Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses, or reviews expressed in this article are those of the author’s alone, and have not been approved or endorsed by any partner.

American Express® Business Line of Credit Reviews & User Insights

American Express® Business Line of Credit is suitable for small businesses seeking straightforward access to capital without a lengthy application process. They are ideal for cyclical businesses that need funds during periods when business is slow. Startups and small businesses have much to gain from the American Express® Business Line of Credit.

The information on this page has not been updated since September 13th 2023

Our Verdict

A line of credit is the only type of business loan American Express Business BlueprintTM program offers right now. The major strength of American Express® Business Line of Credit is their convenient application process. Not only can you get through the application in a matter of minutes, but, once you get approved, you can expect to receive the funds in a timely manner. Moreover, American Express Business Line of Credit has a minimum FICO score requirement of at least 660 at the time of application. The required FICO score may be higher based on your relationship with American Express, credit history, and other factors. However, all businesses are unique and are subject to approval and review.

In this review, our team of expert reviewers has thoroughly analyzed and evaluated American Express Business Line of Credit. We will share our findings and provide our expert insights on why American Express Business Line of Credit is one of the best small business loans out there.

American Express® Business Line of Credit Reviews - What People Say Online

Most customer reviews highlight American Express® Business Line of Credit’s ease of use, flexible access, and helpful service team. However, if you take a closer look at the customer service ratings on Trustpilot and Consumer Affairs, you’ll notice a few interesting things.

Understanding Review Discrepancies

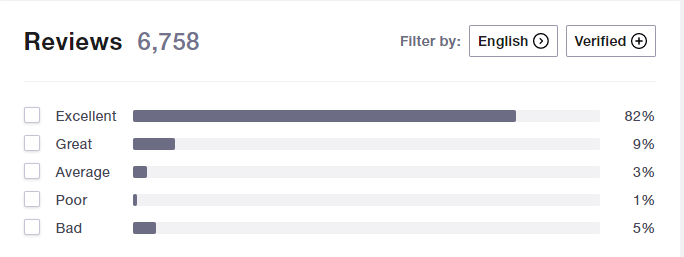

American Express Business Line of Credit has great reviews on Trustpilot based on automated invitations that the company sends out to its customers. Specifically, 82% of these come back as “excellent,” and only a few stated otherwise.

However, the picture is completely different with organic reviews, where a customer submits the review on their own. Among organic reviews, 93% of customers rate their American Express Business Line of Credit experience as “bad.”

While this does create a huge disparity with reviews from automated invitations, it is important to note that organic reviews are typically driven by people who wish to complain. As such, you can expect more negative ratings rather than positive ones.

While American Express Business Line of Credit does receive positive reviews, the majority of them are negative. However, most of the negative feedback is related to American Express Business BlueprintTM banking side and not their business line of credit product.

Trustpilot Rating

American Express® Business Line of Credit is rated 307 out of 324 of the financial companies in the Financial Consultant category of Trustpilot. It is also rated 200 out of 207 best companies within the category of Non-Bank Financial Service.

While these numbers aren’t great, it is important to always use your own judgment when evaluating alternative lending sources. American Express Business Line of Credit is still in the process of gaining momentum, and they might offer just the right solution for your small business.

Summarized Ratings

This parameter considers loan terms, repayment optionality, and loan limits. For each financing arrangement offered, each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

American Express Business Line of Credit gets a 3.0 for Loan Features. This slightly below average score reflects competitive loan terms (up to 18 months), a flexible monthly repayment option, but low loan limits (< $250K).

What is American Express® Business Line of Credit?

American Express Business BlueprintTM hosts the American Express® Business Line of Credit product. It uses an automated application process to provide loans in a timely manner to qualifying candidates.

Small businesses from a variety of industries can typically get a response to their loan application after applying online in a few simple steps. However, the ease of access might mean higher interest rates and a personal guarantee. The business line of credit from American Express ranges from $2,000 to $250,000.

American Express® Business Line of Credit Pros and Cons

Pros

Cons

American Express® Business Line of Credit Loan Features

American Express Business Line of Credit ranges from $2,000 to $250,000, with six, 12, or 18-month terms. American Express Business Line of Credit also provides a host of analytical features with dashboards and payment processing facilities. You need to sign a personal guarantee, but you do not have to supply any collateral for the line of credit.

As an unsecured loan, business lines of credit provide borrowers with a set limit of funds to draw against as needed. You pay interest only on the open balance and there are no prepayment penalties. Lines of credit are paid back within six, 12, or 18 months.

| Term Length | 6, 12, or 18 months |

| Repayment Period | Monthly |

| Min-max Amount | $2,000 to $250,000 |

American Express® Business Line of Credit Interest Rates And Fees

Loan amounts range between $2,000 and $250,000, with available loan payback periods of six, 12, and 18 months. Instead of charging a regular interest rate, American Express Business Line of Credit charges a fee each month based on your outstanding balance. Each month, you’ll make your principal payment along with this fee.

For six-month terms, fees range from 3-9%; 12-month terms range from 6-18%; and 18-month terms range from 9-27%.

| Origination Fees | None |

| Prepayment Fees | None |

| Late Payment Fees | Late fees may be assessed |

| Monthly Fee | Six-month term: 3-9% 12-month term: 6-18% 18-month term: 9-27% |

American Express® Business Line of Credit Loan Eligibility Requirements

To qualify for a American Express Business Line of Credit, the company is going to take a close look at your monthly business revenue, your length in business, and your credit history. The minimum requirements are outlined below.

| Minimum Credit Score | Minimum FICO score of at least 660 at the time of application |

| Average Monthly Revenue | Average monthly revenue of at least $3,000 |

| Minimum Time in Business | Have started your business at least a year ago |

American Express Business Line of Credit performs a hard credit inquiry during the preapproval process, whereas other lenders wait to do a hard credit pull once you’ve already been prequalified for the loan. This is something to keep in mind if you plan on shopping around for your loan.

American Express® Business Line of Credit Application Process

1. Provide Personal and Business Information

Applying for a American Express Business Line of Credit can be completed in just 10 minutes. Simply fill out your name, Social Security number, business name and industry, address and phone numbers, and your business ID. Next, you’ll consent to a hard credit inquiry and wait for a funding decision. If additional information is required, it may take longer to get a final decision.

2. Link Your Bank Account

At the end of the application, you’ll be asked to link your business bank account. This is done for two reasons: (1) This is where your funds will arrive if approved for the loan, and (2) This is where loan repayments will be made.

Linking your bank account is often the case with any alternative lending source, as it ensures fast and convenient services while protecting the lending companies themselves.

How American Express® Business Line of Credit Determines Loan Amount

During the application stage, the representatives at American Express Business Line of Credit perform a hard pull on your credit. While the minimum FICO score is at least 660* at the time of application, they will also examine your credit history to determine your risk and verify your identity.

As mentioned earlier, American Express might also ask for additional information to offer you a more significant credit line. American Express will examine your transaction volume, monthly revenue, and credit score to determine whether you qualify for a loan and how much should be sanctioned to you. It also considers the loan term you’re applying for.

Your chances of approval also depend on whether the term lasts for six, 12, or 18 months. Six-month loans are the most common, and the rates vary depending on the month. If approved, you can request an American Express Credit card directly from your credit line.

American Express® Business Line of Credit Customer Support

- Help Center: You can use the American Express Business Line of Credit help center at any time to find answers to your questions. It contains a wealth of information about applying for funding, making repayments, funding fees, and more.

- Phone & Email Support: If you’d like to speak to a customer service representative, you can reach out to American Express at 888-986-8263 M-F from 8 am to 9 pm EST.

There are mixed reviews about American Express Business Line of Credit customer support, with many complaining about long response times. Others, though, praise the American Express customer service experience and have no complaints regarding wait times.

American Express® Business Line of Credit Perks and Bonuses

Flexibility

American Express states that it will work with you in times of hardship to determine a solution. The lender recommends you contact them right away if you find yourself struggling to repay your loan.

Transparency

The American Express website is professional and transparent. It outlines the benefits of its business loans and offers a “Get Started” button that prompts you to create an account so you can apply for funding. In addition, the website explains how its fee structure works and features a list of frequently asked questions.

Technology

When you commit to an American Express Business Line of Credit, you automatically enroll in Autopay so the lender can withdraw your repayment each month on your due date, making paying back your loan convenient.

With the American Express Business Line of Credit app, you easily apply for funds and can get approved in a timely manner. You may also use the app to withdraw the amount of money you need and keep tabs on your account while you’re on the go.

American Express® Business Line of Credit Alternatives

Fundbox

Fundbox is an alternative lender to American Express Business Line of Credit if you’re looking for a term loan or business line of credit. Fundbox offers both, with amounts ranging from $1,000 to $150,000. Rates start at 4.66% for lines of credit and 8.33% for term loans. Payments are made weekly, and Fundbox does not charge any origination, maintenance, or prepayment fees.

To qualify for a short-term loan or line of credit from Fundbox, you’ll need to have a minimum FICO score of 600, be in business for six months, and have an annual revenue of $100,000 or more. American Express Business Line of Creditrequires one year in business, so if your business is relatively new, Fundbox could be worth considering.

Learn more about how these lenders compare in our American Express Business Line of Credit vs. Fundbox review

Bluevine

Bluevine is another good, alternative option to American Express Business Line of Credit. Loan amounts are the same ($2,000-$250,000) and like American Express Business Line of Credit, Bluevine only offers a business line of credit. Rates start at 4.8% and are made weekly or monthly over six or 12 months. If you’re in need of a longer loan term, American Express Business Line of Credit does offer 18-month terms so that is something to consider.

Bluevine has a streamlined online application and you’ll get a funding decision within just five minutes of applying. If approved, your funds can be in your account in as fast as 24 hours. Qualifications include a minimum credit score of 625, six months in business, and $10,000 in monthly revenue.

Learn more about how these lenders compare in our American Express Business Line of Credit vs. Bluevine review.

Additional Alternatives

| Lender | Loan Amount | Interest Rates | Min. time in business | Min. Revenue |

| Biz2Credit | $25K - $6 million | Starting at 7.99% | 6 months | $250K |

| Credibly | Up to $400K | Starting at 6.99% | 2 years | $100K |

| OnDeck | $6k - $250K | Varies | 1 year | $100,000 |

Final Thoughts

American Express Business Line of Credit small business lines of credit work best for stable businesses who need quick funding and are able to pay it back fast. American Express Business Line of Credits monthly fees can be high, so if you can’t pay the loan off quickly, it may be best to look elsewhere. However, if you can manage the cash flow quickly, this could present a great lending source.

Frequently Asked Questions(FAQ)

This app literally changed my like. It provides a great experience. I absolutely love it!