Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses, or reviews expressed in this article are those of the author’s alone, and have not been approved or endorsed by any partner.

Best Small Business Loans for Veterans to Consider in 2024

Starting a business can be a major challenge for veterans who have limited savings and are facing significant startup costs. Business loans tailored to veterans can give them extra support, helping them to start and grow their businesses.

Veterans may need a small business loan to finance startup costs or to expand and continue to invest in an established business. Loans can help cover renovation costs, equipment purchases, inventory expenses, and other business-related expenses. They can also help business owners navigate times when they are facing cash flow issues. Our team of financial experts reviewed and ranked the best business loans for veterans to help you get funded.

Top Picks for Best Business Loans for Veterans

- Lendzi - Best for Businesses With High Revenue

- Backd - Best for Cheapest Interest Rates

- National Funding - Best for Working Capital Loans

- Biz2Credit - Best for Commercial Real Estate Loans for Veterans

- SMB Compass - Best Variety of Business Loans for Veterans

- Bluevine - Best for Business Lines of Credit for Veterans

- SmartBiz - Best for Franchise Loans for Veterans

If you’re considering a business loan as a veteran, it’s important to take the time to make sure you choose a loan that’s right for your needs. In this review, we highlight the rates, fees and terms of each lender and explain what makes them a good option. We also share potential downsides of each lender, and provide a rating methodology you can use to select the best option for your needs.

Best Small Business Loans for Veterans - Full Overview

If you’re looking for business funding, consider these top-ranked business loans for veterans.

SmartBiz - Best for Franchise Loans for Veterans

- SBA 7(a) loans up to $350,000

- SBA commercial real estate loans up to $5 million.

- Min. Credit Score: 660

- Min. time in business: 2 years

- Loan Repayment 10 - 25 years

- SBA 7(a) loan rates: 10.75%-11.75%

- SBA Commercial real estate loan rates: 5.50-6.75%

- Receive multiple loan offers

- Multiple funding options

- Long repayment terms

- Easy application

- High borrowing amounts

- Not ideal for startups

- Strict qualification requirements

- Other fees apply

SmartBiz offers term loans, SBA loans, and custom financing options, making it one of the more versatile funding choices for veterans. If you own a franchise or are hoping to purchase one, SmartBiz is able to help. Loans can be used to increase inventory or expand your business, pay for daily operating expenses, refinance existing debt, and more. With SmartBiz, the application takes just five minutes and will not affect your credit score.

Main Features

Term loans range from $30,000 to $300,000 with two to five year repayment terms. SBA loans feature longer terms of 24 to 60 months and financing up to $350,000. Commercial real estate loans range from $500,000 up to $5 million. To qualify, applicants must have been in business for at least two years and need to have a personal credit score of at least 660. SBA loans feature interest rates of 7.5% to10.29%, but veterans also need to be aware of application fees and closing costs. Bank term loan interest rates start at 7.99%, and commercial real estate loans start at 7.00%. SmartBiz loan consultants are available by phone during business hours and on Saturdays to help veterans explore their financing options.

To qualify, applicants must have been in business for at least two years and need to have a personal credit score of at least 660. SBA loans feature interest rates of 7.5% to 10.29%, but veterans also need to be aware of application fees and closing costs. Bank term loan interest rates start at 7.99%, and commercial real estate loans start at 7.00%. SmartBiz loan consultants are available by phone during business hours and on Saturdays to help veterans explore their financing options.

Bluevine - Best for Business Lines of Credit for Veterans

- Funding up to $250,000

- Min. credit score: 625

- Min. time in business: 6 months

- Interest rates starting at 6.2%

- Loan Repayment 6-12 months terms

- Quick and simple application

- Quick application

- Fast funding times

- Low interest rates

- Credit line replenishes

- Excellent customer service

- Short loan terms

- Not available in all states

Bluevine offers business lines of credit up to $250,000. As veterans repay their line of credit balance, that credit line is replenished, allowing them to repeatedly draw from it. The line of credit has interest rates as low as 4.8%, making it one of the lower interest financing options available to veterans. Veterans only pay for the funding that they use from the line, and there are no opening, maintenance, or prepayment fees.

Main Features

Applicants need to meet several requirements, including having a FICO score of at least 625, generating at least $10,000 per month in revenue, and having been in business for at least six months. The application is simple and takes just five minutes to complete. Once approved, funds are deposited in veterans’ accounts within hours after they request a draw. Six- and 12-month repayment terms are available.

SMB Compass - Best Variety of Business Loans for Veterans

- Loans up to $10 million

- Min. credit score: can go as low as 550 for certain loans

- Min. time in business: 1+ years in business, no startups

- Funding times: 5 to 7 days for term loans and 24 - 48 hours for line of credit

- Flexible terms: 2 – 10 years for term loans

- Interest Rates: starting at 8.99% for term loans

- Applying does not impact credit score

- Nine loan products to choose from

- Low, competitive rates

- Large loan amounts

- Loan terms up to 25 years

- Excellent customer service

- Poor credit not accepted

- Not available in all states

- Must be in business at least one year

- High revenue requirements

If you’re a Veteran in need of small business financing but aren’t quite sure what type of loan is best, SMB Compass can help. The lender offers nine different types of small business loans, including business lines of credit, equipment financing, asset-based loans, SBA loans, and purchase order financing. To qualify, SMB Compass prefers a minimum credit score of 650, at least one year of business history, and a monthly revenue of $20,000 per month or more. Customer service is excellent, though, so if you have any questions or aren’t sure if you’ll qualify, don’t hesitate to reach out.

Main Features

SMB Compass offers nine different types of small business loans to Veterans. Their mission is to make loans more accessible to small business borrowers by providing cost-effective and flexible lending solutions. SMB Compass business loans range from $10,000 to $10 million with terms up to 25 years. Rates start at 7.99% for qualified borrowers. The lender has currently provided more than 1,200 U.S. businesses with more than $250 million in financing. To apply, simply fill out their easy online application. It takes just a few minutes and will not impact your credit score. If approved, funding can be dispersed within 24 hours.

Biz2Credit - Best for Commercial Real Estate Loans for Veterans

- Working capital up to $2 million

- Term loans up to $500,000

- Term loan interest rate starts at 7.99%

- Loan Repayment 12-36 months terms

- Variable APR depending on the applicant

- Funding in 72 hours

- Soft credit pull

- Multiple funding options

- High funding amounts

- Easy online application

- Fast funding times

- High interest rates

- High annual revenue requirements

Biz2Credit offers working capital, term loan, and commercial real estate (CRE) loan options to veterans. Working capital loans start at $25,000 and are paid back based on business receipts. Term loans are available up to $500,000 with 36-month terms and are suitable for larger projects and business investments. CRE loans are available up to $6 million and are ideal for major projects and acquisitions. They feature interest-only terms up to 36 months.

Main Features

When applying for working capital or a term loan through Biz2Credit, you can be approved in 24 hours and funded within 72 hours of approval. Working capital applicants need an annual revenue of at least $250,000, a credit score of 575 or higher, and have been in business for at least six months. Term loan applicants also need an annual revenue of at least $250,000, along with a credit score of 660 or higher. Those looking for a term loan need to be in business for at least 18 months. CRE requirements are the same as the term loan, and the business owner must already own commercial property.

National Funding - Best for Working Capital Loans

- Min. Time in Business: 6 months

- Min. Credit Score 600

- Borrow up to $500,000 in working capital

- Equipment financing up to $150,000

- Factor rate From 1.10

- Fast funding

- Early payment discounts

- Equipment financing repayment 2-5 years

- Working capital repayment 4 months - 2 years

- No risk to apply

- Early repayment discount

- Solid reputation

- No collateral needed

- Daily or weekly repayments (as opposed to monthly)

- High annual revenue required

- Expensive rates and fees

National Funding offers short-term working capital loans for veteran-run businesses in a variety of industries. Depending on when you apply, you can receive your funds via direct deposit within 24 hours. If you need some extra cash to cover day-to-day expenses or make it through slow or off seasons, it might be a good option.

Main Features

National Funding’s short-term working capital loans range from $5,000 to $500,000 with repayment terms between four months and two years. The factor rate starts at 1.10. To take out a working capital loan, you’ll need a minimum credit score of 600, a business history of at least six months, and $250,000 or more in annual revenue. Note: National Funding offers an early repayment discount. If you pay your loan in full within the first 100 days, you’ll receive a 7% discount on the remaining balance.

Backd - Best for Cheapest Interest Rates

- Borrow up to $2 million

- Min. Credit Score: 640

- Min. Time in Business: 2 years

- Industry best factor rate for MCA - as low as 1.10

- APR for the Line of credit product starts at 35%

- Flexible repayment terms up to 16 months

- Get funding in as little as 24 hours

- Check your rate with a soft credit pull

- Loan amounts up to $2 million

- Flexible payment terms

- Fast and easy online application

- Rates not disclosed

- Not available to startups

- Not all industries will qualify

Backd was founded in 2018 to provide funding to small businesses that may not qualify for traditional financing solutions. The company offers two loan products - working capital loans and business lines of credit. The application takes just a few minutes to fill out and a lending decision is given instantly. If your Veteran-owned business is in need of a large loan, Backd can work with you to get you the funding you need.

Main Features

Backd working capital loans range from $10,000 to $2 million with terms up to 16 months. Payments are made daily, weekly, or semi-monthly and no collateral is required. Lines of credit range from $10,000 to $750,000 with unlimited terms. Rates are competitive, and you can draw on your funds at any time. To qualify, you need to be in business for at least two years, have annual revenues of $300,000 or more, and 640+ FICO score. You also must be based in the U.S. and have a business bank account.

Lendzi - Best for Businesses With High Revenue

- Borrow up to $4 million

- Min. credit score: at least 500

- Min. time in business: 6 months

- Equipment financing up to $2 million

- Business line of credit up to $250,000

- See your options without hurting your credit

- Flexible terms: 3 to 15 months

- Excellent customer reviews on independent review sites

- Get funding in as little as 24 hours

- Multiple lenders and loan options

- Excellent customer reviews

- Competitive interest rates

- Fast funding times

- Poor credit accepted on certain products

- High annual income requirement

- Rates high on certain products

- Phone calls may be required during application process

Lendzi offers seven different types of loans that veterans may qualify for, including short-term loans, working capital loans, business lines of credit, SBA loans, merchant cash advances, and more. Bad credit is not a problem with Lendzi, and if you’ve been denied a loan elsewhere, they want to work with you. Founded in 2020, Lendzi is both a direct lender and a partner with more than 75+ additional lenders, increasing your odds of approval.

Main Features

Lendzi wants to make it as easy as possible for veterans to get a small business loan. Their application is online and takes just a few minutes to fill out, and it will not impact your credit score. From there, you’ll receive a phone call to go over your business and review your options. If approved, Lendzi can have your funds in your account in as little as 24 hours. Most loans range from $5,000 to $400,000, but equipment financing loans go up to $2 million and SBA loans max out at $5 million. Rates are competitive and will vary by lender. To qualify, you need to be in business for at least six months and have $180,000 in annual income.

Main Features of The Best Business Loans for Veterans

- Min. Credit Score - 500

- Min. Time in Business - 6 months

- Min. Annual Revenue - $180,000

- Loan Amount - $5,000 to $400,000

- Interest Rate - Starting at 1.1

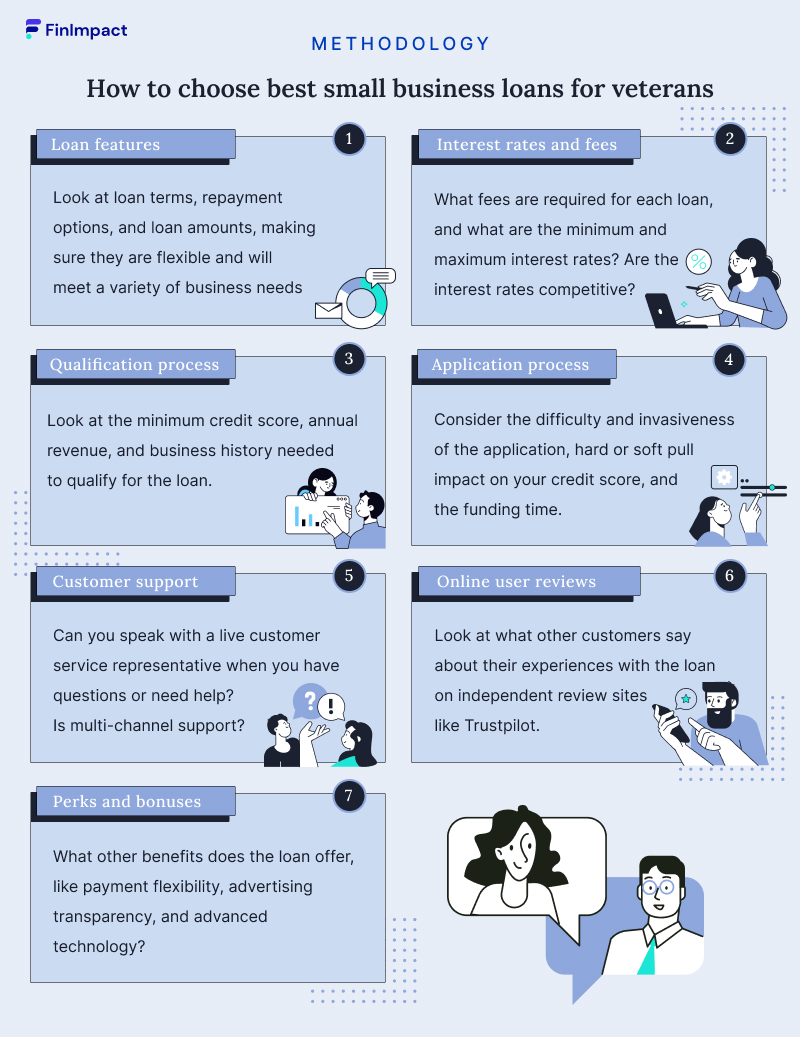

How to Choose the Best Small Business Loan for Veterans

- Loan features: We looked at loan terms, repayment options, and loan amounts, making sure they are flexible and will meet a variety of business’ needs.?

- Application process: How difficult and invasive is the application procedure? Will there be a hard pull or soft pull to your credit score? If you need funding quickly, consider how soon funding is available once you’re approved.

- Interest rates and fees: What fees are required for each loan, and what are the minimum and maximum interest rates? Are the interest rates competitive?

- Qualification process: Do you have the minimum credit score, annual revenue, and business history to qualify for the loan? If your business is less than a year old, you may need to look specifically for funding for startups.

- Customer support: If you have questions or need help, can you speak with a live customer service representative? Are multi-channel support and supplemental information and tools available?

- Online user reviews: We looked at what other customers were saying about their experiences with the loan on independent review sites like Trustpilot.

- Perks and bonuses: What other benefits does the loan offer, like payment flexibility, advertising transparency, and advanced technology?

U.S. Small Business Administration Loans for Veterans

Here are various loan types available for veteran entrepreneurs:

SBA Standard 7(a) Loan Program

The SBA 7(a) loan program is the most common loan program offered by the Small Business Administration. The main benefits of this loan are the low-interest rate and the excellent repayment terms.

The SBA 7(a) loan has a government guarantee. In most cases, the SBA guarantees up to 85% of the loan. A business can use the SBA 7(a) loan funds for any use it has, including short- and long-term working capital, refinancing current business debt, purchasing equipment and supplies, and more.

The SBA 7(a) loan amounts range from $30,000 to $5,000,000 with repayment terms from 10 to 25 years. The interest rates are very low. Any veteran-owned business can apply for an SBA 7(a) small business loan through online facilitators like SmartBiz or SBA’s website.

Here are the top online SBA lenders>>

Military Reservist Economic Injury Disaster Loan (MREIDL)

The MREIDL loan program provides financial help to small businesses that operate or employ military reservists as essential employees. The MREIDL program provides working capital until operations return to normal and the essential employee is released from active military duty and is back at work.

The MREIDL fund does not cover lost income and cannot be used to refinance long-term debt or to expand a business. You can obtain up to $2,000,000 via this program.

SBA Microloan

The smaller loan amounts provided by the SBA are called SBA microloans. Microloans are designed to help veteran and women-owned businesses, minority-owned businesses, etc.

The max loan amount is $50,000, the average microloan is $14,400, and the funds are provided by intermediary lenders like non-profit, community-based organizations. The appeal with SBA-backed microloans is the low 6.5% interest rate and the six years repayment period.

SBA 504 Loan Program

The 504 loan program is backed by the SBA, involving term loans used for the expansion and modernization of objects and commercial real estate. The SBA 504 loan is up to $5,000,000, and you can use it to promote business growth and job creation. A 504 loan cannot be used for working capital, existing debt repayment, or rental real estate investment.

Veteran-owned businesses looking to purchase a building or land, building new facilities for their business, and investing in long-term machinery and equipment could apply for an SBA 504 loan.

SBA Express Loan

From 2007 to 2013, there was a special Patriot Express loan program, where veteran entrepreneurs were the primary eligible borrowers, which is now known as the Express loan program. The Express loan goes up to $500,000.

It is among the most popular loan delivery methods, as the main attraction with the Express loan is that it is granted (or denied) within 36 hours of application.

The Express loan can be used for working capital, purchasing real estate, and refinancing debt. The SBA Express Line of credit has an average repayment of seven years, ranging from 10 to 25 years.

SBA Veterans Advantage Loan

To help veteran-owned businesses, the SBA offers Veteran Advantage loans. To be eligible, an honorably discharged veteran must own the business's majority (at least 51%).

Service-disabled veterans could also run the business, active-duty military service members participating in the Transition Assistance Program (TAP), reservists, National Guard members, and spouses. Widowed spouses of service members who died while in service are eligible to apply.

The Veterans Advantage loan ranges up to $350,000, and the SBA does not require any upfront fee for loans under $150,000. Veteran business owners have an excellent chance of getting a Veteran Advantage loan, as the SBA also enables veteran-owned businesses better opportunities via government contracts.

Veteran Loans from Credit Unions and Nonprofit Organizations

In addition to the lenders above, many credit unions and nonprofit organizations also offer loans for veterans. If you have a veteran-owned company, you may want to consider these loan options.

PeopleFund

PeopleFund is a nonprofit lender and certified Community Development Financial Institution that works to foster diversity and innovation. PeopleFund has lent money to over 3,000 small businesses and nonprofits in its 25-year history.

PeopleFund focuses on supporting veterans, women, and minorities in low- to moderate-income areas of Texas. Loans are customized to each applicant’s needs, and PeopleFund provides one-on-one consulting and group training to help business owners succeed. Fourteen percent of the businesses funded are veteran-owned businesses.

Loan options include working capital term loans, revolving lines of credit, and financing for equipment purchases. Loan interest rates range from 7 to 15%, and PeopleFund offers veterans discounted interest rates. Existing small businesses are eligible for up to $5 million in funding, and loan terms range up to 84 months.

Navy Federal

The Navy Federal Credit Union is a not-for-profit credit union that was founded in 1933. Today, the credit union has more than 11 million members and serves the military, veterans, and their families. Loan options for veterans include business lines of credit, vehicle and term loans, and real estate loans.

Business lines of credit amounts start at $35,000 and are ideal for business growth, unexpected expenses, and navigating cash flow gaps. Borrowers only pay interest on the funds that they use. Applicants will need to provide personal and business tax returns for two years, a business plan, financial statements, a personal financial statement, and proof of collateral.

Term loans are available for purchases and refinancing, including vehicle and equipment purchases. These loans carry a $150 origination fee, but there is no prepayment penalty. Applications are processed within seven to 10 days. Among other requirements, applicants will need to provide a certificate of insurance, a personal guarantee, and a personal credit check will be performed.

Hivers and Strivers

Hivers & Strivers is an angel investment group that invests only in companies that are led by military veterans. Those companies include Vet Accel, True Made Foods, Independence Hydrogen, and LeaseLock.

Hivers and Strivers provides early-stage capital for businesses, and veterans need to apply through Gust. Initial investment amounts range from $200,000 to $500,000, and businesses need to be beyond the concept stage. Applicant businesses should provide opportunity for significant growth and should not be reliant on government contracts.

Accion

Accion is a global nonprofit that was founded in 1961. Accion works to empower people who are underserved, including veterans, and the Accion Opportunity Fund helps more small businesses access the loans that they need.

The Accion Opportunity Fund supports business owners in multiple ways, including giving them access to capital, networks, and coaching opportunities. Over its 25 years of service, the fund has invested $516 in small business owners.

Loan amounts range from $5,000 to $100,000 with terms of 12, 24, 36, or 60 months. There are no prepayment penalties, and interest rates start at 5.99%. The loan application is available online, and applicants can also get phone support in Spanish and English. Eligible applicants will be given multiple prequalified offers, so they’ll be able to choose the loan option that’s best for them.

What Is a VA Small Business Loan?

VA small business loans are financing options designed to support veteran-owned businesses. While the U.S. Department of Veterans Affairs doesn’t provide VA small business loans, these loans are available from multiple sources, including traditional banks and online lenders. They may feature lower interest rates or eligibility requirements designed to make them accessible for veterans.

Do you have an idea for a business? Here’s how to start a veteran-owned business?

Who Qualifies for a VA Small Business Loan?

Loans designed specifically for veterans will typically require that the applicant be an active military member, a veteran, or a family member. Oftentimes, a spouse or widowed spouse of an active military member or veteran can also apply. The applicant may need a minimum credit rating, often in the 600s, and may need to provide business plans, financial statements, tax information, and business licenses or certifications to qualify for a loan.

Many loans have specific business requirements, as well. It’s common to require that the business be located and operating in the United States. Some loans also have specific requirements for the amount of time that the business has been in operation, and may require that the business be at least six months old. Businesses may also need to meet income requirements, often starting at $100,000 in revenue per year. The business may need to be entirely veteran-owned or the majority of the business may need to be veteran-owned.

How To Apply for a VA Loan

In addition to the typical types of documentation, like business plans, financial statements, and tax information, veterans and their families also need to produce forms that prove their service histories.

There are multiple documents that prove service history and military status, and loans may accept all or some of the following:

- Military ID card

- Veterans ID card

- VA-issued ID card for health care

- Veterans designation on a driver’s license

- State veterans ID card

- Veterans group membership card for the VFW, DAV, or American Legion

- DD Form 214

How Veterans Can Use VA Business Loan Funds

Veterans can use VA business loan funds in multiple ways, depending on the type of loan that they’ve chosen.

- Lines of credit: Highly flexible options that allow veterans to repeatedly draw down and repay that funding over a short-term period. Veterans can use lines of credit for nearly any expense, including navigating times of limited cash flow, equipment purchases, and other business investments.

- Term loans: Feature a longer repayment term, but offer similar unrestricted potential uses. Veterans might use term loans for larger investments, like renovation expenses, large equipment purchases, large inventory purchases, and other expenses. Term loans are paid out as a lump sum, so they tend to be better for large, one-time expenses.

- SBA loans: Available in amounts from $500 to $5.5 million, they’re often used for significant purchases or investments. A veteran might use an SBA loan for expenses like refinancing debt, purchasing real estate, investing in machinery or equipment, or remodeling or expanding a business space.

Are There Startup Business Loans for Veterans?

There are multiple types of startup business loans for veterans. Some lines of credit are available to businesses that are at least six months old, and they can be used to help business owners navigate those initial years. Some funders like Hivers and Strivers provide startup capital for veteran-owned businesses.

You can see our top picks for startup loans here >>

Other Resources for Veteran-owned Businesses

In addition to small business loans, there are many other resources available to veteran-owned businesses. The following resources include training programs and small business grants, and growth resources offered by the government and nonprofit organizations.

- Boots to Business: an SBA training program that’s part of the Department of Defense Transition Assistance Program. It’s available to active duty service members, veterans, and their spouses. The program provides detailed information on entrepreneurship and business ownership.

- Women Veteran Entrepreneurship Training Program: offers both in-person and online training for women veterans who hope to start or who are running businesses in Texas. Veterans can participate in webinars, workshops, and training sessions, receive one-on-one advising, and apply for business loans.

- Service-Disabled Veteran Entrepreneurship Training Program (SDVETP): offers service-disabled veteran entrepreneurs training to prepare them for business ownership. The programs are offered through grantees, including St. Joseph’s University and Dog Tag, Inc.

- StreetShares Foundation: a nonprofit that inspires, educates, and supports the military entrepreneurial community. StreetShares help to connect veterans with capital opportunities, coaching and networking, educational opportunities, and access to mentors. The services are available to military community entrepreneurs nationwide, and they help entrepreneurs to start and grow their businesses.

- The Global Good Fund Veterans Leadership Program: during the program, veterans develop leadership skills through pairings with executive coaches and c-suite business mentors. Veterans also have access to leadership assessment resources, a global peer network, and $10,000 of targeted funding.

If you’re the spouse of a veteran, check out these 9 options for military spouse business grants >>

Conclusion

Veteran entrepreneurs and business owners have access to many different business loans and funding opportunities. From programs designed specifically for veterans to options like short-term loans and working capital, these resources can help veterans to build and expand their businesses. As with any funding opportunity, it’s important to consider factors like interest rates and loan terms when finding the loan that’s right for you and your business.

*The required FICO score may be higher based on your relationship with American Express, credit history, and other factors.