Startup capital is the amount of money that a business, which is just starting out, needs in order to become operational and to also become profitable. The money is usually provided by a third party or institution like a bank or financing company and in return for providing this startup capital, the third party usually requires some form of payment called a return on investment.

How Startup Capital Works

When seeking initial capital investment, the first step is researching the potential market for your product or service. This is generally encapsulated in a business plan that includes a SWOT analysis, your approach to how to start a small business, a marketing plan, business start-up costs, and financial projections. Additionally, you'll need a pitch deck to present to potential investors.

The financials help you understand how much money you need from potential capital investment, how long it will last, and what kinds of returns you can expect on their initial capital investment. Additionally, it forecasts how long it will take before you reach profitability.

Once you have your plan in place, you'll seek out investors that specialize in your niche. The size of investment that you need determines what type of startup capital investment to search for.

The funder will perform due diligence on you, your idea, and the market potential for your product or service. This helps them determine how much to invest and what they'll expect in return. It is wise to hire a lawyer to review the agreement to ensure that you receive fair terms before signing contracts.

What is Startup Capital Used For?

Startup investment money is usually very specific about what it will be spent on:

| Rent | Utility deposits |

| Inventory | Equipment |

| Advertising | Employee wages |

The initial capital investment needs to be adequate enough to carry your business until its revenues are self-sustaining.

Where To Find Startup Capital

- Crowdfunding: Raising small amounts of money from a large group of people. Crowdfunding can provide startup capital through investors or loans. Some crowdfunding platforms allow you to pre-sell your product or service to secure the funding you need to bring it to market without borrowing costs or giving up equity.

- Angel investors: Angel investors focus on startups that require smaller amounts of money. They tend to be industry veterans who retired from their careers and now use their capital and expertise to help entrepreneurs launch their businesses.

- Startup Venture Capital: For companies with larger potential, startup venture capital investors are willing to take on substantial risk for the opportunity of a larger payday in the future. These investors usually seek an exit through a sale or IPO within three to five years to repay their investors and then they move on to the next idea.

- Business Loan: Banks and other lenders provide the cash you need in exchange for monthly payments of principal and interest. Startup business loans typically require a documented source of repayment and a personal guarantee. The maximum loan amount that you qualify for may be less than the full amount that you need.

- Family and friends: Many entrepreneurs reach out to family and friends to fund their initial capital investment since these people know and trust them.

- Personal Savings and Assets: Sometimes referred to as Bootstrapping. Business owners often launch their businesses in stages based on personal savings, home equity, credit cards, and other debt instruments. As revenues grow or other sources of money become available, the business expands when and where it can. This process may be slower, but it preserves your ownership and minimizes debt payments.

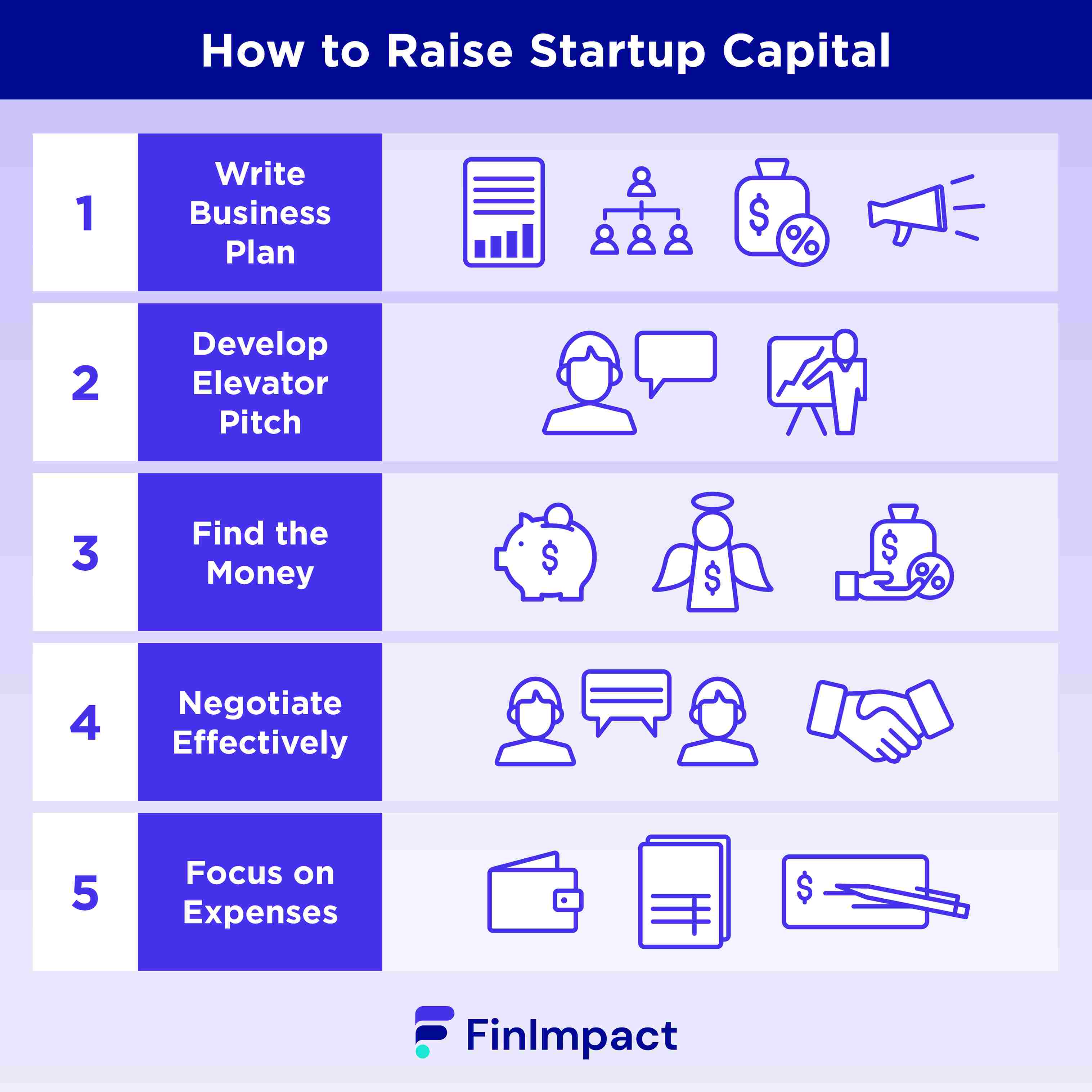

How to Raise Startup Capital

- Write a business plan: Your business plan provides a detailed roadmap for your business' success. It includes your marketing plan, financials, and other critical information that investors and lenders need to see.

- Develop your elevator pitch: When speaking with investors and lenders, your time is limited. Be sure that you can provide a compelling reason for them to want to know more in 30 seconds or less. Once you've caught their attention, then you can go into more detail and answer their questions. This should be before the business plan, not after

- Find the money: When considering how to raise capital for a startup, seek out investors or lenders that match your strategy and cater to your niche. The best options often open other doors for you to new clients, suppliers, or advisors to accelerate your plan.

- Negotiate effectively: Everything is negotiable and the first offer is rarely their best offer. Don't be afraid to hold negotiations with multiple sources of startup capital at once to find the best deal for you.

- Stay focused on expenses: Once you have the money, watch every penny that you spend. Ideally, you won't have to seek out additional sources of capital for future growth. Remember, each extra round of funding means higher interest expenses or a reduced ownership stake for you. It also takes your time away from building the business.

Advantages and Disadvantages of Startup Capital

When raising startup venture capital to fund your business, in addition to knowing your business start-up costs and legal requirements for starting a small business, you also need to know the advantages and disadvantages before accepting their money:

Advantages:

- Raise larger amounts of capital: When involving a lender or investor, you have greater access to startup capital than if you tried to fund the business solely from your personal savings.

- Better cash flow: Since the initial capital investment doesn't require monthly loan payments, you have more money to cover monthly expenses and reinvest in the business.

- No personal guarantees: When borrowing money for your business, most banks require a personal guarantee for the loan which puts your assets at risk in case the business fails or cannot make payments.

- Access to industry expertise: Many investors not only provide startup venture capital but ongoing advice and connections that can grow your business. In some cases, those connections can be more valuable than the money they invested.

Disadvantages:

Ownership stake is reduced: In exchange for the initial capital investment, the investors require shares of your company. Depending upon the size of the investment, they could become majority shareholders.

- Finding investors can be time-consuming and challenging: While you are out searching for investors, you aren't focused on your business. This process takes time and it doesn't always end with an agreement, so the time and effort could be for naught.

- Overall cost can be expensive: While you aren't making monthly payments, the cost of equity can be expensive when you consider how much you are giving up. These costs are generally only realized when the company is sold or when it goes public.

- Outsized growth expectations: Investors expect high returns on their capital, which can require you to scale the business quickly. In some cases, the high expectations force the business to grow faster than it is capable of or quicker than you'd like.

Final Tips on Acquiring Startup Capital

While some people can fund the business with personal savings, most entrepreneurs need outside help, and arriving at a meeting with a potential investor fully prepared is vital:

- Gather Documents

- Know Where the Money Is Going

- Be Prepared and Ready to Answer Probing Questions

- Research The Investor

- Gain an Approximate Idea of What They Might Want In Return

- Have an Experienced Professional Look at Your Business Plan

- Dress Like You Mean Business

- Be Open and Transparent With Everything

Most initial capital investments are limited by your income, assets, and credit score. Raising startup venture capital from investors requires giving up a portion of your company's ownership. You need to be clear on what you are prepared and not prepared to give in return for acquiring the investment capital. Also, and this is vital, the question “Can I meet their financial expectations” must be considered thoroughly and not on the spot. Take their proposal home, take your time, and be realistic in being able to fulfill their investment expectations.

When you're looking for money to start your business idea, Torro is a good option for raising startup capital.

- They can provide new businesses up to $575,000 with limited asset verification

- No business appraisal

- Little to no paperwork

- Apply online

- Receive fast approval

- Same-day funding