoFi gets a stellar 4.7 for Loan Features, which is attributable to its highly flexible term lengths, loan amounts, and loan structure optionality (fixed vs. variable).

SoFi Pros

SoFi Cons

What Types of Student Loans Does SoFi Offer?

This SoFi student loans review will explain the loan options this lender offers and who they're best for. In addition to student loan refinancing, borrowers can turn to this lender for help funding their undergraduate or graduate degree. Law school and MBA loans are also available, along with parent student loans for parents and guardians who are willing to borrow money to help fund their dependent's education

The sections below explain the fees, features, and eligibility requirements for each type of student loan SoFi offers:

- Undergraduate student loans

- Graduate student loans

- Law school & MBA student loans

- Parent student loans

- Student loan refinancing

SoFi Undergraduate Student Loan Review

SoFi Undergraduate Student Loan Features

SoFi undergraduate school loans come with flexible repayment terms and fixed or variable interest rates. You can choose to begin repaying your loans while you're still in school, but you can also enjoy a grace period of up to six months. Borrowers can take out a minimum of $5,000 in private student loans up to the full cost of attendance.

Loan terms |

5,7,10,15 year terms |

Repayment period |

Begins during school or after |

Loan amount |

$5,000 up to the cost of attendance |

Loan Structure Flexibility |

Fixed or variable |

SoFi Undergraduate Student Loan Interest Rates and Fees

SoFi student loans free of monthly fees, origination fees and hidden fees. You won't even be charged a late fee if you pay your student loan payment after its due date. Interest rates are also competitive, although their advertised rates do include a .25% rate discount for using autopay.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

None |

Maintenance Fees |

None |

Fixed Rates |

3.22% - 11.16% APR with autopay |

Variable Rates |

1.10% - 11.68% APR with autopay |

SoFi Undergraduate Student Loan Qualification Requirements

SoFi student loans for undergraduates may be difficult to qualify for if you don't have good credit or a co-signer who can help bolster your application. The minimum credit score for these loans is 650. Also note that borrowers must be pursuing a bachelor's degree at an eligible school and attending at least half-time to qualify.

Institution Type & Course Load Requirements |

Borrowers must be enrolled in a degree-seeking program at an eligible school and be attending classes at least half-time and be making Satisfactory Academic Progress (SAP); loans are not available for borrowers seeking an associate degree |

Minimum Credit Score |

650 |

Minimum Income |

Not disclosed |

Maximum Debt-to-Income |

Not disclosed |

Co-signer/Joint Application Requirements |

Co-signers accepted |

SoFi Graduate Student Loan Review

SoFi Graduate Student Loan Features

SoFi private student loans for graduate students offer the same level of flexibility as their undergraduate loans. You can choose from fixed or variable interest rates, and you can opt to repay your loans over 5 to 15 years. You can also begin making payments during school or defer your payments until six months after graduation.

Loan terms |

5,7,10,15 year terms |

Repayment period |

Begins during school or after |

Loan amount |

$5,000 up to the cost of attendance |

Loan Structure Flexibility |

Fixed or variable |

SoFi Graduate Student Loan Interest Rates and Fees

SoFi graduate degree loans are also free of fees, including monthly fees, prepayment penalties, and late fees. Interest rates are competitive, although a .25% autopay discount is represented in their advertised rates. As you compare rates and loan options, note how interest rates on federal Direct Unsubsidized Loans for graduate students are currently set at 5.28%.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

None |

Maintenance Fees |

None |

Fixed Rates |

4.13% - 11.06% APR with autopay |

Variable Rates |

1.95% - 11.58% APR with autopay |

SoFi Graduate Student Loan Qualification Requirements

While SoFi graduate student loans are geared to borrowers pursuing a graduate level degree, some graduate-level certificate programs are also eligible. Minimum credit score requirements may make it difficult to qualify. However, borrowers can use their job offer letter as proof of income when applying for a graduate student loan.

Institution Type & Course Load Requirements |

Borrowers must have an undergraduate degree and be attending a degree program at least half-time at an approved, degree-granting institution; some graduate school certificate programs are also eligible |

Minimum Credit Score |

650 |

Minimum Income |

Not disclosed |

Maximum Debt-to-Income |

Not disclosed |

Co-signer/Joint Application Requirements |

Co-signers accepted |

SoFi Law & MBA Student Loan Review

SoFi Law & MBA Student Loan Features

SoFi also offers law school and MBA student loan programs, which let students begin repaying their debts during school if they prefer. Borrowers can also enjoy a grace period of up to six months after graduating before they begin making payments. Flexible repayment terms are also offered with options that last up to 15 years.

Loan terms |

5,7,10,15 year terms |

Repayment period |

Begins during school or after |

Loan amount |

$5,000 to up to the cost of attendance |

Loan Structure Flexibility |

Fixed or variable |

SoFi Law & MBA Student Loan Interest Rates and Fees

SoFi law school and MBA loans are also strikingly free of fees, including prepayment penalties and late fees. Interest rates are also competitive, and borrowers can choose from fixed rate and variable rate options.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

None |

Maintenance Fees |

None |

Fixed Rates |

4.08% - 11.01% APR with autopay |

Variable Rates |

1.90% - 11.53% APR with autopay |

SoFi Law & MBA Student Loan Qualification Requirements

While SoFi doesn't publish all of their approval requirements, they do note that law school and MBA students can use a job offer letter as their proof of income when applying for a loan as long as their start date is within a year.

Institution Type & Course Load Requirements |

Borrowers must have an undergraduate degree and be attending a degree program at least half-time at an approved, degree-granting institution |

Minimum Credit Score |

650 |

Minimum Income |

Not disclosed |

Maximum Debt-to-Income |

Not disclosed |

Co-signer/Joint Application Requirements |

Co-signers accepted |

SoFi Parent Student Loan Review

SoFi Parent Student Loan Features

SoFi student loans for parents are offered with the same flexible repayment options as their other private student loans. However, there is no grace period offered and parents must begin making interest-only or full payments once the loan is disbursed.

Loan terms |

5, 7, 10, and 15 year terms |

Repayment period |

Interest-only or immediate payments required right away |

Loan amount |

$5,000 up to the cost of attendance |

Loan Structure Flexibility |

Fixed or variable |

SoFi Parent Student Loan Interest Rates and Fees

SoFi student loans for parents come with no hidden fees and competitive interest rates. In fact, borrowers can compare them to federal Direct PLUS loans for parents which currently charge a fixed APR of 6.28%.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

None |

Maintenance Fees |

None |

Fixed Rates |

4.23% - 11.16% APR with autopay |

Variable Rates |

1.30% - 11.68% APR with autopay |

SoFi Parent Student Loan Qualification Requirements

SoFi student loans for parents are for parents and guardians who are borrowing to help a student who is attending an eligible college or university at least half-time. While SoFi does not publish all their eligibility requirements, parents can check their rate for free online before they apply.

Institution Type & Course Load Requirements |

Student must be attending a degree program at least half-time at an approved, degree-granting institution |

Minimum Credit Score |

650 |

Minimum Income |

Not disclosed |

Maximum Debt-to-Income |

Not disclosed |

Co-signer/Joint Application Requirements |

Not available with parent student loans |

SoFi Student Loan Refinancing Review

SoFi Student Loan Refinance Features

SoFi makes it possible to refinance both private and federal student loans you have, and often the better rates and terms. Borrowers can choose to repay their SoFi student loan refinance loan for up to 20 years when they refinance, and there are no limits on how much you can borrow as long as you meet eligibility requirements for the loan amount you need.

Loan terms |

5, 7, 10, 15, and 20 year terms |

Repayment period |

Begins right away |

Loan amount |

$5,000 minimum with no limits |

Loan Structure Flexibility |

Fixed or variable |

SoFi Student Loan Refinance Interest Rates and Fees

SoFi refinance loans are just as free of hidden fees as their other student loan products. SoFi student loan rates can be fixed or variable as well, and they're competitively priced.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

None |

Maintenance Fees |

None |

Fixed Rates |

2.49% - 7.24% APR with autopay |

Variable Rates |

1.74% - 7.24% APR with autopay |

SoFi Student Loan Refinance Qualification Requirements

Borrowers who want to refinance their student loans with SoFi will need to meet income and credit requirements for the amount they want to borrow. Also note that borrowers must have graduated from a selection of Title IV accredited university or graduate programs. In other words, refinance loans are not available to those who did not finish their degree.

Institution Type & Course Load Requirements |

Borrowers must have graduated from a selection of Title IV accredited university or graduate programs |

Minimum Credit Score |

650 |

Minimum Income |

Not disclosed |

Maximum Debt-to-Income |

Not disclosed |

Co-signer/Joint Application Requirements |

Co-signers accepted |

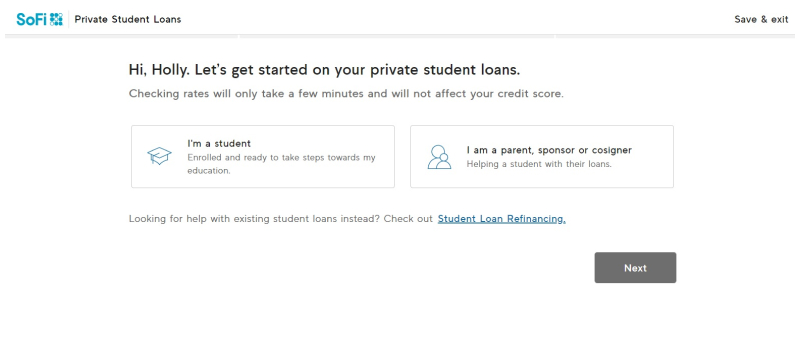

SoFi Student Loan Application Process

SoFi makes it easy for borrowers to apply for a loan entirely online, although the process can look different depending on the type of student loan you're applying for. That said, SoFi does let all of their borrowers prequalify and check their rate ahead of time. Better yet, checking your rate and eligibility will not have an impact on your credit score.

You'll start the process by selecting the type of loan you need and clarifying whether you are applying for a loan yourself or with a co-signer. If you're trying to refinance student loans you already have, you'll also make this selection fairly early in the process.

The next step is starting your loan application, which will require you to have some information handy. As you prepare to get started, here's what you may need:

- Social Security number

- Proof of income

- Government-issued ID

- School information (student’s estimated graduation date and academic term)

- Loan amount

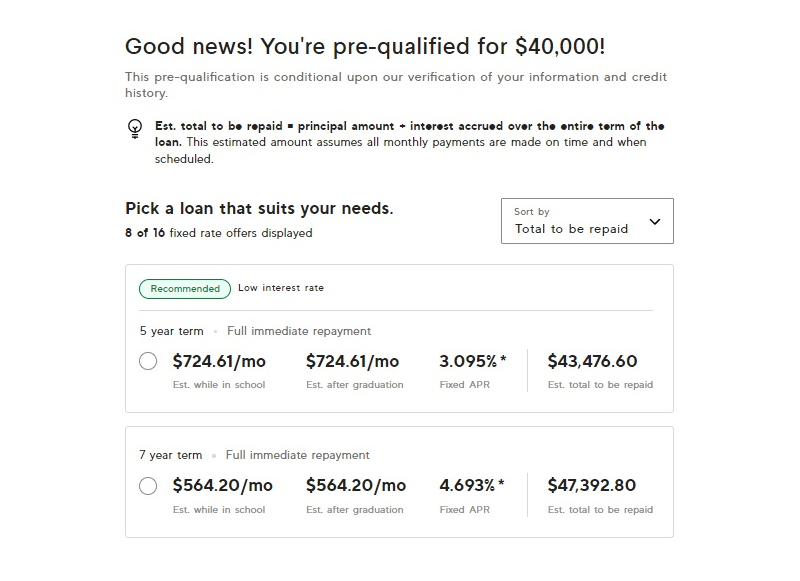

- Financial aid you expect to receive

Once you move through the process, you'll be shown an estimated interest rate for the loan amount you want to borrow. Note, however, that this rate is just an estimate. If you want to know the exact rate you're eligible for, you'll have to fill out the full loan application and apply.

This part of the process is also where you'll decide on the loan term and monthly payment that suits your needs and budget. You also get to select whether you want to begin making payments during school or wait until you graduate (if you're eligible).

While you can apply for a SoFi student loan in just a few minutes, it may take up to six weeks for your school to receive your loan funds. If you're refinancing student loans you already have, however, the process can be completed on a much faster timeline.

SoFi Customer Support

SoFi offers a few different ways to contact them if you need help with private student loans. For starters, you can call the company at 1-855-456-SOFI on Monday through Thursday from 5 a.m. to 7 p.m. PST. You can also call them on Friday through Sunday from 5 a.m. to 5 p.m. PST.

Online chat support is also available on the SoFi website.

Customer service reviews on platforms like Trustpilot are also somewhat favorable when it comes to their customer service. However, SoFi does offer other banking and investment products, so it's important to note that not all of their customers who left reviews use their private student loans.

As one customer put it, "This company has been extremely helpful in coming to my aid in refinancing my student loans. 5 stars - best of the best - companies like these give me faith in commerce and the great USA. Stay safe!"

SoFi Online Reviews

SoFi currently has an average star rating of 2.8 out of 5 stars on Trustpilot. In the meantime, 78% of their reviews were rated "excellent," and another 10% were rated "great" or "average."

That said, the fintech company does have some pretty mixed reviews when it comes to their student loan refinancing products. For example, some readers said that SoFi did not have the best rates out there when compared to other student loan refinancing companies.

Other past customers had much larger complaints. In fact, one user who left a note within SoFi student loans reviews said, "This is one of the most mismanaged companies I have ever been associated with knowing. How a company can just flat out "lose" an application, or lack of correspondence is just unbelievable."

As another user put it, "They sent me cold emails to refi student loan. I filled out an application. They run my credit score 811 and then deny me. I call to ask why and a rude customer service rep says because of my irregular employment. I have owned my own business for 10 years. She then tells me to apply again. Awful experience."

The positive reviews are related to |

The negative reviews are related to |

Quick and easy loan approval process |

Higher rates than advertised |

Competitive rates and loan terms |

Mismanaged applications |

Help making monthly payments more manageable |

Rude customer service |

SoFi student loans Perks and Bonuses

Flexibility

SoFi is known for offering several flexible repayment plans when it comes to their student loans and refinance products. Not only that, but they offer multiple loan discount opportunities including a 0.25% autopay interest rate discount. If a borrower of their co-signer are existing SoFi customers, an additional 0.125% interest reduction can also apply.

SoFi student loans also come with unemployment protection that gives you time to catch up with payments when you lose your job. This benefit is offered in three-month increments for up to 12 months, although interest will continue accruing on your loans during the deferment period.

In the meantime, borrowers should note that SoFi student loan forgiveness is not available.

Mentorship

SoFi offers career coaching services that are completely free for members. Their professional coaches can help you figure out your next best steps whether you're considering a career change or you're looking for a job. They can also help with personal branding advice or provide customized support based on your unique career goals.

Technology

SoFi makes it easy for borrowers to manage their loans with the help of a handy online dashboard. SoFi also offers a mobile app that lets users manage all their accounts in one place.

Final Thoughts

SoFi student loans come with competitive rates and flexible loan terms, but it's important to know their limitations. For example, you cannot use this lender if you need to borrow less than $5,000. SoFi also fails to offer a co-signer release option on their student loans, so anyone who cosigns a student loan will be responsible for repayment until the loan terms are up.

Either way, SoFi makes it easy to check your rate and compare loan terms without a hard inquiry on your credit report. This perk can help you decide whether their student loan products make sense for your needs and goals.

Frequently Asked Questions (FAQs)

This app literally changed my like. It provides a great experience. I absolutely love it!