| All content presented here and elsewhere is solely intended for informational purposes only. The reader is required to seek professional counsel before beginning any legal or financial endeavor. |

Nonprofits play an essential role in society by addressing critical social issues and providing services to those in need. While these organizations operate with a mission-driven focus, they still require adequate funding to sustain their operations and expand their impact.

One crucial aspect of financial management for nonprofits is working capital, which is the cash and other liquid assets available to cover day-to-day expenses. A lack of working capital can limit a nonprofit's ability to carry out its mission, making it vital for leaders of these organizations to understand how to manage and increase their working capital effectively.

Do Nonprofit Organizations Have Working Capital?

Yes, nonprofit organizations have working capital. Working capital refers to the liquid assets available to cover day-to-day expenses, such as salaries, rent, and utilities. Nonprofits, like any other business or organization, need working capital to operate effectively.

However, nonprofits often face unique challenges when it comes to managing their working capital, such as fluctuations in donations and grant funding, which can affect their cash flow.

Therefore, nonprofit leaders need to understand the importance of working capital and take steps to manage it effectively to ensure the organization's financial sustainability and mission impact.

How To Calculate A Nonprofit’s Working Capital Ratio?

Calculating a nonprofit's working capital ratio is a straightforward process that involves a simple formula. The working capital ratio measures the ability of an organization to meet its short-term financial obligations.

Here's how to calculate a nonprofit's working capital ratio:

- Calculate the nonprofit's current assets: Add up all the liquid assets that the nonprofit has on hand. This may include cash, accounts receivable, and short-term investments.

- Calculate the nonprofit's current liabilities: Add up all the nonprofit's short-term financial obligations, such as accounts payable, short-term loans, and accrued expenses.

- Subtract the nonprofit's current liabilities from its current assets: This calculation will give you the nonprofit's working capital.

- Divide the nonprofit's working capital by its current liabilities: The resulting number is the nonprofit's working capital ratio.

For example, if a nonprofit has $100,000 in current assets and $75,000 in current liabilities, its working capital would be $25,000. Dividing $25,000 by $75,000 gives a working capital ratio of 0.33 or 33%.

A working capital ratio of less than 1 indicates that the nonprofit may have difficulty meeting its short-term financial obligations, while a ratio of greater than 1 indicates that the nonprofit has sufficient working capital to cover its expenses.

What Are Other Important Nonprofit Financial Ratios?

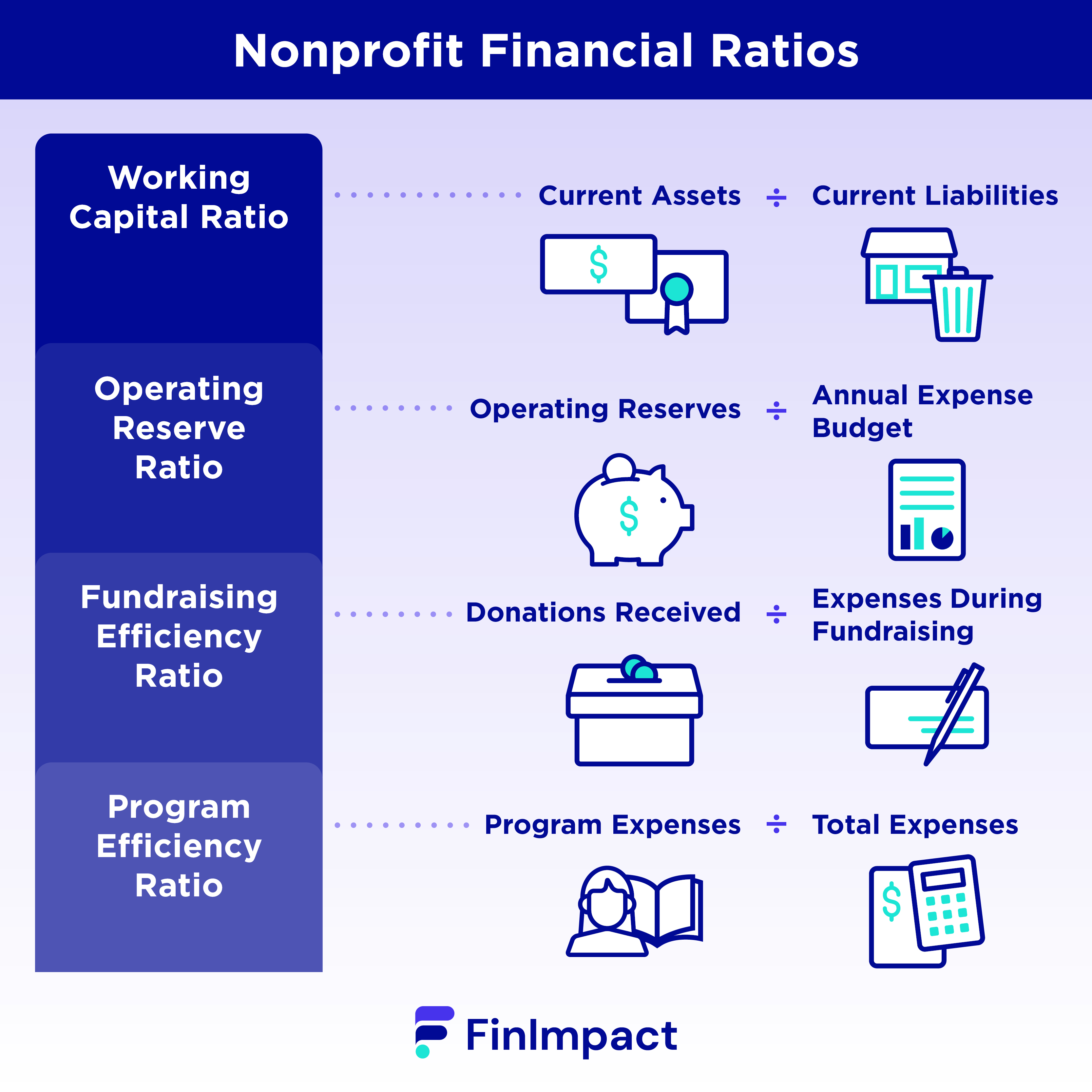

In addition to the working capital ratio, there are several other financial ratios that are important for nonprofits to monitor. These ratios provide insight into the financial health and sustainability of the organization.

Here are some key nonprofit financial ratios to consider:

- Current ratio: This ratio is similar to the working capital ratio but provides a broader view of a nonprofit's ability to meet its short-term financial obligations. It is calculated by dividing current assets by current liabilities. A current ratio of 1 or greater indicates that the nonprofit has sufficient short-term assets to cover its liabilities.

- Debt-to-equity ratio: This ratio measures the proportion of debt financing compared to equity financing. It is calculated by dividing total liabilities by total equity. A low debt-to-equity ratio indicates that the nonprofit is using more equity financing, which can be a sign of financial stability.

- Program expense ratio: This ratio measures the proportion of expenses that are dedicated to the nonprofit's programs versus administrative and fundraising expenses. It is calculated by dividing program expenses by total expenses. A high program expense ratio indicates that the nonprofit is using its resources efficiently to support its mission.

- Fundraising efficiency ratio: This ratio measures the effectiveness of the nonprofit's fundraising efforts. It is calculated by dividing fundraising expenses by total contributions. A low fundraising efficiency ratio may indicate that the nonprofit is not using its resources effectively to generate donations.

- Operating reserve ratio: This ratio measures the nonprofit's ability to cover its expenses during times of financial hardship. It is calculated by dividing the nonprofit's unrestricted net assets by its annual expenses. A higher operating reserve ratio indicates that the nonprofit has more financial flexibility to weather financial challenges.

By monitoring these financial ratios, nonprofit leaders can gain insight into the financial health of their organization and make informed decisions about resource allocation and fundraising strategies.

How Much Money Can A Nonprofit Have In Reserve?

There is no specific limit on how much money a nonprofit can have in reserve. The amount of reserve funds that a nonprofit should hold depends on various factors, such as its financial goals, the nature of its operations, and the potential risks it may face.

Nonprofits should aim to maintain a balance between having enough reserve funds to cover unexpected expenses or revenue shortfalls and using their resources to advance their mission.

The amount of reserve funds that a nonprofit should hold can vary widely depending on the organization's size and complexity. However, some financial experts recommend that nonprofits aim to maintain a reserve fund equivalent to three to six months of operating expenses.

This can provide a cushion to cover unexpected expenses, revenue shortfalls, or other financial challenges that may arise.

Ultimately, the amount of reserve funds that a nonprofit should hold depends on its unique circumstances and financial goals. Nonprofits should carefully assess their financial needs and work with their financial advisors to develop a reserve fund policy that aligns with their mission and long-term financial sustainability.

How Can I Increase the Working Capital Ratio Of My Nonprofit?

Increasing the working capital ratio of a nonprofit requires a combination of financial management strategies and operational improvements. Here are some ways to increase the working capital ratio of your nonprofit:

- Improve cash flow management: Nonprofits can improve their working capital by managing their cash flow effectively. This includes setting up a cash flow projection system to anticipate upcoming expenses and revenues, collecting payments from donors and grantors on time, and negotiating favorable payment terms with vendors.

- Increase fundraising efforts: Nonprofits can increase their working capital by raising more funds through donations, grants, and other fundraising activities. This may include diversifying revenue streams, leveraging social media and online fundraising platforms, and building stronger relationships with donors.

- Reduce expenses: Nonprofits can increase their working capital by reducing unnecessary expenses and finding ways to operate more efficiently. This may include consolidating administrative functions, negotiating better prices with vendors, and exploring cost-saving measures such as energy efficiency upgrades.

- Consider short-term borrowing: Nonprofits may consider short-term borrowing options, such as lines of credit or bridge loans, to bridge any temporary gaps in cash flow. However, it's important to carefully weigh the costs and risks of borrowing against the potential benefits.

- Optimize inventory management: If your nonprofit maintains inventory, you can optimize inventory management to reduce excess inventory and improve cash flow. This may include setting up an inventory tracking system, renegotiating terms with suppliers, and reducing lead times.

By implementing these strategies, nonprofits can improve their working capital ratio and increase their financial sustainability. It's important to work closely with a financial advisor to develop a comprehensive plan that aligns with your nonprofit's mission and long-term goals.

What Are Nonprofit Business Loans?

Nonprofit business loans are loans designed specifically for nonprofit organizations to help them finance their operations and projects. These loans typically have lower interest rates and longer repayment terms compared to traditional business loans, and may also come with more flexible repayment terms and fewer requirements for collateral.

Nonprofit business loans can be used to fund a wide range of activities, including:

- Capital expenses: Nonprofits can use loans to finance capital expenses, such as purchasing or renovating a facility, buying equipment, or investing in technology upgrades.

- Program expansion: Loans can help nonprofits expand their programs, launch new initiatives, or increase their capacity to serve their communities.

- Cash flow management: Nonprofits can use loans to manage cash flow challenges or bridge funding gaps between grants or donations.

- Debt consolidation: Nonprofits can use loans to consolidate high-interest debt into a single, lower-interest loan, which can help improve their cash flow and reduce their overall debt burden.

There are several organizations that offer nonprofit business loans, including community development financial institutions (CDFIs), nonprofit lenders, and socially responsible banks. Nonprofits may also be eligible for government-backed loans or grants, depending on their location and type of operation.

Before applying for a working capital business loan for a nonprofit, it's important for nonprofit leaders to assess their organization's financial needs and capacity to repay the loan. It's also important to compare loan options and work with a financial advisor to ensure that the loan aligns with the nonprofit's long-term goals and mission.

Do Nonprofits Need Collateral?

When it comes to loans, especially traditional ones like banks, nonprofit organizations will need to have collateral. This could be in the form of physical assets or cash reserves the nonprofit owns, or an asset that a donor pledges.

What Are the Average Interest Rates of Nonprofit Business Loans?

The interest rate on a loan depends on the type of lender you get your loan from. In general, bank rates are in the low single digits, while online lenders tend to charge higher interest rates.

Online business loans and financing: 7% to 100%

SBA loans: 5.5% to 11.25%

What Do You Need to Apply For a Nonprofit Loan?

Because of their fluctuating financial nature, getting loans approved for nonprofit organizations is much more challenging than for-profit businesses. Key information you'll need to provide when applying for a loan is recent, accurate financial information about the organization, a plan for the amount and use of the funds, and a repayment plan. Be prepared to answer questions about your organization’s cash flow and management.

What to Consider Before Applying For a Nonprofit Business Loan?

Before applying for a nonprofit business loan, there are several factors to consider to ensure that the loan aligns with the organization's financial goals and long-term sustainability. Here are some key considerations:

- Financial health: Nonprofits should assess their financial health and determine whether they have the capacity to repay the loan. This includes reviewing their current cash flow, debt-to-equity ratio, and credit score.

- Loan purpose: Nonprofits should have a clear understanding of how they plan to use the loan funds and how it aligns with their mission and long-term goals.

- Loan terms: Nonprofits should carefully review the loan terms, including interest rates, repayment terms, fees, and any restrictions or requirements.

- Loan options: Nonprofits should research different loan options and compare them to determine which loan best fits their needs. This may include considering nonprofit-specific lenders, community development financial institutions (CDFIs), socially responsible banks, or government-backed loans.

- Collateral: Nonprofits should consider whether the lender requires collateral and whether they have the assets to secure the loan.

- Risks and benefits: Nonprofits should weigh the risks and benefits of taking on debt, including the potential impact on their credit rating, the cost of borrowing, and the potential impact on their ability to secure future funding.

- Sustainability: Nonprofits should consider how the loan fits into their overall financial sustainability plan and whether it aligns with their long-term goals.

Before applying for a nonprofit business loan, it's important for nonprofits to work closely with a financial advisor and legal counsel to ensure that the loan aligns with their financial goals and mission.

Alternative Nonprofit Funding Options

In addition to nonprofit business loans, there are several alternative funding options that nonprofits can explore to support their operations and projects. Here are some examples:

- Grants: Nonprofits can apply for grants from foundations, corporations, and government agencies. These grants typically do not need to be repaid, but require a competitive application process and may have specific requirements for how the funds can be used.

- Donations: Nonprofits can solicit donations from individuals, corporations, and other organizations. This may include one-time or recurring donations, as well as major gifts or planned giving.

- Crowdfunding: Nonprofits can use crowdfunding platforms to raise funds for specific projects or initiatives. This involves soliciting small donations from a large number of individuals through online platforms.

- Social enterprise: Nonprofits can generate revenue through social enterprise ventures, such as selling products or services, or by investing in socially responsible companies.

- Corporate partnerships: Nonprofits can form partnerships with corporations to secure funding or in-kind support. This may include cause-related marketing campaigns, employee giving programs, or sponsorships.

- Impact investing: Nonprofits can attract funding from impact investors, who are interested in investing in organizations that generate social or environmental impact in addition to financial returns.

- Peer-to-peer lending: Nonprofits can explore peer-to-peer lending platforms, which allow individuals to lend money directly to nonprofit organizations in need of funding.

It's important for nonprofits to carefully consider the pros and cons of each funding option and to choose the option that best aligns with their mission and financial goals.

Nonprofits should also work closely with financial advisors and legal counsel to ensure that they are in compliance with any regulations or requirements related to their funding sources.

Organizations Helping In Nonprofit Financial Management

Nonprofit financial management can be complex, and many nonprofit organizations may not have the internal resources or expertise to manage their finances effectively. Fortunately, there are several organizations that provide support and resources to help nonprofits with financial management. Here are some examples:

- Nonprofit Finance Fund (NFF): NFF is a community development financial institution that provides loans, consulting, and other resources to nonprofit organizations. They also offer educational resources and trainings on financial management.

- BoardSource: BoardSource is a nonprofit organization that provides training and resources to nonprofit board members and executives. Their resources include guidance on financial management best practices, board governance, and strategic planning.

- National Council of Nonprofits: The National Council of Nonprofits is a network of state and regional nonprofit associations that provides advocacy, resources, and education to nonprofit organizations. They offer a range of resources on financial management, including templates, guides, and webinars.

- Financial Management Association for Nonprofits (FMA): FMA is a professional association that provides training, certification, and consulting services to nonprofit organizations. Their resources include financial management training and certification programs, as well as consulting services to help nonprofits with financial planning and analysis.

- Nonprofit Association of the Midlands (NAM): NAM is a nonprofit organization that serves as a resource and advocacy center for nonprofits in Nebraska. They offer a range of resources on financial management, including workshops, webinars, and technical assistance.

- Certified Public Accountants (CPAs): CPAs who specialize in nonprofit accounting can provide valuable support and expertise to nonprofit organizations. They can help with financial planning, audits, tax compliance, and other financial management issues.

These organizations can provide valuable support and resources to help nonprofit organizations with financial management. Nonprofits should research and explore the resources available to them to ensure they are managing their finances effectively and efficiently.

How Technology Can Help Nonprofits Manage Working Capital

Technology can play a vital role in helping nonprofits manage their working capital effectively. Here are some ways technology can help:

- Cloud-based accounting software: Cloud-based accounting software such as QuickBooks, Xero, or Wave can help nonprofits automate financial reporting and tracking of expenses and income. This software can provide real-time access to financial information, making it easier to track cash flow and budget effectively.

- Payment processing tools: Payment processing tools such as PayPal, Stripe, and Square can help nonprofits receive payments quickly and securely. These tools can also help reduce administrative costs and errors associated with processing checks and cash.

- Donor management software: Donor management software such as DonorPerfect, Bloomerang, or NeonCRM can help nonprofits manage their relationships with donors effectively. These tools can track donor history, manage donations, and create targeted fundraising campaigns.

- Budgeting and forecasting tools: Budgeting and forecasting tools such as Budget Maestro, Adaptive Insights, or Planful can help nonprofits create and manage their budgets effectively. These tools can also provide real-time financial insights, allowing nonprofits to make informed decisions quickly.

- Fundraising platforms: Fundraising platforms such as GoFundMe, Kickstarter, or Indiegogo can help nonprofits raise money quickly and effectively. These platforms can also help nonprofits reach a wider audience and generate greater visibility for their cause.

- Inventory management software: Inventory management software such as Unleashed, TradeGecko, or Cin7 can help nonprofits manage their inventory more efficiently. These tools can track inventory levels, automate reordering, and provide real-time reporting on inventory levels and costs.

Overall, technology can help nonprofits manage their working capital more effectively by providing real-time visibility into financial data, reducing administrative costs and errors, and automating key financial processes. By using technology, nonprofits can make better-informed decisions, optimize their cash flow, and focus on their core mission.

Strategies for Improving Nonprofit Fundraising

Nonprofit organizations rely on fundraising to support their mission and programs. However, competition for donor dollars is fierce, and it can be challenging for nonprofits to stand out and raise enough funds to sustain their operations. Here are some strategies for improving nonprofit fundraising:

- Develop a clear and compelling message: Nonprofits need to have a clear and compelling message that resonates with donors. The message should be concise, compelling, and highlight the impact the nonprofit is making in the community. This message should be incorporated into all fundraising efforts, including donation pages, fundraising campaigns, and social media.

- Leverage social media: Social media can be a powerful tool for nonprofits to reach a wider audience and engage with donors. Nonprofits should leverage social media platforms such as Facebook, Instagram, and Twitter to share their message, highlight their impact, and engage with donors. Nonprofits can also use social media to promote fundraising campaigns and events.

- Focus on donor retention: Donor retention is critical for nonprofits to sustain their operations. Nonprofits should focus on building relationships with their donors and making them feel appreciated. This can be done through personalized thank-you notes, regular updates on the impact of their donations, and invitations to events and volunteer opportunities.

- Host fundraising events: Fundraising events can be a fun and engaging way to raise funds for nonprofits. Events can range from auctions, galas, and walk-a-thons to bake sales and yard sales. Nonprofits should leverage their networks and community partnerships to host successful fundraising events.

- Leverage corporate partnerships: Corporate partnerships can be a valuable source of funding for nonprofits. Nonprofits should identify businesses that align with their mission and values and develop partnerships that can provide financial support, volunteers, and other resources.

- Provide giving options: Nonprofits should provide donors with various giving options, such as monthly donations, one-time donations, and legacy gifts. This can make it easier for donors to give and support the nonprofit in a way that works best for them.

- Invest in fundraising infrastructure: Nonprofits should invest in their fundraising infrastructure, such as donor management systems and fundraising software. These tools can help nonprofits track donations, manage donor relationships, and streamline fundraising processes.

Improving nonprofit fundraising requires a strategic approach that focuses on building relationships with donors, leveraging social media, hosting events, and investing in fundraising infrastructure. By implementing these strategies, nonprofits can increase their visibility, engage with donors, and raise the funds they need to support their mission and programs.

Final Word

In summary, managing working capital effectively is crucial for nonprofit organizations to sustain their operations and achieve their mission. Technology can play a vital role in helping nonprofits manage their working capital effectively, by automating financial reporting, tracking expenses, managing donors, and fundraising.