| All content presented here and elsewhere is solely intended for informational purposes only. The reader is required to seek professional counsel before beginning any legal or financial endeavor. |

An SBA startup loan is a loan overseen by the Small Business Administration which is a governmental body set up to help small business either start their businesses or help small business grow. The SBA loan program's intention is to offer loan terms and loan rates that are more competitive in order to foster the growth of US businesses.

Key Points:

- The SBA offers a number of loans that can help business owners get the funding they need without outrageous interest rates.

- Some of these loans require collateral, while others don’t. It largely depends on the amount of funding you need and your credit profile.

- Whether you need a microloan of just a few thousand dollars or a $5 million loan, the SBA has multiple options. The SBA even offers an Express Loan that has a 36-hour turnaround time.

The Best Options for SBA Startup Loans

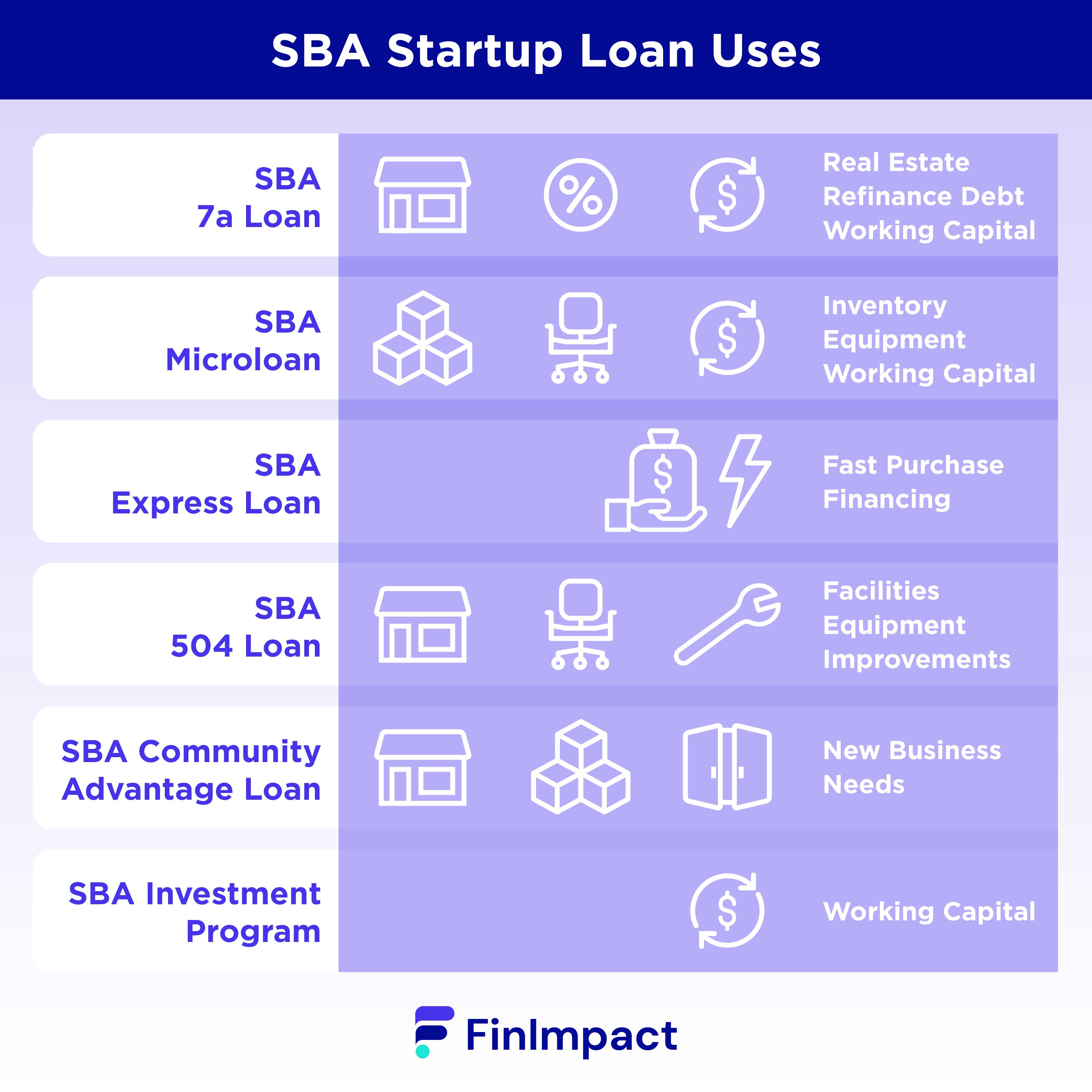

1. SBA 7(a) Loan

This is the most popular SBA startup loan type because it can help fund retail spaces as well as other business needs. SBA 7(a) Loans also help you refinance previous business debt and give you access to short and long-term working capital. The maximum loan amount you can take on is a whopping $5 million.

To be eligible for SBA 7(a) Loans, you’ll need to meet some basic requirements as a business. You need to:

- Run a for-profit business

- Be considered a small business

- Be in business or preparing to start a business within the U.S.

- Have reasonable invested equity

- Use personal savings before seeking financial assistance from the SBA

- Demonstrate a need for a loan

- Use the funds for a sound business purpose

- Not be delinquent on any debt obligations to the U.S. government

Pros

- High borrowing limits up to $5 million.

- Competitive interest rates.

- Long loan terms available.

- Many different industries are eligible.

Cons

- Must use personal savings before applying for the loan.

- Collateral is often needed to secure a loan.

- You need decent credit for most lenders.

2. SBA Microloan for Startup

An SBA microloan is exactly what it sounds like, a small loan offered by the SBA. You can only get up to $50,000, but the average microloan hovers around $13,000. Again, these loans can be used for a variety of purposes, including:

- Working capital

- Inventory

- Supplies

- Furniture

- Fixtures

- Machinery

- Equipment

Since SBA Microloans are offered through outside lenders, the eligibility requirements are up to those individual lenders. As long as you can prove you’re a business owner (or will be), you can likely qualify. Just know that these loans may require some sort of collateral.

Pros

- Loans often have quick turnaround times.

- Many types of industries qualify.

- There are lower credit options.

Cons

- Very low credit borrowers still won’t qualify.

- Loan amounts only go up to $50,000.

3. SBA Express Loan

The SBA Express Loan is meant for business owners looking for money fast. The SBA promises to respond to your application within 36 hours. Just like microloans, eligibility decisions are made by the individual lenders that offer the loan. The maximum loan amount for this type of loan is an impressive $500,000. For loans on the larger end of the spectrum, you may need to provide collateral, but loans up to $25,000 often don’t require collateral.

Pros

- Fastest turnaround time for SBA Loans.

- Good credit borrowers can qualify for relatively low interest rates.

- No collateral is needed for loans under $25,000.

- Long repayment terms are available.

Cons

- Good credit is needed.

- There may be restrictions on how you spend your money.

- Collateral is needed for large loans.

4. SBA 504 Loan for Startup

SBA 504 Loans can be found through Community Development Companies (CDCs), which are SBA partners that offer funding in their local communities. You can secure up to $5 million and use 504 Loans for purposes that help business growth and job creation. These can be used to purchase or construct new facilities or existing buildings. Additionally, borrowers can use funds to purchase equipment and improve any land, parking lots, or other existing facilities they have.

The eligibility requirements for SBA 504 Loans are fairly general. All you have to do is:

- Operate a for-profit company in the U.S.

- Have a net worth of less than $15 million

- Have an average income of less than $5 million after taxes

Pros

- Most businesses will qualify for funding.

- Long loan lengths are available.

- Large loans are available.

- They come with fixed-rate loans, so they won’t fluctuate with the market.

Cons

- The application process is extremely long.

- Wait times for loan approvals can be high.

5. SBA Community Advantage Loan

Community Advantage Loans were designed to help businesses in underserved communities. These are limited-time loans that will end in September 2024, unless otherwise extended. Right now, you can get up to $350,000 in funding.

To qualify, you’ll have to meet stricter requirements than other loans, since Community Advantage Loans are meant for specific communities. Businesses must be located in one of the following types of areas:

- Low-to-moderate income communities

- Empowerment zones and enterprise communities (EZ/EC)

- Historically underutilized business zones (HUBZones)

- Promise zones

- Opportunity zones

- Rural areas

Additionally, this funding is specifically for new businesses who have been in operation for less than two years. Businesses also qualify if 51% or more of it is owned by one or more Veterans or if more than 50% of the full-time workers are low-income.

Pros

- These loans specifically help underserved communities.

- Loan amounts all the way up to $350,000.

- Collateral isn’t required for smaller loans.

Cons

- Higher credit score is required.

- There are specific requirements you must meet to qualify.

- There’s a lengthy application process.

6. SBA Investment Program

The SBA partners with Small Business Investment Companies (SBIC) to offer investors to businesses looking to grow. The SBICs are licensed by the SBA, so you can be sure they’re reputable investors. Generally, these investments come in a few different forms:

- Debt: This is a more standard loan with a range between $250,000 - $10 million.

- Equity: This isn’t straight-up funding, but instead the SBIC invests in your business in exchange for shared ownership.

- Debt with equity: This is a combination of funding and limited shared ownership.

The catch with this investment program is that it’s not for businesses starting from zero. Since these investors are often getting some sort of ownership in the business, they want to protect their assets. So, they want businesses that meet the following requirements:

- At least 51% of your employees and assets must be based within the U.S.

- Be a small business, as stated by the SBA

- NOT be in industries like farming, real estate, and financing

Pros

- Very high loan amounts, all the way up to $10 million.

- Relatively relaxed qualifications required.

Cons

- Not necessarily meant for startups.

- You’ll be sharing ownership in your business.

- Those in the farming, real estate, and finance industry won’t qualify.