Startup business credit cards are designed to help startups cover a variety of business expenses, for example, office supplies, inventory, and travel. Also, by using a startup credit card, your personal money and other funds will be free to be used for other purposes. As long as you use the card, responsibly, you can also save on financing fees.

Key Points:

- Startup business credit cards can be used to pay for a number of business expenses, such as office supplies, utilities, and marketing costs.

- Since there is no shortage of startup cards on the market, it’s important to shop around and explore all your options.

- While most startup business credit cards require good to excellent credit, there are cards available for startups with fair or poor credit.

What is a Startup Business Credit Card, and How Does It Work?

A startup business credit card is similar to a personal credit card. A company lends you money, up to a set credit limit. Then, you will need to pay it back at some point in the future with interest, which is the cost to borrow money.

While a personal credit card is intended for personal expenses, a startup business credit card can help you cover expenses that will allow you to launch or grow your startup. It can be a great way to keep your personal finances separate from your business finances so you’ll have an easier time filing your taxes.

In addition, you may use a startup business credit card as a credit building tool. If you repay your balance in full at the end of every billing cycle, your credit score will slowly but surely increase. You may also be able to score valuable rewards like cash back and travel points.

What are the eligibility requirements?

Each startup business credit card has its own eligibility criteria. However, most credit card issuers will look at your personal credit to determine whether to approve your application. While a credit score of 700 or higher is ideal, rest assured there are options for lower credit scores.

If you have fair credit or poor credit, you may get approved for a secured credit card, which requires a refundable deposit, a traditional credit card with a lower credit limit or higher interest rate. As you make consistent timely payments and position yourself as a responsible borrower, you may earn a credit limit increase or lower rate.

To approve you for a startup business credit card, most issuers will also ask for a personal guarantee. A personal guarantee states that if your startup is unable to pay your credit card, the issuer has the legal right to sue you and possess your personal money. Essentially, a personal guarantee makes you personally responsible for your startup credit card payments in the event of default.

List of Startup Business Credit Cards

As you shop around for startup business credit cards, here are some options you may come across.

- Ink Business Unlimited Credit Card: The Ink Business Unlimited Credit Card offers unlimited 1.5% cash back on every purchase. You can redeem points for statement credits, gift cards, or travel perks. Plus there’s no annual fee and a $750 welcome offer you can receive after you spend $7,500 on purchases in the first three months of opening your account. Good credit is required.

- American Express Blue Business Cash Card: With the American Express Blue Business Cash Card, which requires good to excellent credit, you can enjoy 2% cash back on eligible purchases of up to $50,000 per calendar year, then 1% cash back. You won’t have to pay an annual fee and may earn a $250 statement credit after you make $3,000 in purchases within the first three months of opening your account.

- American Express Business Gold Card: The American Express Business Gold Card will reward you with 4 points per dollar on eligible expenses categories during each billing cycle. There is a $295 annual fee but you can redeem your points for flights and hotels booked through American Travel. Also, if you spend $10,000 on eligible purchases within the first three months of opening your account, you may lock in 70,000 points. You’ll need good to excellent credit to get approved.

- Brex 30 Card: Unlike other startup business credit cards, the Brex 30 Card does not require a personal guarantee. Instead it evaluates your available liquid capital and company spend. You can earn 1 point per dollar you spend on everyday purchases and bonus rewards on a variety of categories. You can transfer your points to a partner airline and enjoy free or discounted flights. There is no annual fee.

- Capital One Spark Cash Select: The Capital One Spark Cash Select offers unlimited 1.5% cash back on every purchase plus 5% cash back on hotels and rental cars booked through Capital One Travel. It doesn’t charge an annual fee and there are no limits or category restrictions. Excellent credit is required.

- Ramp Card: The Ramp card will reward you with 1.5% cash back on every purchase and provide discounts on goods and services from companies like Amazon Web Services and Slack. It uses special technology to go over your expenses and find areas where you can save. Instead of a personal guarantee, Ramp requires you to have at least $75,000 in your business bank account.

- U.S. Bank Business Triple Cash Rewards World Elite Mastercard: The U.S. Bank Business Triple Cash Rewards World Elite Mastercard offers 3% cash back on eligible purchases and 1% cash back everywhere else. There’s no annual fee and the rewards never expire. A personal credit score of at least 670 is preferred.

- SVB Innovators Card: Issued by Silicon Valley Bank, the SVB Innovators Card is a charge card, meaning there’s no APR because your balance is due in full every month. You can enjoy unlimited 2x points per dollar on every purchase without an annual fee. While a personal guarantee isn’t required, excellent credit is recommended.

- IHG Rewards Premier Business Credit Card: If you travel a lot and stay at IHG Properties, like the Holiday Inn, Intercontinental, and Crown Plaza, the IHG Rewards Premier Business Credit Card is worth exploring. In exchange for a $99 annual fee, you’ll get 10 points per dollar at IHG Hotels and Resorts as an IHG® Rewards Club Premier Credit Card member, 5 points per dollar on travel, dining, select business, and at gas stations, and 3 points per dollar on all other purchases. This card requires good credit for approval.

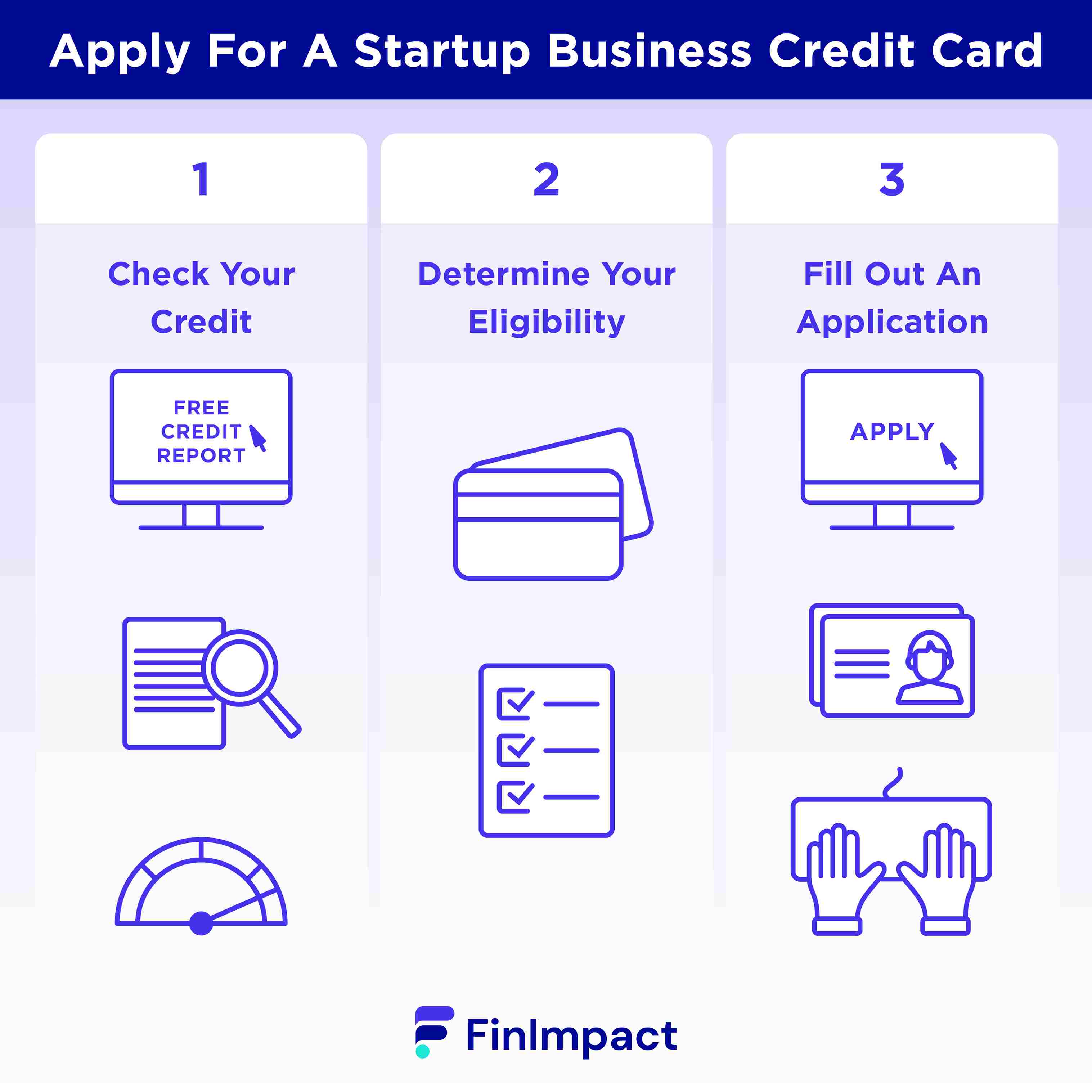

How To Apply For A Startup Business Credit Card?

If you’re interested in a startup business credit card, here’s what you will need to do to apply.

- Check Your Credit: It’s important to know where you stand credit wise before you apply. Check your personal credit score on a website that offers free credit reporting. You can also go to AnnualCreditReport.com to pull free copies of your reports from each major credit bureau.

- Determine Your Eligibility: Next, make sure you understand the eligibility criteria of the startup card you’d like to apply for. You will likely need a certain credit score and/or personal guarantee to get approved.

- Fill Out the Application: Most credit card issuers will allow you to apply for a startup card online. When you do so, be prepared so submit the following information:

- Business name, address, and phone number

- Business type and industry

- Legal business structure

- Federal identification number (EIN or SSN)

- Number of employees

- Annual business revenue

How Can I Use A Startup Business Credit Card?

Just like a personal credit card, a startup business credit card is versatile, meaning you can use it to cover a variety of business expenses, such as:

Keep in mind that most credit card issuers will not allow you to use a startup business credit card on personal spending and legal settlements. In addition, you should avoid using one for cash advances, payroll, or expensive or big-ticket items you’ll need months or years to pay off.

Challenges For Startups That are Applying for Business Credit Cards

As a startup, there are a few challenges you might face when you apply for a business credit card, including:

- Your Business is New: Since your venture hasn’t been around for very long, it is riskier for credit card issuers to lend to you than an established business. This is because you likely lack a stable financial history that shows you’ll be able to make your payments.

- You Don’t Have the Best Personal Credit: Most credit card issuers require a good to excellent personal credit score. Your options will be limited if you have less-than-perfect credit.

- You Need a Compelling Case for Your Business: A business plan that describes your startup and explains what you intend to do with the credit card funds might be required. It can prove to credit card issuers that you have a solid business idea and high likelihood of success.

Tips To Keep In Mind When Applying For Startup Business Credit Card

Here are some tips to consider when you apply for a startup business credit card.

- Choose Cards That Align With Your Spending: Each credit card offers a unique reward program. That’s why it only makes sense to select one that matches your spending habits. If your business spends a lot at restaurants or gas stations, for example, make sure you go with a card that prioritizes these expense categories.

- Look for Small Business Credit Cards: While corporate cards are designed for established businesses with many employees, small business credit cards are a better option for your startup. Fortunately, there are plenty of small business cards out there.

- Don’t Apply for Multiple Cards at Once: It’s better to apply for one credit card that you believe you’ll get approved for than several cards at the same time. Here’s why: most credit card issuers will perform a hard inquiry, which can have a negative impact on your credit score.

- Prioritize No Annual Fee Cards: As a startup, there’s a good chance you don’t have a lot of extra cash at your disposal. For this reason, choose startup business credit cards with no annual fees. If a card does have a fee, do the math and make sure the benefits outweigh it.

- Take Advantage of Sign-Up Bonuses: There are many startup business credit cards who offer great perks when you initially sign up for them. These sign-up bonuses are a great way to earn “free” points, cash, or other rewards.

Business Mentoring Organizations That Could Help

If you’re a startup owner, these organizations may come in handy.

- Small Business Development Centers. Small Business Development Centers (SBDC) offer counseling and training to small businesses owners. You can search for an SBDC in your local area.

- SCORE. SCORE is a nonprofit that connects small business owners with free confidential mentorship and free or low cost workshops. You can find a SCORE chapter near you.

- Local networking events. Find local networking events for business owners and startups in your area. This way you can share advice and support one another.

- Women’s Business Centers. If you’re a woman, Women’s Business Centers can do wonders for your startup through their ample networking opportunities. Chances are there’s one near you.