| All content presented here and elsewhere is solely intended for informational purposes only. The reader is required to seek professional counsel before beginning any legal or financial endeavor. |

Is equipment a current asset ? The answer is no and this is because a current asset is defined as something of value that will be converted or sold for cash within the first year of having purchased it. When a company does not plan to use, sell, or convert an item into cash within one year, it is classified as a non-current or long-term asset.

Benefits of Non-Current or Long Term Asset Equipment

Many benefits are associated with noncurrent or long-term asset equipment. It enables firms to spread the expense of the equipment across a number of years and take advantage of the accompanying tax benefits.

Lower up-front expenses: Non-current or long-term asset equipment enables firms to amortize the cost of the equipment over a number of years, minimizing the financial impact on the business.

Tax advantages: Depending on the type of asset, firms may be eligible for specific tax deductions that are exclusive to the use of non-current or long-term asset equipment.

Access to advanced technology: Non-current or long-term asset equipment enables organizations to get equipment that is more technologically advanced and of higher quality than what they could purchase outright.

Enhanced competitiveness: Staying abreast of the most recent technological advancements can help a business maintain a competitive edge in its field.

Reduced worry: By utilizing non-current or long-term asset equipment, firms can decrease the anxiety associated with sourcing and purchasing new equipment frequently.

Increased efficiency: Equipment that is a non-current or long-term asset can help firms boost their productivity by ensuring they have the proper tools and machines.

Increased dependability: High-quality, non-current, or long-term asset equipment is frequently more reliable than cheaper, short-term alternatives, resulting in fewer failures and repairs.

Reduced risk: Using non-current or long-term asset equipment reduces the risk of having to replace obsolete equipment with newer, more costly alternatives.

Understanding Equipment as a Non-Current or Long Term Asset

Noncurrent assets are those that are not anticipated to be used or converted into cash during the next year or operational cycle, and are often retained for an extended term. Equipment is often the most important noncurrent asset for firms, and its depreciation and amortization should be managed over time. It is essential to recognize that equipment might be tangible or intangible.

- Tangible vs Intangible Equipment: Tangible equipment is physical and can be seen, touched, and felt, however tracking intangible equipment is more difficult. It is essential for business owners to maintain accurate records of their intangible assets and tangible equipment. Moreover, intangible equipment may have a longer useful life than tangible equipment; therefore, business owners must be aware of the various depreciation rates for tangible and intangible equipment.

- Equipment is prone to depreciation: Due to wear and tear or becoming obsolete due to technological advances, the value of equipment will decline over time. You must monitor the depreciation of your equipment to maintain a positive return on investment. In addition, businesses that depreciate their equipment may be eligible for tax deductions, which can provide further financial benefits.

- Recording Equipment as an Asset in Accounting Records: It is essential to record the purchase of equipment as an asset on the balance sheet to ensure that the company accounts for the asset's cost accurately.

- Equipment amortization should also be managed: If the equipment acquisition is financed by a loan, the loan must be repaid over time, and the loan's interest must be recorded and controlled through amortization.

- Equipment should be maintained: To guarantee that the equipment retains its value and can be utilized for an extended period of time, it should be regularly maintained and serviced.

- Equipment should be insured: Equipment can be costly, therefore it is vital to insure it in case of damage or loss, and you should routinely examine your insurance to ensure that it still meets their needs.

- Equipment should be tracked over time: In order to monitor the asset's performance, it should be tracked and monitored over time to record any changes.

- Equipment should be classified accordingly: Equipment should be classed as either a tangible or an intangible asset, depending on its type wherever and whenever it is recorded.

- Equipment should be regularly updated: To ensure that the equipment is up-to-date and to avoid any potential problems, it should be updated regularly. In any case, it is an asset, and your assets reflect monetary value.

Examples of Tangible and Intangible Equipment Assets

Tangible Assets:

- Computer

- Printer

- Desk

- Chairs

- Telephone

- Copier

- Fax machine

- Camera

- Cash register

- Vehicle

Intangible Assets:

- Software

- Website

- Database

- Patent

- Trademark

- Copyright

- Licenses

- Customer list

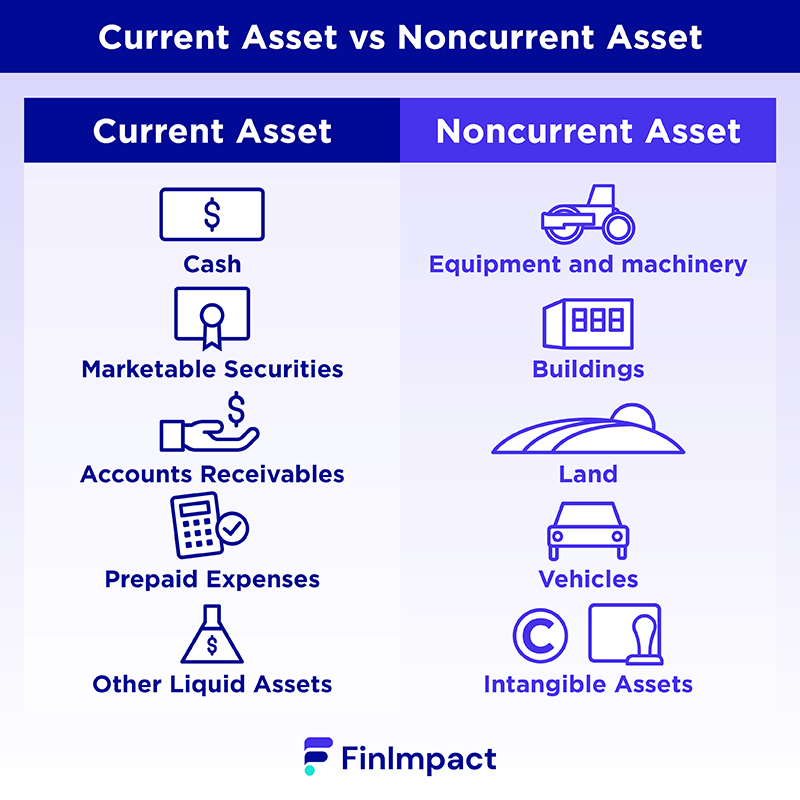

What Qualifies as a Current Asset?

Here are several examples of current assets your business may own.

Cash: This is the most liquid current asset category and includes all cash on hand, checking accounts, and savings accounts.

Marketable securities: Marketable securities are short-term securities you can sell quickly for stocks or bonds without any loss in value.

Accounts receivables: Accounts receivables are funds your customers owe for any purchases they made on credit - like equipment lines of credit or loans. Not collecting accounts receivables can lead to a bad credit score for your business.

Inventory: Inventory refers to items your business plans to sell for profit within the next year.

Prepaid expenses: These are advanced payments your customers made for goods and services they’ll receive in the future.

Other liquid assets: Other liquid assets can be converted into cash within one year but don’t fall into any of the categories above, such as office supplies.

Accounting for Non-Current or Long Term Assets

Accounting for noncurrent or long-term assets is a crucial aspect of financial statement preparation. Noncurrent assets are property, plant, and equipment with a useful life of more than one year. These assets must be recognized, measured, and disclosed in line with generally accepted accounting principles.

The following are practical accounting standards for noncurrent assets:

- Recognize noncurrent assets upon acquisition and record the asset's cost. This guarantees that all costs are recorded and accounted for appropriately.

- Ascertain the asset's fair worth upon acquisition. This is done to guarantee that the asset's actual value is recorded.

- Examine the carrying value of the asset at the end of each reporting period. This ensures that the asset is neither over- nor undervalued, and that the financial statements appropriately reflect the asset's genuine value.

- The noncurrent asset should be disclosed in the notes to the financial statements. This is done to ensure that users of the financial statements fully comprehend the asset and its value.

- Observe the asset for any changes in its condition or value. This ensures that the asset is neither undervalued nor overvalued.

- Document any asset impairment losses that may arise. An impairment loss is incurred when an asset's carrying value exceeds its recoverable value.

- Record any earnings or losses resulting from the asset's sale. This is done so that the gain or loss from the asset's sale is accurately shown in the financial accounts.

- Input any depreciation or amortization costs related to the asset. This ensures that the cost of the item is assigned to the accounting periods during which it is utilized.

- Make any required adjustments to ensure the item is reported at its true value. This ensures that the asset's genuine value is appropriately reflected in the financial accounts.

How To Evaluate Non-Current or Long Term Assets

Assessing non-current or long-term equipment assets involves determining the worth of business-owned equipment that has been in use for more than a year. The evaluation process assists in determining whether the equipment is still useful to the firm and whether it should be retained, sold, or discarded.

To appropriately appraise the equipment, the company must examine the cost of acquisition, the present market value, the cost of maintenance, and the asset's future potential usage.

Get a professional appraisal: To obtain an accurate evaluation of the asset, it is essential to locate a professional appraiser with expertise in the sort of equipment being appraised.

Understand the cost of acquisition: You should be aware of the amount spent for the item, as this will be factored into its evaluation.

Consider the current market value: While determining the value of the asset, the current market value of the equipment should be considered.

Evaluate the cost of maintenance: The cost of maintaining the asset, such as the cost of components and labor, must be considered in order to make an accurate assessment of the equipment.

Determine future potential: Consider the possibility of changes in the industry that could affect the value of the equipment when determining the future possible usage of the asset.

Evaluate the equipment's condition: The equipment's condition should be considered when determining the asset's value, as it will help to determine the asset's worth.

Develop a suitable depreciation rate: Setting a suitable depreciation rate is essential, as it enables an accurate assessment of the asset's current worth.

How To Depreciate Non-Current Equipment Assets

Depreciation is a method of allocating the cost of a non-current asset over the item's useful life. It is a method of calculating the cost of a long-term asset, such as equipment, furnishings, and supplies, throughout the course of its useful life.

Equipment depreciation is calculated as follows:

Depreciation = (Cost - Salvage Value) / Useful Life

This allows firms to deduct the asset's cost over the asset's useful life and spread the deductions over multiple tax returns.

- Estimate the useful life of the asset: This is the estimated period of time that the asset can be used for the purpose for which it was obtained.

- Compute the asset's salvage value: Which is its projected residual worth at the end of its useful life.

- Record the asset's cost: This is the asset's cost at the time of acquisition.

- Monitor the depreciation expense: This is the periodic expense reported to account for the reduction in the asset's value over its useful life.