| All content presented here and elsewhere is solely intended for informational purposes only. The reader is required to seek professional counsel before beginning any legal or financial endeavor. |

When completing the SBA loan application process, the SBA Form 413 personal financial statement is a key element of your loan application. Your lender and the SBA use this form to evaluate your creditworthiness and your ability to repay the loan. This information contributes to their decision of whether or not to fund your application.

Key Points:

- Most SBA loans and SBA loan programs require you to complete the SBA 413.

- Having your financial paperwork well-organized can help you to easily and quickly complete the form.

- Form 413 includes details on your assets, liabilities, and sources of income, so the SBA understands whether it could recoup its money if you defaulted on the loan.

- It’s important that you have a clear understanding of your finances so you don’t leave out any important information that could mean the difference between your getting the loan or SBA loan denied.

Who Should Complete The SBA Personal Financial Statement?

Depending on your business structure, several different people may need to complete the SBA personal financial statement:

List all the eligible applicants with short explanations

- The proprietor of the business

- Each general partner

- Each owner or limited partner with 20% or more equity interest in the business

- Any person or entity providing a guarantee on the loan

- If an owner of the business files a joint tax return with a spouse, the spouse’s assets must also be included in the PFS, as well as those of any minor children

What Do I Need To Complete The SBA 413 Form?

The SBA 413 Form can be overwhelming at first glance, but preparing all of your documents ahead of time can make it easier to complete. Start by studying the form’s requirements so you're familiar with what you will need. Next, gather the essential financial documents that you will use to produce the information the form requires:

- Bank statements

- Tax returns

- Pay stubs

- IRA, 401(k), and any other retirement account statements

- Life insurance documents

- Statements for other sources of income, like disability income, pensions, and real estate income

- Statements for loans, like your mortgage, auto loan, and credit card statements, that include your account number, payment amount, and current balance

As you gather these documents, you should pull them within a 30-day period from the date when you will be completing the 413 form. This will ensure that the information you’re using is current.

How To Fill Up The SBA Form 413 - A Step By Step Guide

Understanding how to fill out the SBA personal financial statement is a matter of taking the form one section at a time. To start, make sure that you’re working with the most current version of the form. You can find it online on the SBA website. The following step-by-step instructions will guide you through the process of completing the form.

- Section 1: Sources of Income & Contingent Liabilities

- Basic Business Information: Start by providing basic information about your business, like your home and business address, home and business phone, and type of business, such as an LLC or S-Corp.

- Information About Assets: Next, you will need to list the monetary value of all of your assets. This section includes all of your personal assets. Be sure not to omit any assets, since the value of your assets helps to prove that you’re capable of paying back a loan. Your assets can include:

- Cash on hand and in banks: Add up all of the cash you have, including what is in checking accounts.

- Savings accounts: Add up the balances of all savings accounts.

- Retirement accounts: Be sure to include the balance of all of your retirement accounts. If you had accounts under a previous employer, look up those old accounts and include those balances.

- Accounts and notes receivable: Any promissory notes that you have regarding amounts owed to you can also be considered assets.

- Life insurance: If you own any whole life insurance policies, the cash surrender value may be listed as an asset.

- Stocks and bonds: Check your current stock and bond values and include those updated values.

- Real estate: The value of your real estate is a major portion of your assets, so be prepared with updated information on your property’s market value.

- Automobiles: You’ll need to add up the market values for all of the automobiles that your family owns.

- Other personal property and assets: Other personal property and assets might include boats, furniture, jewelry, and any other items of significant value.

- Total: Add together all of your assets to get your total asset value and include it on the last line.

- Information About Liabilities: The following section focuses on your liabilities, like mortgages and car loans. Include each liability on the appropriate line, dividing them by type:

- Accounts payable: In the accounts payable section, you should total any amounts that you owe to lenders other than banks.

- Notes payable to banks and others: Include debts to banks such as auto loans, lines of credit, and credit cards.

- Automobile Automobile loans: If you have auto loans, you will need to provide the total balance of the loans.

- Other installment Loans: Provide the total balance due for any installment loans, such as student loan debt.

- Loan against life insurance: If you have any loans against your life insurance policy, provide the total balance due..

- Mortgages on real estate: Provide the total balance due for any mortgage loans. You will describe your mortgage details in Section 4.

- Unpaid taxes: If you have unpaid taxes, you will need to provide the current balance of those liabilities.

- Other liabilities: Include any other debts that you haven’t highlighted above, like the total balance due on any credit cards or other consumer debt.

- Total liabilities: Add up all of the liabilities to get your total.

- Net worth: To calculate your net worth, you will need to subtract your total liabilities from your total asset value, which you calculated in the asset section.

- Add together your total liabilities and your net worth. The resulting figure should equal your asset total. This step ensures that you’ve made all of your calculations correctly.

- Sources Of Income: Next, provide information on any and all income sources.

- Salary: Provide your salary from any current jobs, including what you receive from your business and any other employment.

- Net investment income: If you have stock dividend income, you’ll need to record it as your net investment income.

- Real estate income: Identify any income you receive from real estate, like rental properties.

- Other income: Include any other sources of income that you haven’t previously mentioned.

- Contingent Liabilities

- As endorser or co-maker

- Legal claims and judgments

- Provision for federal income tax

- Other special debt

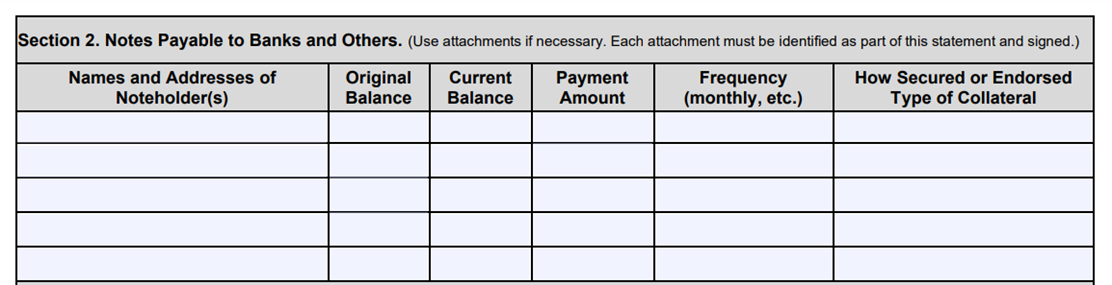

- Section 2: Notes Payable to Banks and Others

In Section 2, you will need to provide information about all of the debt that you included in the notes payable column in Section 1. You will need to complete the following information for each debt:

- Name and address of the noteholder: Provide the name and address of the creditor for each debt.

- Original balance: Indicate the balance that you borrowed when you first established the credit.

- Current balance: Indicate your current debt balance.

- Payment amount: Provide the amount that you pay on the debt each month. If the debt is a loan, then list your monthly loan payments. If the debt is a credit card, indicate that the amount varies from month to month.

- Frequency: Indicate how often you make payments on the debt. In most cases, this will be monthly.

- How secured or endorsed/type of collateral: If your debt is a credit card, then it was an unsecured debt. If you have a loan, you may have put down collateral; identify what that collateral is.

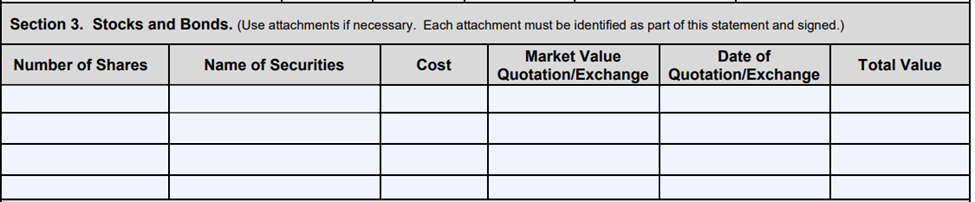

- Section 3: Stocks and Bonds

- Next, you will need to provide details about any stocks and bonds that you or your spouse own. You will have listed them in the assets column in Section 1.

- Number of shares: Detail the total number of shares of each type of stock or bond that you own.

- Name of securities: Provide the name of the stock or bond.

- Cost Basis: Indicate the original purchase cost of a share.

- Market value quotation/exchange: Indicate the current market value of a share.

- Date of quotation/exchange: Provide the date that you checked the current value.

- Total value: Multiply the number of shares that you own by the current market value to determine the total current value of your stocks or bonds.

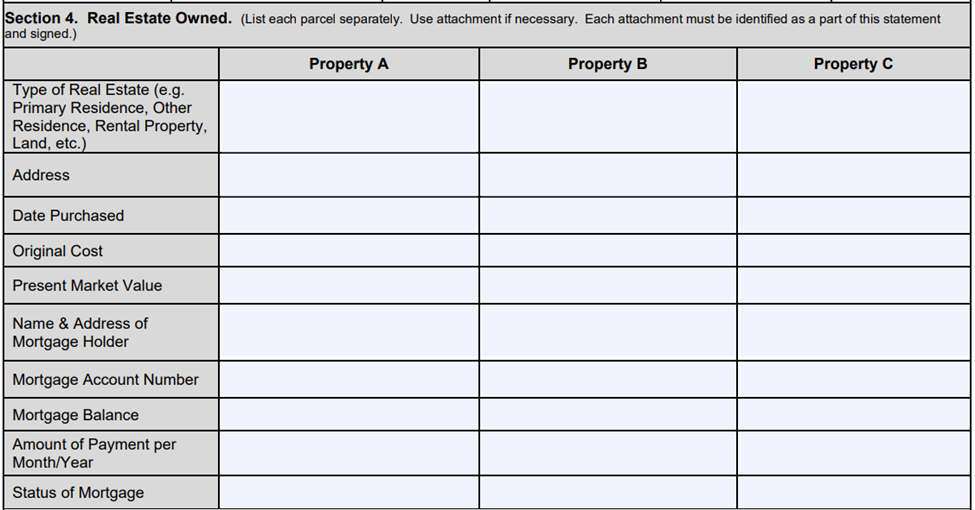

- Section 4: Real Estate Owned

You will need to fill out a column in Section 4 for each real estate property that you own.

- Type of property: Indicate whether the property is a lot, a residential home, or an investment property.

- Address: Provide the address for each property.

- Date of purchase: Indicate the date when you closed on the property.

- Original cost: Include the original purchase price for each property.

- Present market value: Your mortgage broker can provide you with an estimate of the property’s current value.

- Name and address of mortgage holder: Include contact information for the bank that owns your mortgage.

- Amount of payment per month/year: Specify your monthly or yearly mortgage payments on each property.

- Status of mortgage: Indicate whether your mortgage is current, in foreclosure, or paid in full.

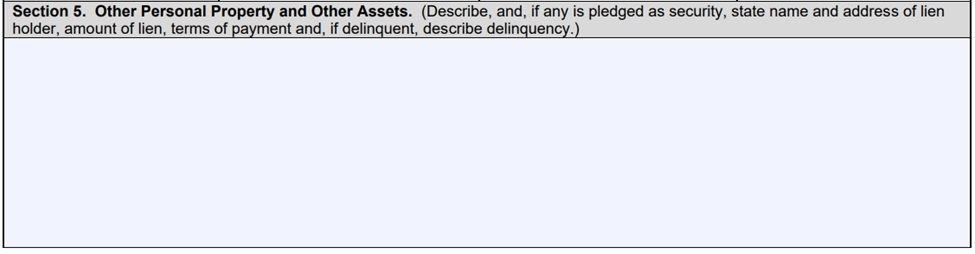

- Section 5: Other Personal Property and Other Assets

In Section 5, you will need to provide detail about any items that you listed in the “Other Personal Property” and “Other Assets” columns from Section 1. Section 5 is somewhat open-ended, but it’s important to go into detail about these assets. If you have used these assets as collateral for a loan, you will need to provide information about that loan, including its amount, terms, and status.

- Section 6: Describe Any Unpaid Taxes

If you have any unpaid taxes, then you need to complete Section 6. If you have unpaid state or local taxes, it’s important to demonstrate that you are on a payment plan. You will need to provide details about that payment plan to remain eligible for a SBA loan.

- Section 7: Include Any Other Liabilities

If you listed any “Other Liabilities” in Section 1, you will need to detail those liabilities in Section 7. These liabilities might include situations that don’t fit into the above categories:

- Cosigned or guaranteed obligations

- Debts to foreign governments

- Debts that come from private agreements

- Outstanding lawsuits

- Section 8: Life Insurance Held

If you have life insurance, you will need to provide details about each policy, including the insurance company name, the face amount and cash surrender value of each policy, and the beneficiaries.

How To Submit The Form 413?

Once you’ve completed Form 413, you can submit it directly to your SBA lender. Be sure to also include any supporting documents, like additional pages that you used to list your debts or assets.

Tips On Completing The SBA Form 413

- Collect your financial documents before you start to apply. You’ll need information about your bank accounts, mortgage, retirement accounts, life insurance, pay stubs, loans, and investments.

- When completing the form, go into as much detail as possible, especially when explaining your debts.

- If you have questions about the form or need help completing it, you can hire a loan broker or consultant to help you.

- Be sure to carefully review the form for accuracy before you sign it. Reporting inaccurate figures could cause your application to be rejected.

Final Word

- Be sure to accurately represent both your assets and your debts.

- Be prepared with additional documentation that your lender may request to verify the statements you make in the form.

- If you have questions about the form, contact your lender or consider hiring a professional to help you.

- Take your time with this complicated form, since accuracy is essential.

Thoroughly completing the form is a key step in getting approved for your SBA loan.