Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

Upstart Business Loans: 2024 Review & User Insights

Upstart business loans offer quick funding without hidden fees. Borrowers have great things to say about Upstart on third-party review sites, and the company is open to fair and bad credit borrowers, making it a great option for a wide range of business owners.

Expert Reviewer Verdict

Upstart is a straightforward and fast funding solution for businesses that have been registered for at least 12 months. The lending marketplace is an especially good option for businesses that struggle with fair or bad credit and may be turned down elsewhere.

You’ve got nothing to lose by checking your rate, but you should compare Upstart’s rate and term with options from other lenders. Keep in mind is that Upstart is relatively inflexible during times of hardship, and you can’t change your due date, so you should ensure your business can handle the fixed monthly payments before formally applying.

Summarized Ratings

This parameter considers loan terms, repayment optionality, and loan limits. For each financing arrangement offered, each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

Upstart scores a subpar 2.3 for Loan Features, which is reflective of its relatively low loan limits and terms.

Upstart Business Loans Review Video

Our small business loan expert provides an in-depth analysis, including pros and cons of Upstart's small business loans.

What Is Upstart Business Loans?

Upstart is an artificial intelligence lending marketplace that provides a variety of loan types through its lending partners. Upstart business loans are designed for small businesses that have been established for 12 months or longer.

The company uses a nontraditional evaluation process that allows some fair and bad credit borrowers to qualify. Most loans are fully automated, and funds are delivered within one business day. The funds can be used to help with purchasing inventory, hiring employees, and more.

Upstart Business Loans Pros and Cons

Pros

Cons

Upstart Business Loans Features

You can borrow between $5,000 and $200,000 from Upstart with a repayment term of one or two years. You’ll begin making your monthly fixed payments to Upstart’s lending partner approximately 20 to 40 days after the origination of your loan. Your promissory note will list your due date, and you won’t be able to change your due date, but you can schedule your monthly payment for anytime prior.

| Term length | 1 or 2 years |

| Repayment period | Repayment begins 20 to 40 days after origination |

| Min - Max amount | $5,000 to $200,000 |

Upstart Business Loans Interest Rates and Fees

Upstart doesn’t charge any hidden fees. The origination fee, which varies by applicant and will fall between 4% and 6% of the loan amount, is expressed in the APR, which is capped at 35.99%. There are no maintenance fees, and you can pay your loan off early without incurring any fees.

The only other fee you could be responsible for is a late payment fee. If you’re more than 15 days past due, you’ll be charged the greater of 5% of the past due amount or $15.

| Origination Fees | 4% to 6% |

| Prepayment Fees | None |

| Late Payment Fees | $15 or 5% of past due amount |

| Maintenance Fees | None |

| Interest Rates (APR) | Up to 35.99% |

Upstart Business Loans Qualification Requirements

New and unregistered businesses are not eligible for Upstart business loans, and neither are sole proprietorships or nonprofits. Your business will need to have been registered as an LLC, LLP, S-Corp, or C-Corp for at least 12 months, and you’ll need to supply your EIN number when applying.

Upstart doesn’t specify minimum revenue requirements, but you will need to supply a source of revenue, which will be evaluated when determining the amount you qualify for. Upstart also requires a minimum credit score of 550.

| Minimum Credit Score | 550 |

| Minimum Annual Revenue | Not Disclosed |

| Minimum Time in Business | 12 months |

| Other requirements | Registered as LLC, LLP, S-Corp, or C-Corp and have an IRS EIN number |

Upstart Business Loans Application Process

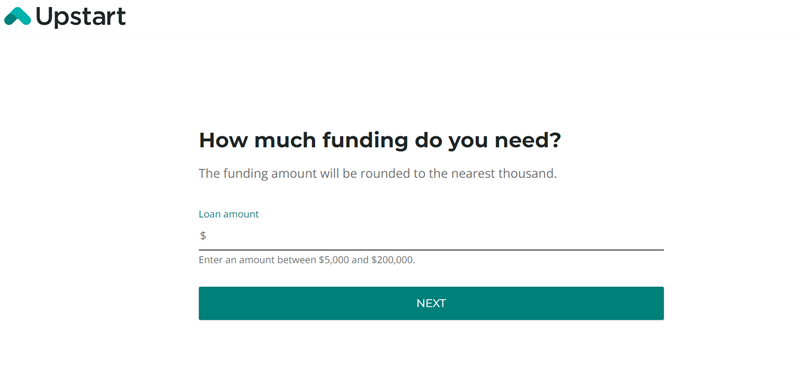

Step 1

Start by clicking “Check Your Rate” on Upstart’s business lending page. You’ll first enter the amount you’re looking to borrow.

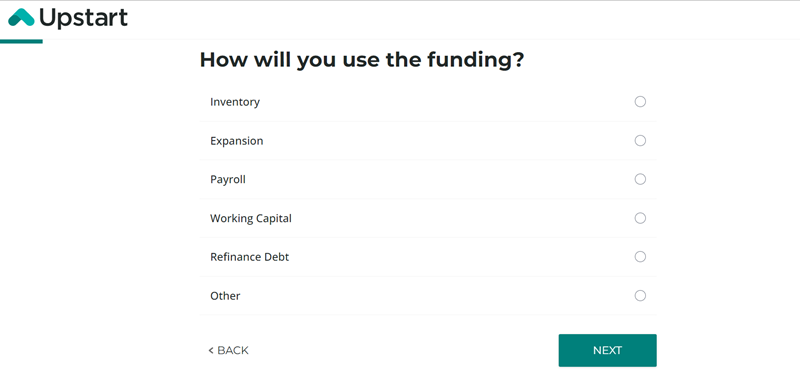

Step 2

On the next page, you’ll indicate what you’re using the money for. If none of the choices fit your needs, you can select “other.”

Step 3

You’ll then enter details about your business, such as your legal business name and address. You’ll also connect your bank account using Plaid. Upstart uses only an initial soft inquiry when providing your rate, so getting a quote won’t hurt your credit. Follow the prompts until you reach your quote.

Step 4

If you’re happy with the estimated APR, continue with your application. Once you accept your rate, Upstart will conduct a hard inquiry, which will cause a small dip in your credit score.

Step 5

You may need to upload additional documents for verification. More than half of applicants will receive an instant decision, but some may be asked to substantiate their revenue source or submit a bank signature card or other documents.

Step 6

Once you receive your final rate, approve your loan and sign your loan documents.

Step 7

If you sign by 5pm EST on a weekday that isn’t a holiday, your funds will be sent on the next business day.

Upstart Business Loans Customer Support

Upstart offers general support to customers from 9am to 8pm ET daily, including weekends. Payment support is available from 9am to 9pm on weekdays and from 9am to 7pm on Saturdays. You can reach customer support at 1-855-438-8788, or you can email support@upstart.com at any time.

Upstart Business Loans Online Reviews

Upstart is one of the most highly-reviewed loan providers on Trustpilot, with a 4.9 out of 5 star rating from more than 39,000 borrowers. Customers were pleased with the application process and funding time, and cited prompt communication from the customer service team. Borrowers felt they were able to make an informed decision with Upstart’s transparent funding options and that the rates were reasonable and fair.

However, Upstart received several negative reviews with the Better Business Bureau. Some people complained that Upstart required too many documents for approval. Others were unhappy that they were not approved for a loan, despite meeting minimum credit requirements. Many customers also faced financial hardship and were dissatisfied with Upstart’s inflexibility when repayment became unaffordable.

| The positive reviews are related to | The negative reviews are related to |

| Communicative customer service | Inflexibility with modifying payments for hardship |

| Easy application and quick funding | Stringent application requirements |

| Reasonable rates | Loan denials |

Upstart Business Loans Perks and Bonuses

Flexibility

Upstart is relatively inflexible when it comes to dealing with hardship or loan modification. While you can change your payment date, you can’t change your due date, and you’ll be charged a late fee if you schedule your payment for after your due date. There’s no formal hardship program, and Upstart reportedly does not allow you to defer or skip a payment if you’re experiencing hardship. You also can’t modify your loan terms. However, the company does state that they sometimes offer alternative payment plans that can help you avoid additional fees.

Transparency

Upstart is very transparent about its funding options and fees, something that customers say they appreciate in their online reviews. The company clearly outlines your loan options so you can assess what will fit your budget, and Upstart doesn’t charge any hidden fees or prepayment penalties. Furthermore, Upstart maintains an informative website with a help center and a variety of resources, including calculators to help you estimate your monthly payment.

Technology

Upstart leverages artificial intelligence technology to evaluate applicants based on more than just their credit scores and to provide a quick and efficient application process. Once you’re approved for a loan, you’ll have access to Upstart’s online dashboard, where you can manage your loan and set up automatic payments. While Upstart doesn’t have a mobile app, the company’s website is mobile-responsive, so you can manage your account on-the-go.

Upstart Business Loans Alternatives

National Funding

National Funding offers an online application with fast funding in as little as 24 hours and is well-reviewed on Trustpilot. The company also doesn’t charge prepayment penalties. However, National Funding also offers equipment financing, with a guarantee of lowest monthly payment, and provides more flexible terms and higher loan limits. You can also get a loan after only six months in business, but National Funding has stricter credit and revenue requirements than Upstart. And decisions aren’t instant — a specialist will call you once you’ve submitted your application to complete the process.

Learn more in our National Funding review

Fundbox

Like Upstart, Fundbox is well-reviewed on Trustpilot and offers a quick and easy application with fast funding as soon as the next business day. But unlike Upstart, which offers term loans with fixed monthly payments, Fundbox offers a business line of credit of up to $150,000. You’ll need a 600 credit score, 6 months in business, and $100,000 in annual revenue to qualify. You’ll be able to see fees upfront when you draw funds, and may even receive a three-day grace period for repayment.

Learn more in our Fundbox review

Final Thoughts

Upstart business loans are best for businesses that have been registered for a year or more and borrowers willing to personally guarantee the loan. Upstart is also open to fair and bad credit borrowers.

You can get a quote without hurting your credit score, and you can expect minimal paperwork and great customer service during the application process. Plus, there’s no penalty for paying your small business loan off early.