Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

Square Loans Reviews: Business Expert Analysis & User Insights

As a major player in small business financing, Square attracts business owners with its quick application process, transparent prices, and flexible borrower qualifications. With no credit score or collateral requirements, you don’t need to choose Square - it will choose you.

Square joined the world of business financing in 2014. The company started out by offering merchant cash advances, but today it mainly focuses on fixed-term loans, which are formerly known as Square Capital loans.

Square loans are available exclusively to businesses and merchants that already use the Square payment processing service, and are ideal for those who process consistent, large volumes of credit card transactions.

Summarized Ratings

Square has a stellar User Reviews rating of 4.7, which is reflective of the independent user reviews posted on Trustpilot.

Square Loan Reviews

Square business loans score on Trustpilot sits at a very healthy 4.7 stars out of 5 from almost 1,200 reviews.

Users are particularly impressed by the ease and expediency of the application process, and just how quickly they were able to access funding. Others are pleased to find there are no hidden fees, and that all charges are laid out very clearly from the start of a loan.

However, in some instances, customers have expressed concerns over inconsistent offers, and aren’t sure when they may or may not be eligible to apply. Square customer service is usually happy to address these questions and explain your circumstances if you get in touch, though.

In addition, some customers have complained about rejections due to being flagged for unusual account behavior. This is most likely due to the fact that Square likes to see consistency in payments, and companies that have fluctuating sales could see higher levels of rejection.

| Positive Reviews | Negative Reviews |

| Fast application process | Slow customer service on occasion |

| Quick funding | Unclear eligibility process |

| Easy to understand loans | Rejections for inconsistent sales |

Pors

Cons

What Are Square Loans?

Square offers small businesses fixed-term loans with no ongoing interest rates. Instead, there’s just a simple flat fee. Square’s business loans operate a bit differently than traditional loans, though. With this type of lending, you’ll be borrowing against a percentage of your future credit and debit card sales. The loan, plus a flat fee, will be deducted directly from all sales from your Square sales processing software. Since payments are a percentage of your daily sales, you pay less on slow days and more on busier days.

Because you must actively be using Square to qualify, approvals are much easier to get and a lot faster to process than with other platforms.

Square Loans Features

The huge advantage of a small business loan from Square is minimal documentation required. With Square, you can be approved and funded in as little as 24 hours.

However, you should bear in mind that you don’t actually apply directly for a loan here.

You have to wait to be invited and will receive notification of your pre-approval via your Square account. If you’re interested in taking a loan, make sure you are using Square payment processing; then, get in touch with customer services to express your interest in the loan.

| Term length | Variable |

| Repayment period | Daily deductions from credit and debit card sales |

| APR range | Factor rates between 1.10 - 1.16 |

| Min - Max amount | $300 - $250,000 |

Square Loans Interest Rates and Fees

Square charges a factor rate only. A factor rate is a rate that represents the cost of funding your loan. Factor rates start at 1.10, so to figure out your fee, simply multiply your loan amount by the factor rate. If you get a loan of $1,000, for example, you’d times this by 1.10, giving you a total loan payment of $1,100.

There are no origination, prepayment, or maintenance fees to pay, making it very easy to understand how much you'll actually be charged each day.

Square also doesn’t charge late fees since everything is deducted from your credit and debit card sales. If you have a good day of sales, you’ll pay more; if you make fewer transactions, you’ll pay less.

Note: For any loan amount over $75,000, you’ll need to sign a blanket lien. This means Square has the right to seize any of your business assets to cover the debt.

| Origination fees | None |

| Prepayment fees | None |

| Late payment fees | None |

| Maintenance fees | None |

| Interest rates | Factor rate between 1.10 and 1.16 |

If you are struggling with substantial amounts of debt, a debt relief company such as Accredited Debt Relief could be your lifeline. The company can help you help you save up to 50% of enrolled debt.

How to Qualify for Square Loans

To access Square business funding, you need to be a user of the Square payments platform and be processing the majority of your sales using its payments system.

Once that’s taken care of, you’ll need to meet the following three requirements:

- Process at least $10,000 a year or more in sales

- Consistently take card payments from Square

- Have a mix of new and returning customers

Outside of these requirements, other criteria aren’t strict at all. There are no minimum standards for time in business, personal guarantee requirement, and your credit score won’t play a part in the loan decision.

| Minimum credit score | No minimum required |

| Minimum annual revenue | $10,000 |

| Minimum time in business | No minimum required |

Square Business Loans Application Process

If you are already using Square to receive payments, getting a Square loan is easier than ever. As a payment processor, Square will already have plenty of information about your business and finances. If the company deems you fit, they will extend a loan offer to you, meaning there are no long forms to fill out. Should you decide to accept, the funds will be transferred directly into your bank account.

Below are the steps to create an account with Square.

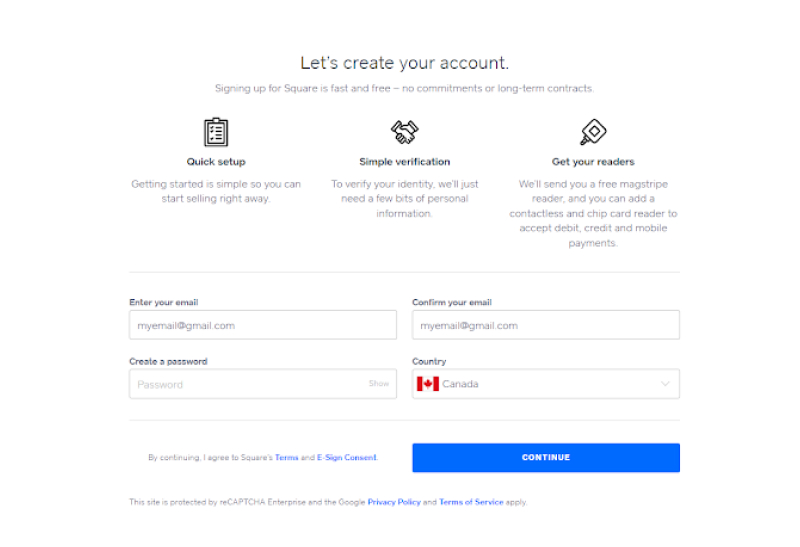

1. User Account Creation

Create a free user account directly through Square’s website by entering your email, selecting your country, and creating a password.

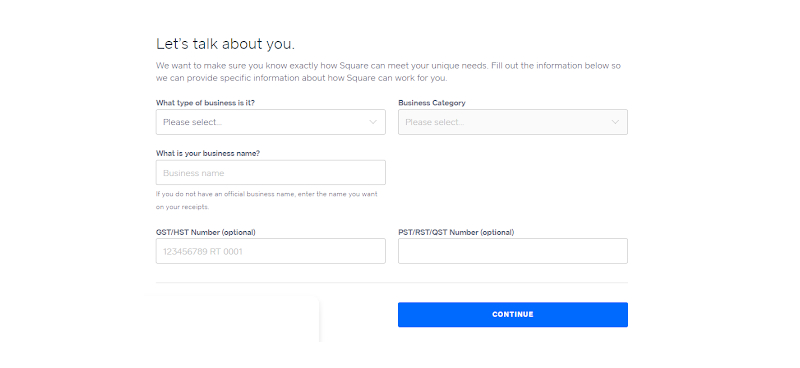

2. Business Information

Once you create a free account, you’ll provide details about your business, such as its type and business category, business name, and GST/HST number.

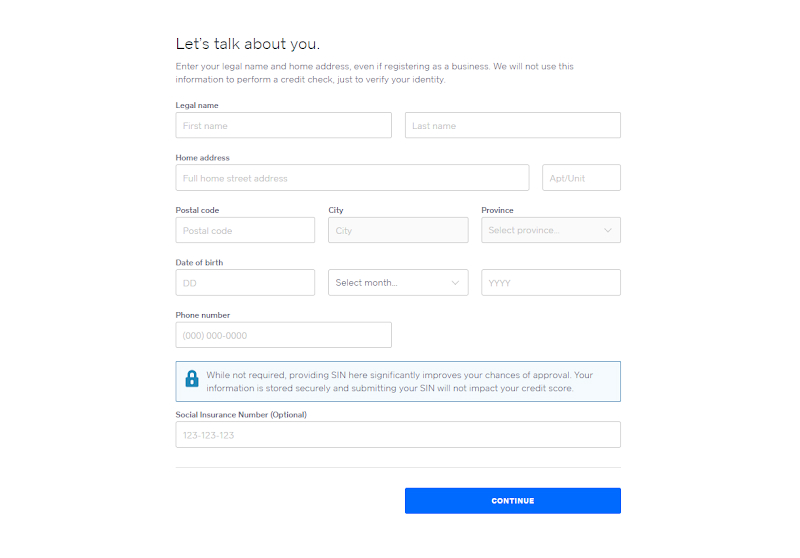

3. Personal Information

You’ll also be asked to provide some personal information, including your name, date of birth, address, and phone number.

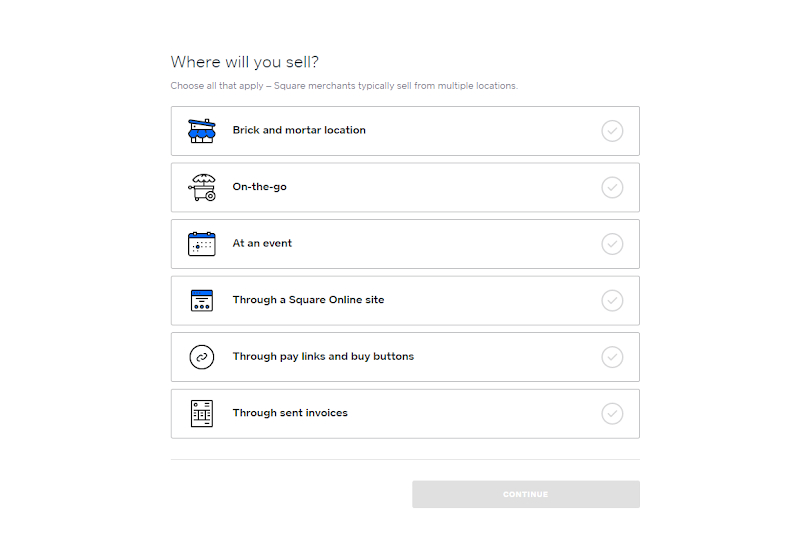

4. Additional Details

Next, you need to select where you are planning to sell your product (brick and mortar location, on-the-go, at an event, through a Square Online site, through pay links and pay buttons, or through sent invoices). You also have an opportunity to specify whether you are interested in any additional Square services.

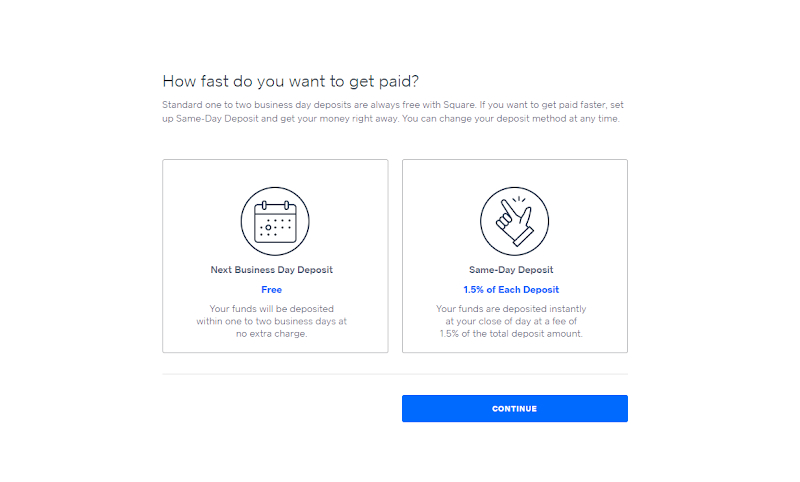

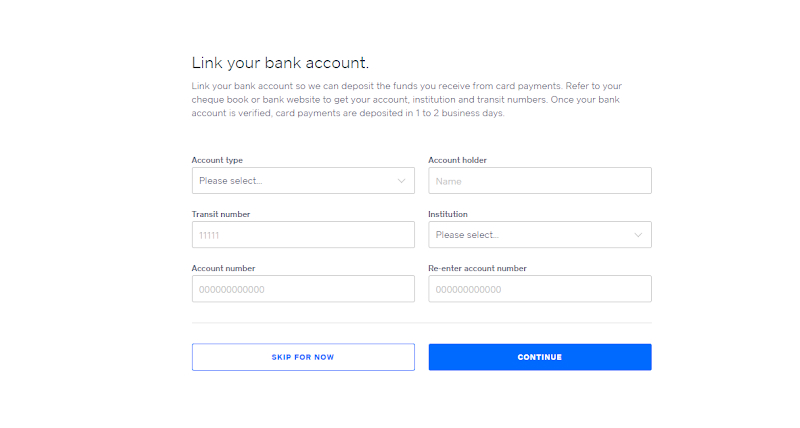

5. Payment Information

Finally, link your bank account and choose how fast you wish to get paid. With Square, you receive the funds directly in your bank account within one or two business days.

6. Square Loan Offer

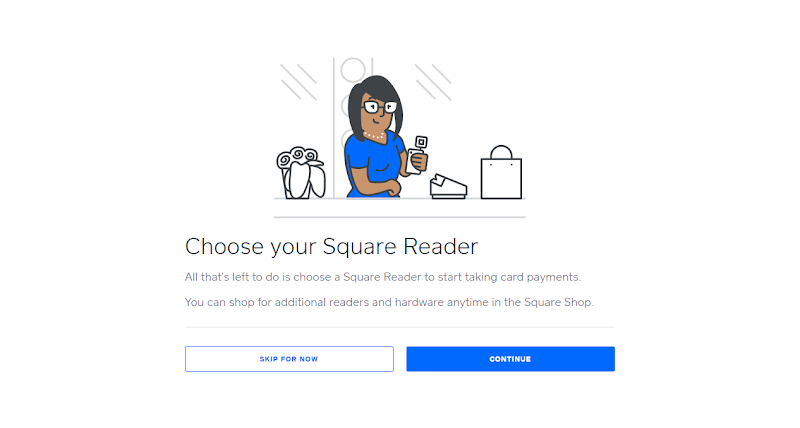

Once you choose your Square Reader, you are ready to sell with Square. As you continue doing business, Square will review your transactions and sales histories to determine whether you are eligible for a loan. If you qualify, they will send an offer right to your Square dashboard.

If you need a loan but haven’t received an offer, you can take a short survey that will help Square get to know your business better. When determining loan eligibility, the company looks at processing volume (usually at least $10,000 annually), payment frequency, and your business’s mix of new and returning customers.

7. Fund Disbursement

Once you accept your Square offer, you may be asked for some documents to prove your and your business’s identity. Within one to three days, the loan should be officially approved, with the funds being deposited into your bank account within another one to three days.

How Does Square Determine Loan Amount

The loan decision is almost entirely based on how much you process in sales through Square. The higher your sales, the more you can borrow.

Your factor rate is usually determined by the consistency of sales. If you peaks and troughs in your credit and debit card sales, you might be paying a higher rate as you present a greater lending risk, though evidence of strong daily sales will bring this figure down.

Customer Support

You can get in touch with Square over the phone, via email, and on social media using Facebook messenger. It can be difficult to find these options via the website, though, and new customers might struggle to find the right answers.

That being said, the platform has been investing in its customer service team in recent years, and we’re definitely seeing improvements. The FAQ page has been expanded, and you can now access the Square seller community forum where customer service agents regularly respond to queries made via posts.

As a result of these innovations and improvements to regular contact methods, we’re starting to see an increase in positive responses to customer service.

Square Loans Perks and Bonuses

Flexibility

Rather than paying a fixed amount, the repayments are based on a percentage of daily credit card sales. This provides a flexible and convenient way to repay the loan.

Transparency

Square is one of the most transparent lenders in the marketplace. They charge one flat fee (factor rate) that is paid back over the lifetime of the loan.

The Square website provides a good amount of information on its main website and through the Square Loans Support Center. By reviewing this information, you should be able to get a good idea of what to expect from the Square services.

Technology

As an innovator in everything related to credit card payments, Square is known for its mobile payments solution and mobile wallet. Naturally, their fast, automated business loans come with convenient auto-payments that are deducted directly from your credit card sales.

Final Thoughts

If you’re after a small business loan process that’s easy to understand, comes with low fees, and has an incredibly simple application process, then you’ve come to the right place. Square might just be one of the most convenient lenders we’ve encountered, and it's incredibly easy to manage your loan.

The biggest drawback comes from the requirement to use the Square payment processing platform and the fact that you have to wait for a loan offer. It can be difficult to get in touch or know when you’ll be deemed eligible, but this is an area the platform is improving.