| All content presented here and elsewhere is solely intended for informational purposes only. The reader is required to seek professional counsel before beginning any legal or financial endeavor. |

Acquiring a startup business loan is often more difficult for new business than established ones. This is because established businesses have a business/credit history and profits which makes them a lower risk for lenders than a company that has neither of the history nor the profits. This is the first step in understanding how to acquire a business loan for a startup.

Startup loans can offer funding for startup costs like new employees, equipment, retail space and more.

1. Understand How Startup Business Loans Can Help

Before deciding whether a startup loan is for you, you first need to understand what you can use the loan for. In general, you can use these loans for any purpose related to starting your business. More specifically, you can use a loan to:

- Buy business equipment for your startup.

- Buy or rent a retail property

- Pay for utilities, Wi-Fi, etc

- Purchase new office furniture

- Purchase inventory

Also, be aware that you should have a specific purpose in mind long before applying for funding. Many lenders will ask you how you plan to use their financing, so be prepared with an answer.

2. Know What to Look for in a Startup Business Loan

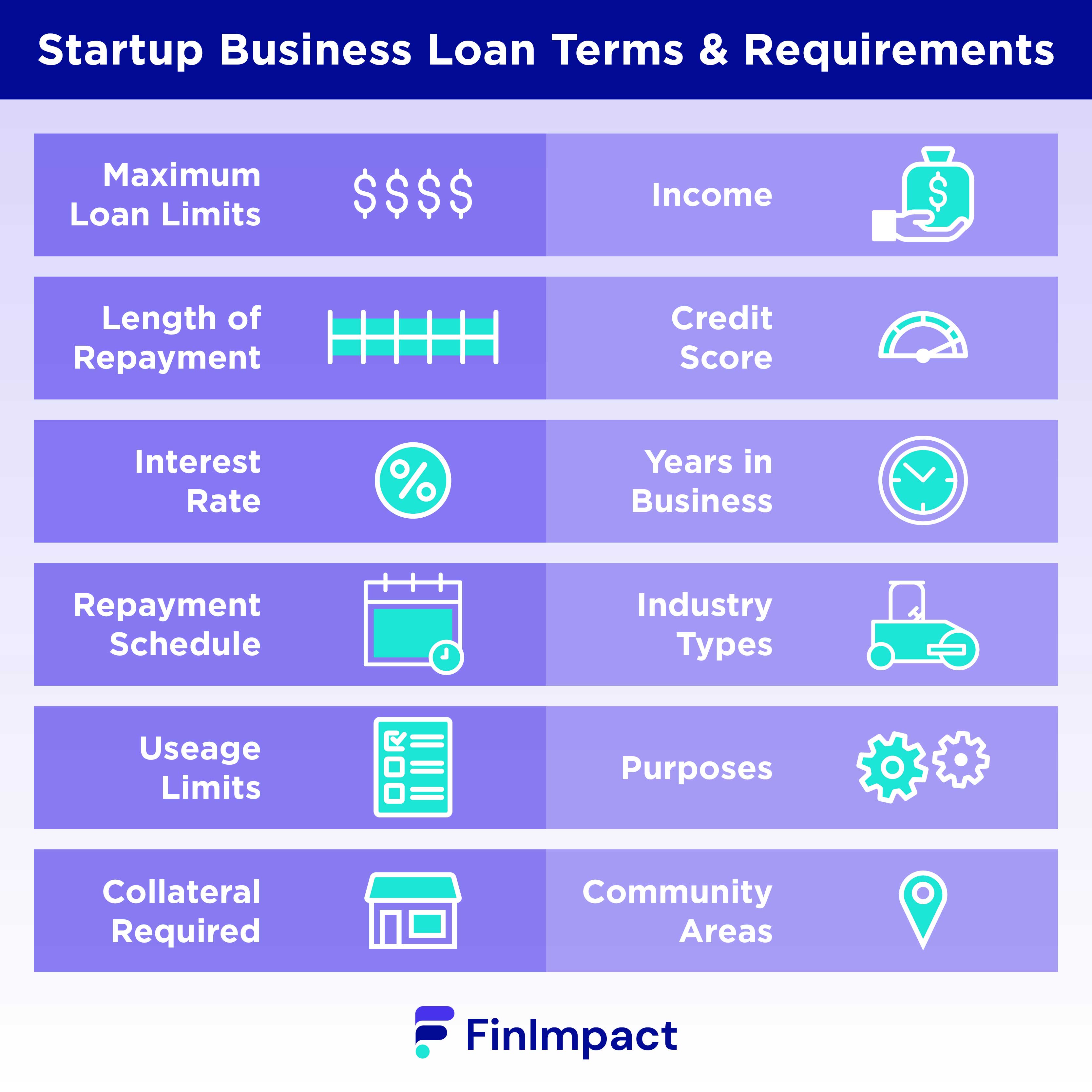

You’ll see a lot of different terms when shopping for a startup loan. Understanding these terms can help you understand what’s most important to you in a loan. When doing your research, make sure to look at the following features of each loan:

- Maximum loan limits: Smaller businesses will need a smaller loan than those who need a ton of equipment and many employees. Make sure you understand how much you can take out with each lender. Some lenders offer millions of dollars in financing, others offer much smaller loans.

- Length of repayment: How long you get to pay back the loan will be a large factor in the total cost of your monthly payment. If you need long loan terms of 10+ years, make sure the lenders of your choice offer this.

- Interest rate: Your interest rate determines how much you’ll pay in interest over the life of the loan. The higher your rate, the more you’ll end up paying. Generally, your interest rate is determined, in part, by your credit score. Better scores secure lower interest rates.

- Repayment schedule: Will you make payments bi-monthly? Once a month? Your repayment schedule will tell you this. How your business plans to get paid can help you determine the repayment schedule that works best for you.

- Usage limitations: Many business loans allow you to use the money how you see fit, as long as it’s for a necessary business reason. However, some loans limit the industries that can use their loans and also may have limits on how you use the money. Make sure to read the fine print of any loan agreements before signing them so you know how you can use the money.

- Collateral required: Some, but not all startup loans will require some sort of collateral. This is something of value that you put up against the loan so, in the event that you stop making payments, the lender has something they can repossess. If you don’t have any assets you’re willing to put up as collateral, make sure you’re looking for lenders who don’t have collateral requirements.

3. Research the Different Types of Startup Business Loans

Startups have a large number of financing options to consider when looking for a startup loan. Which one works best will depend on the type of business you’re opening, your credit score, and the collateral you have available. You’ll find the following options when looking for startup loans:

- SBA 7(a) Loans: SBA 7(a) Loans are a very common SBA loan, offering up to $5 million in funding for retail space, office furniture and fixtures, and long- and short-term working capital.

- Term loans: Term loans are offered by banks and credit unions. They offer general funding for most startup costs. These often come with higher interest rates, but often don’t require collateral.

- Short-term loans: These are term loans, but for short amounts of time. Often the terms are a year or two, with low interest and no collateral required.

- Microloans: Microloans, offered by the SBA, are loans under $50,000. SBA Microloans are meant for businesses with smaller needs who are looking for shorter repayment terms. These loans often don’t require any collateral since they’re less risky to the lenders.

- A business line of credit: A business line of credit combines the perks of loans and credit cards into one financing option. You’ll get a credit line that you can draw from as needed with a set term to pay back your purchases.

- Business credit cards: Business credit cards are meant for smaller purchases, as they come with very high APRs. You can make purchases, pay back the credit line, and use it again.

- Equipment financing: Equipment financing - If you’re looking to specifically finance equipment, you opt for equipment financing. These loans are often large loans with reasonable interest rates. You can find new or used equipment financing through big banks, credit unions, and online lenders.

4. Evaluate the Requirements for each Startup Business Loan

The requirements for a startup business loan will vary depending on the lender you work with. Luckily, most lenders are upfront about these requirements. Look at the following for each loan:

- Income requirements: Even though you’re a startup, some lenders will require that you show proof of income or at least savings before they lend you money. For example, the SBA requires that you use any personal savings before seeking a loan.

- Credit score requirements: Generally, those with very bad credit will have a more difficult time qualifying for a loan. That said, each lender and loan type comes with different credit requirements. SBA loans often have more lenient requirements, with private, online lenders often requiring a score of 600+.

- Years in business required: Startups with at least a few months in business will find more options available since they have a record of (hopefully) success.

- Industry or community requirements: Some loans are only available for certain industries or purposes. For example, the SBA Community Advantage Loan is only for startups in underserved communities and opportunity zones. Make sure you research carefully before submitting an application to ensure you’re in the applicable industry.

5. Compare Lenders and Select the Best One

While it’s great that there are tons of lending options for startups, it can make comparing the options tedious. When narrowing down your lender options, make sure you’re comparing the following features, which can make the comparison process a little simpler.

- The reputation of the lenders: First and foremost, you want a lender you can trust. Use private rating sites like the Better Business Bureau to see how other customers rate the company.

- The interest rates the lenders charge: The higher your interest rate, the more you’ll pay over the life of the loan. While your credit score will be a large deciding factor in your interest rate, there are some lenders that start with lower rates than others. SBA loans, for example, often come with more controlled interest rates.

- Any fees the lenders charge: Some lenders will charge origination fees and outrageous late payment fees. Write down all of the fees each lender you’re researching has and compare them before making a final decision.

- Other features personally important to you: Certain lenders will work better for certain borrowers. Consider what else you’re looking for in a lender. Do you want someone who offers a quick application? Top-notch customer service? No prepayment penalties?

6. Prepare the Necessary Business and Financial Documentation

Now that you’ve completed your research, it’s time to get to the more tedious part of the application process: gathering all your finances. Startup loans are often larger loans, so you’ll need quite a bit of documentation to demonstrate that you can pay the loan back. Gather the following before going through the application process:

- Your business plan: Not all lenders will require your business plan, but it’s a good idea to have one available either way. This plan outlines your goals for your business and when you expect to make a profit.

- An explanation of how you’ll use the funds: Lenders will want to know how you’re going to spend your money so they can ensure it falls within their guidelines.

- Your personal and business tax returns: If you haven’t been in business long, you’ll be asked for personal tax returns to provide proof of your income and other personal details.

- Cash flow projections: This is the important information that lenders will want to know. Your cash flow projections will let the lender know how long until you’re going to turn a profit. This needs to align with their lending terms so they can ensure you’ll pay them back.

7. Submit the Application

Once you submit your application, you have nothing left to do but wait. How long your application takes to process is up to the lender, but many online lenders provide a response within a few days. After that, it can take a week or a couple of weeks to actually receive the funding. Unless you get a loan like the SBA Express Loan, which has a 36-hour turnaround time, you should expect to wait a bit for your loan to be approved and funded.

How to Get a Startup Business Loan with Bad Credit

If you have a credit score between 300 - 579, you’re considered to have poor credit. For many lenders, this is too low a score to qualify you for funding. While SBA startup loans don’t have a minimum credit requirement, many of the lenders that offer them do. Typically, if you’re in the low 600s, you can qualify, but those with scores over 700 will qualify for better rates.

If you have bad credit, jump down to the next section to find some alternative lenders. If, however, you’re willing to pay higher interest rates, there are a few lenders that will work with you to provide startup loans. A few include:

- National Business Capital: National Business Capital lets you search 75+ lenders for loans and lines of credit. You can compare lenders who accept your specific credit profile.

- Lendio: You can also compare lenders with Lendio. You can find business loans, lines of credit, equipment financing, and more.

- Fundbox: Funbox offers a business line of credit for those with credit scores as low as 600.

What If I’m Rejected for a Startup Business Loan?

At the end of the day, certain borrowers just won’t qualify for funding, or at least not worthwhile funding. In the event that you’re rejected by a lender, take the following steps to get the money you need:

Understand why you were rejected

If you’re rejected for a loan, you have a right to know why. The lender you’re working with should provide an email or letter explaining why you were denied. If they don’t, contact customer support and find out who you should speak with about a loan denial. From there, ask for a clear explanation so you can make sure to correct anything you need to go forward.

If your credit score isn’t up to par, take the steps to start raising it. If you don’t have enough time in business, you may have to look elsewhere for funding until you’ve been up and running for at least a few months.

Consider alternative funding

Loans and lines of credit lines are great ways to finance your startup, but they’re not the only options. If you can’t secure a loan, consider one of the following options instead:

- Personal financing: It’s ideal for business owners to have some of their own personal savings to invest in their business. It’s the only way to be able to control how and where you spend your money without paying any interest.

- Friends and family: If you don’t have any capital saved up, you can always consider asking your family and friends for a loan. You should approach them the same way you would a professional investor. Tell them how you plan to spend the money, set up a repayment schedule, and only borrow as much as you need.

- Small business grants: The SBA offers a limited number of small business grants to new business owners. These grants aren’t for businesses that aren’t open yet, so you’ll need to be in business for at least a very short period of time before you can qualify.

- Crowdfunding: There are less conventional ways to get loans these days. Crowdfunding is one example. Instead of asking a big bank for a loan, you’re working with an online lender that funds your loan from investments from individual investors. You’ll pay back the loan just like you would any other loan, but you may have to pay a little extra in fees.

- Venture capitalist firms: Venture capitalist firms are like the more experienced crowd funders. Professional investment managers will pool money from individual investors and then invest that money in startups for a mall percentage of the company.

- Angel investors: Angel investors offer new business owners funding in exchange for a portion of the company profits. Angel investors typically get involved early on in the planning process and are more involved than just getting a loan to fund your business. Angel investors can often provide a substantial amount of capital, though.